The Bottom Line: Outsized flows into actively managed ETFs disregards evidence that most active investment managers tend to underperform their benchmark most of the time.

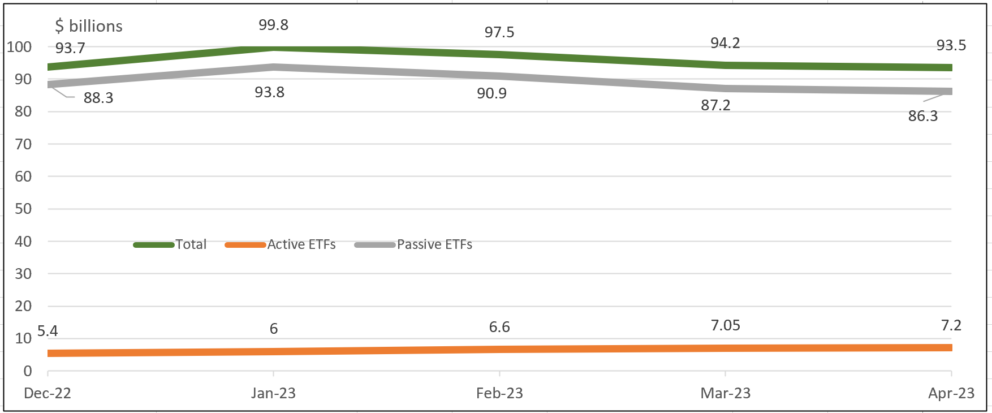

Total net assets of sustainable active and passive ETFs: December 30, 2022 – April 28, 2023 Notes of Explanation: Sources: Morningstar Direct and Sustainable Research and Analysis

Notes of Explanation: Sources: Morningstar Direct and Sustainable Research and Analysis

Observations:

- According to reporting in the Wall Street Journal on May 3, 2023 investors have been directing outsized flows into actively managed exchange-traded funds versus index-tracking ETFs. While accounting for less than 6% of total assets, active ETFs have attracted about 30% of the total flows to ETFs so far this year. This is being attributed to a greater interest in active management in the light of turbulent market conditions as well as the “ease with which they allow investors to more easily trade specific strategies.” While this thinking may seem to be appealing in the short term, the fact is that a majority of active managers tend to underperform their benchmark most of the time. The underperformance rate in both categories and regions tends to increase with longer time horizons. Also, when funds outperform in a certain category, the outperformance doesn’t persist, and it doesn’t increase the odds of outperformance in a future period.

- The trend so far this year favoring conventional funds can also be observed regarding sustainable ETFs through the end of April. During the first four months of the year, actively managed sustainable ETFs added $1.8 billion in assets, or a gain of 33%. This compares to a $2.0 billion decline in the assets of passively managed ETFs, or 0.2% without adjusting for year-to-date market gains and the blockbuster launch in early April of the $2.0 billion Xtrackers MSCI USA Climate Action Equity ETF (USCA). The new ETF, which focuses on companies that are addressing and adapting to climate change, pulled in more than $2 billion in assets in its first day of trading, with the bulk of that money coming from Finnish pension fund Ilmarinen.

- Actively managed ETFs reached $7.2 billion in assets at the end of April and account for 7.7% of sustainable ETF assets. Actively managed sustainable ETFs have also outpaced sustainable passively managed ETF new fund launches throughout 2022 but lagged nine to 11 passively managed fund launches during the first four months of 2023.

- It should be noted, however, that about two-thirds of the four-month gains recorded by actively managed sustainable ETFs are sourced to six recently launched funds managed by Putnam Investment Management and Dimensional Fund Advisors investing in US equities, international equities, and fixed income securities. These funds, which were launched between November 2022 and January 2023 and likely sourced the bulk of the new money via internal sources, added $1.2 billion or 67% of the total four-month net gain.

- These funds include the Putnam ESG Core Bond ETF (PCRB), Dimensional US Sustainability Core 1 ETF (DFSU), Putnam PanAgora ESG International Equity ETF (PPIE), Putnam ESG Ultra Short ETF (PULT), Putnam ESG High Yield ETF (PHYD) and Dimensional International Sustainability Core 1 ETF (DFSI). Net expense ratios reported by these funds average 36 basis points and range from a low of 18 basis points to a high of 60 basis points.