Fund Name: Direxion MSCI USA ESG-Leaders vs. Laggards ETF

Investment Adviser/Subadvisor: Rafferty Asset Management LLC

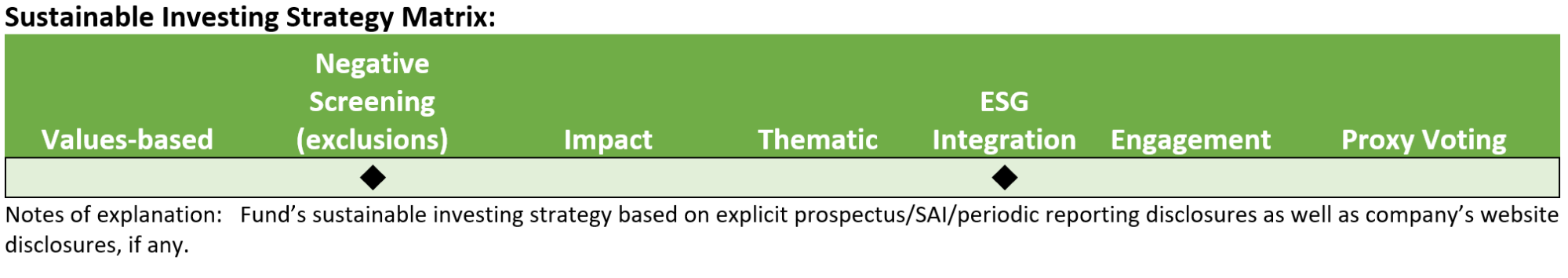

Sustainable Investing Strategy: ESG Integration-Mixed*

Investing strategy description:

The fund’s tracking index seeks to provide long exposure to companies with high environmental, social, and governance (ESG) ratings and trend relative to their sector peers and short exposure to companies with low ESG performance relative to their sector peers, as determined by MSCI. Securities included in the index are determined based on their combined ESG score for each security. The combined ESG score is determined by multiplying a security’s ESG rating by the security’s ESG trend score.

MSCI determines each security’s ESG rating by assigning a key issues score to each security based on an evaluation of the company based on 37 different key ESG issues, related to climate change, pollution, human capital, product liability, corporate governance, and corporate behavior. A weighted average of the key issues score is then determined. MSCI then normalizes the weights of the constituents within each sector to reflect the sector weight of the MSCI USA Index.

MSCI determines the ESG trend score by determining the ESG rating change from the prior period to the current period. A value is assigned by MSCI based on three levels, Upgrade, Neutral, or Downgrade. An Upgrade score is assigned when a company’s latest ESG Rating has increased by at least one level compared to the previous assessment. A Neutral score is assigned when a company’s latest ESG Rating has not changed from the previous assessment and a Downgrade score is assigned when a company’s latest ESG rating has decreased by at least one level compared to the previous assessment.

Companies assessed by MSCI that are found to be in violation of international norms (for example, facing very severe controversies related to human rights, labor rights, or the environment) and/or involved in controversial weapons (landmines, cluster munitions, depleted uranium, and biological and chemical weapons) will not be included in the long component but may be included in the short component.

The fund will invest in derivatives, such as swap agreements, but these are not subject to an ESG determination.

*Exclusions are in the form of short positions maintained by the fund.

Fund Name: Direxion Daily Global Clean Energy Bull 2X Shares (KLNE)

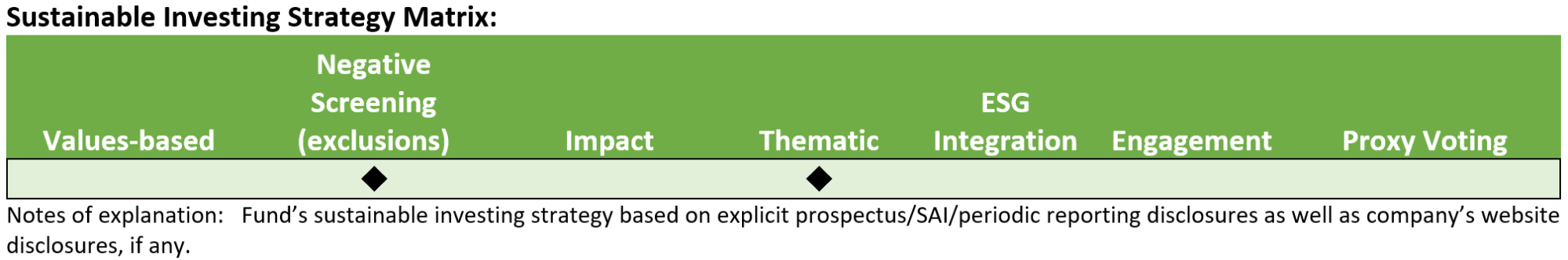

Sustainable Investing Strategy: Negative Screening (exclusions), Thematic

Investing strategy description: Effective October 18, 2021, the methodology of the S&P Global Clean Energy Index tracked by the fund changed to expand the index universe, change the weighting schema and incorporate certain exclusion criteria. The revised index is designed to track the performance of companies from developed markets whose economic fortunes are tied to the global clean energy business. The index is limited to those stocks traded on a developed market exchange that meet or exceed, at the time of inclusion, $300 million in total market capitalization, $100 million in float-adjusted market capitalization, and $3 million average daily value traded over a six-month period. Universe of index eligible companies included in the S&P Global Broad Market Index that (i) derive at least 25% in aggregate revenue from clean energy-related businesses as defined by FactSet’s RBICS classifications; (ii) generate at least 20% of their power (as measured by Trucost Power Generation Data for Utility Companies) from renewable sources (i.e., wind, solar, hydroelectric, biomass, geothermal) and are classified in the Electric Utilities, Multi-Utilities or Independent Power Producers & Energy Traders GICS sub-industries; (iii) are classified in the Renewable Electricity GICS sub-industry; or (iv) had an Exposure Score (as defined below) of at least 0.5 in the Eligible Universe for consideration as of the previous rebalancing. S&P Dow Jones Indices LLC then applies three exclusion criteria, assigns a clean energy Exposure Score and applies a carbon intensity screen to each company in the universe of eligible companies in order to construct the index.

At each rebalancing date, S&P Global applies the following three exclusion criteria to the companies in the universe of eligible companies:

- Business Activity Screen – Excluded is any company with specific levels of involvement and/or significant ownership in any company (as measured by Sustainalytics, a third-party data provider) that is involved in: controversial weapons, small arms, military contracting, tobacco, thermal coal, oil sands, shale energy and arctic oil & gas exploration.

- Global Standards Screen – Excluded is any company that Sustainalytics has identified as causing, contributing to or being linked to violations of international norms and standards as set forth in the United Nations Global Company Principles and its associated standards, conventions and treaties). • Media and Stakeholder Analysis Overlay – S&P Global will review the S&P Global Media and Stakeholder Analysis, analyzing certain environmental, social and governance (“ESG”) risks (e.g., economic crime and corruption, fraud, illegal commercial practices, human rights issues, labor disputes, workplace safety, catastrophic accidents and environmental disasters), and may exclude a company due to such ESG risks.

Next, to seek to quantify a company’s level of involvement in the clean energy business, S&P Global assigns a company a clean energy exposure score based on either a Clean Revenue Score or a Clean Power Generation Score (an “Exposure Score”). For non-power generating companies, S&P Global assigns a Clean Revenue Score based on the following clean revenue thresholds (calculated as the percentage of a company’s revenue attributed to clean energy): 0 (x < 25%), 0.5 (25% < x < 50%), 0.75 (50% < x < 75%) or 1 (X > 75%). For power generation companies, there will be two scores available for each company – a Clean Revenue Score and a Clean Power Generation Score, the higher of which is assigned to that company. A Clean Power Generation Score is based on the following clean power generation thresholds (calculated as the percentage of a company’s revenue attributed to clean power generation): 0 (x < 25%), 0.5 (25% < X < 50%), 0.75 (0.50% < X < 75%), or 1 (X > 75%). If more than 100 securities have an Exposure Score of 1, all Exposure Score 1 securities are selected for the index. If fewer than 100 securities have an Exposure Score of 1, then securities are ranked by float-adjusted market capitalization and the highest-ranking security with an Exposure Score of 0.75 is added to the index until 100 index constituents are selected. If there are still not 100 index constituents, the highest ranking security with an Exposure Score of 0.5 is added to the index until the 100 index constituents are selected. However, the index’s weighted average Exposure Score will never be less than 0.85. Last, S&P Global applies a carbon intensity screen to each company. The index will not include a company that has an S&P Trucost Limited carbon-to revenue footprint score three standard deviations above the mean carbon-to-revenue footprint score of all companies in the universe of eligible companies with an Exposure Score of 1. A company’s carbon-to-revenue footprint score is calculated by dividing the company’s annual greenhouse emissions in metric tons by its annual revenues for the corresponding year, expressed in millions of U.S. Dollars. This step removes companies from the index that have very large carbon-to-revenue footprints, meaning that they are not clean energy companies based on this metric. Although the index seeks to identify 100 companies for inclusion, the actual number of constituents may be more, or less. At each rebalancing, the index constituents are weighted based generally on the product of each constituent’s float-adjusted market capitalization and its Exposure Score.