![]()

Fund Group: Spear Advisors

Fund Name: Spear Alpha ETF (SPRX)

Investment Adviser: Spear Advisors LLC

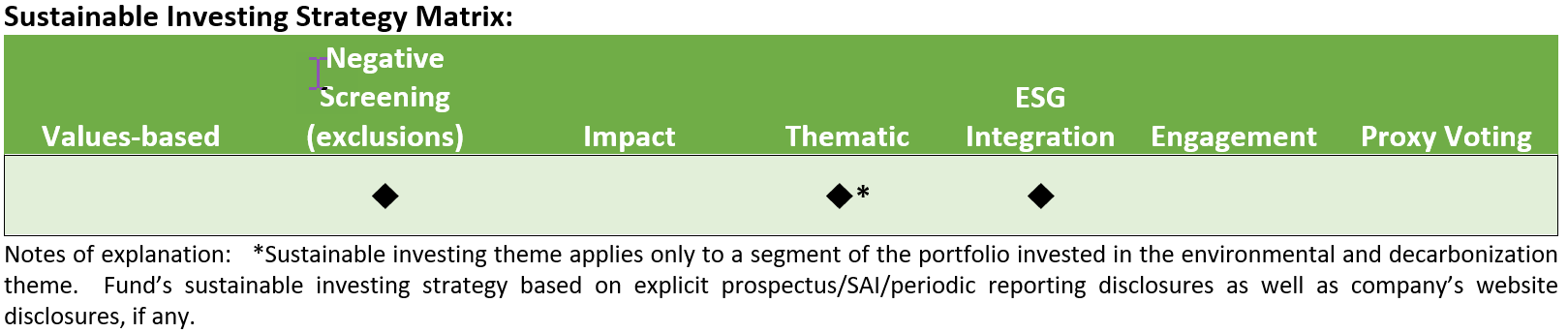

Sustainable Investing Strategy: ESG Integration-Mixed*

![]()

Investing strategy description: The fund is an actively managed ETF that will invest primarily in equity securities, including common stock or American depositary receipts (ADRs) of companies that Spear Advisors LLC believes are poised to benefit from breakthrough innovation in industrial technology. The adviser targets technological developments that can be categorized into one or more of the following themes: Environmental focus and decarbonization, manufacturing digitization, robotics, industrial automation and photonics and additive manufacturing, space exploration and artificial intelligence.

Sustainable investing strategy description: ESG Integration-Mixed

Thematic: According to the fund’s advisor as set out in the fund’s prospectus, decarbonization and broader environmental awareness is a powerful theme with the potential for significant innovation in industrial technology. Companies within this theme include those that engage in one or more of the following, or similar, activities: (i) providing low carbon footprint solutions, such as electric and hydrogen vehicles; (ii) providing products, components, services and materials that go into the associated infrastructure (e.g., charging stations, electronic components, materials); (iii) providing products and services that improve the environmental operating efficiency (e.g., energy efficiency innovations) of physical structures; (iv) providing technologies and services for carbon sequestration; and/or (v) providing equipment, components, and services for other environmental initiatives such as water filtration and environmental remediation. This is just one of five themes pursued by the fund.

ESG integration and Negative Screening: In evaluating investments for the fund, the adviser applies an environment, social, and governance (ESG) framework that evaluates companies based on various metrics, such as the company’s impact on the environment. This includes consideration of whether the company has any targets for carbon emission reduction, its commitment to reducing energy consumption, and the company’s history or potential to improve the industrial sector or generate environmental benefits. The adviser also considers a company’s governance philosophy, such as the company’s management incentive structure, board of directors composition, and employee ownership. The adviser uses this ESG framework to screen companies for inclusion or exclusion from the fund’s investment universe. The implementation of the fund’s ESG framework, including the evaluation of each investment idea, as well as identification of opportunities that benefit from environmental focus, is a core part of the research process and the fund’s investment theme.

Note of Explanation:

ESG Integration-Mixed-The Fund’s ESG criteria are generally designed to exclude companies that are involved in, and/or derive significant revenue from, certain industries or product lines, including: gambling, alcohol, tobacco, coal, and weapons. The investment adviser conducts a supplemental analysis of individual companies’ corporate governance factors and a range of environmental and social factors that may vary by sector. The investment adviser engages in active dialogues with company management teams to further inform investment decision-making and to foster best corporate governance practices using its fundamental and ESG analysis. (Note: There is a distinction between engagement when appropriate through dialogue with company management teams as part of an adviser’s fundamental due diligence process and engagement as an active owner on environmental, social and governance issues. Same applies to proxy voting and filing or co-filing shareholder proposals).