Sustainable Bottom Line: Index tracking funds appeal to sustainable investors, but at least four key questions should be added to the due diligence evaluation process.

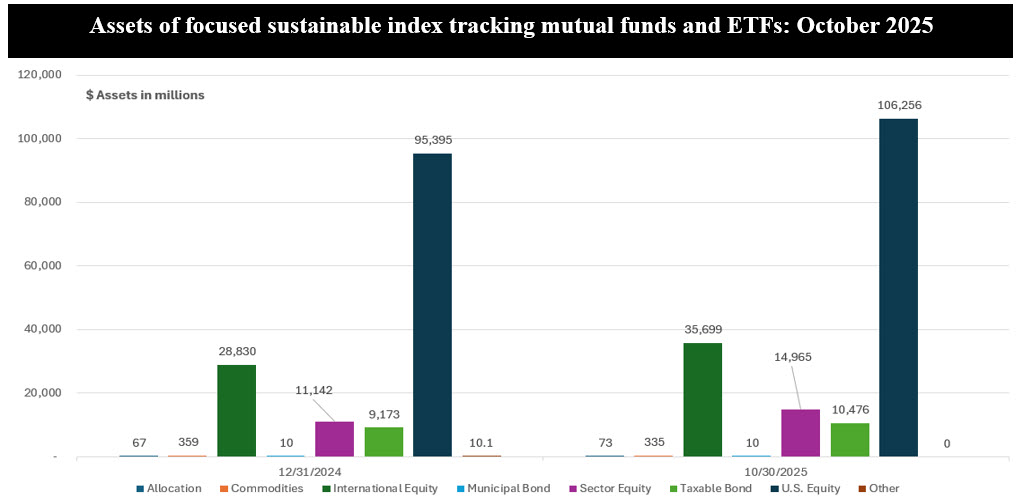

Notes of Explanation: Investment category Other as of December 31, 2024, included three small ETFs, a leveraged thematic equity funds and two covered call ETFs, that were liquidated during 2025. Sources: Fund prospectuses, Morningstar and Sustainable Research and Analysis LLC.

Observations:

• Focused sustainable index tracking ETFs and, to a lesser extent, mutual funds, represent a significant gateway for sustainable investing. The assets of sustainable index tracking mutual funds and ETFs in the U.S. closed the month of October with $167.8 billion in net assets according to Morningstar, accounting for 44% of the sustainable segment’s long-term assets under management that reached $380.01 billion. At $119.7 billion, index tracking ETFs account for 71% of the focused sustainable index fund assets under management.

• Sustainable index tracking mutual funds and ETFs added $22.8 billion in net assets from the start of the year, up from $145 billion, an increase of 15.7%. On a combined basis, these funds posted an average return of 20.4%, suggesting that the gains in assets entirely attributable to capital appreciation were offset somewhat by fund outflows during the period.

• For liquid and highly efficient market sectors, investors in general are expressing a preference for index funds over actively managed funds because broad market indexes deliver instant diversification, they systematically capture market risk premia, and typically exhibit lower fees and turnover drag, making compounding more efficient over time, while also avoiding, in many cases, manager selection risk. In areas such as large-cap equities, core fixed income, or rules-based thematic segments where securities are well-covered, frequently traded, and information is rapidly priced in, active managers often struggle to outperform after costs whereas index funds offer transparent exposures, tax-efficient implementation (especially via ETFs), and market-like returns with structurally lower cost and implementation risk. According to the latest S&P Global S&P Indices Versus Active (SPIVA) report, the long-term trend shows yet again that most active fund managers underperform the S&P 500 Index, with about 90% underperforming over 10 years. However, there can be periods of improved performance; for example, in the first half of 2025, a significant number of large-cap, small-cap, and mid-cap managers outperformed their benchmarks, in contrast to previous years, dominated by a few large stocks, resulting in higher tracking error without a consistently higher expected return.

• For the same reasons, retail and institutional investors have embraced focused sustainable index tracking funds. In addition, however, index tracking sustainable funds and their indices offer investors greater transparency around the implementation of their chosen sustainable investing approaches. This allows investors to more clearly establish and validate a linkage between their sustainability preferences and the fund’s investing approach.

• When choosing to invest in a sustainable index fund, investors should seek answers to the following additional questions as part of their fund evaluation and due diligence process: How does the fund’s sustainable investing approach and methodologies align with the investor’s sustainability preferences? How does the fund’s performance over 1-year, 3-years and 5-years compare with the performance of an equivalent conventional index, and what is the fund’s tracking error relative to the equivalent conventional index? What are the fund’s stewardship and engagement practices? And, does the fund offer expanded reporting that explains the fund’s performance results within the context of its sustainable investing approach? For a comprehensive list of due diligence evaluation questions, refer to the Index Mutual Fund and ETF Evaluation Checklist.