Chart of the Week – February 24, 2025: Focused sustainable high yield funds decline in number

Chart of the Week – February 17, 2025: Water and water-related thematic funds

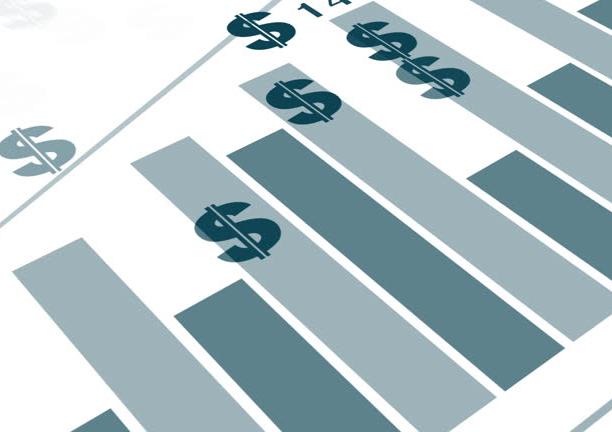

Chart of the Week – February 10, 2025: Vanguard lowers fees on 2 focused sustainable funds

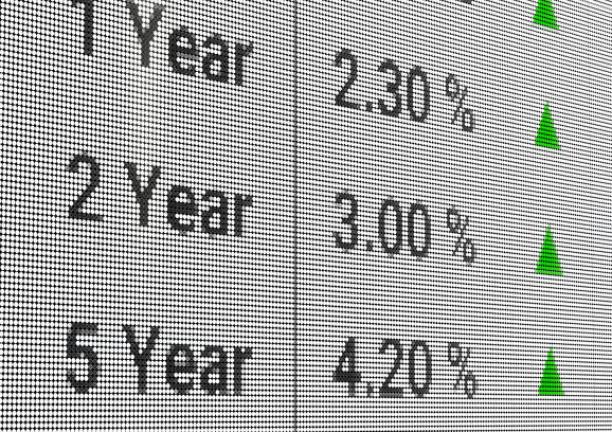

Chart of the Week – February 3, 2025: Focused sustainable fixed income funds YE 2024

Chart of the Week – January 27, 2025: Green bond funds update

Chart of the Week – January 20, 2025: Top performing funds in 2024

Chart of the Week – January 13, 2025: Top 10 assets gaining mutual funds in 2024

Chart of the Week – January 6, 2025: Sustainable ETF launches 2024