The Bottom Line: To ensure alignment with sustainable investing preferences, index fund investors should delve into the methodology used by index providers to construct benchmarks.

0:00

/

0:00

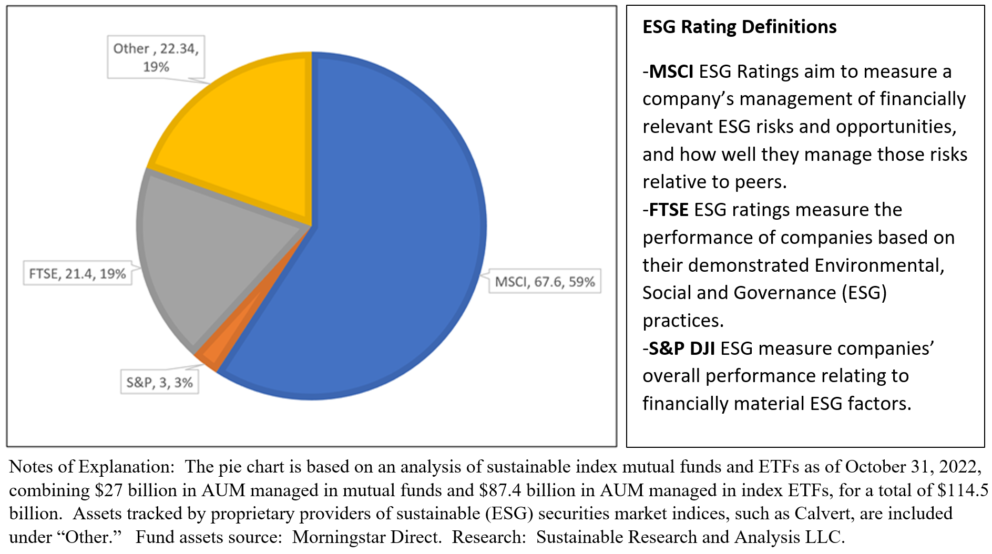

Leading providers of sustainable (ESG) securities market indices used in index funds

Observations:

- Total US sustainable mutual fund and ETF assets under management as of October 31, 2022 stood at $295.8 billion, based on Morningstar’s definition. Of this sum, $114.5 billion, or 39% of assets, is managed passively through index mutual funds and ETFs. That is, funds seeking to replicate the yield and total return performance of securities market indices.

- Many but not all index funds license the use of securities market indices designed and maintained by third party index providers, including firms like MSCI, S&P Dow Jones, FTSE (a unit of the London Stock Exchange Group), Bloomberg, ICE and J.P. Morgan, to mention just a few. While some securities market indices may be customized to suit the needs of the index fund manager, most rely on the expertise of the third-party index providers to construct the rule set for the index as well as the identification, selection and maintenance of securities that comprise the index. In the case of sustainable or ESG indices, this also involves determining eligibility requirements based on ESG or sustainability criteria as well as the application of exclusions. These may be based on companies’ involvement in specific business activities, involvement in relevant ESG controversies as well as performance against one or more set of internationally recognized principles, such as the United Nations’ Global Compact.

- In effect, the index and, in turn, the index fund, relies on sustainability or ESG opinions attributable to the index provider. For sustainable index fund investors, this means that their sustainability preferences should be aligned with the ESG opinions, views, and approaches expressed by the third-party index providers.

- Some of the largest ESG index providers, according to data as of October 31, 2022, include MSCI, FTSE and S&P Dow Jones. Together, the indexes created and maintained by these three firms account for 80% of sustainable index fund assets under management.

- But ESG is not universally defined and ESG scores, that are at the core of constructing sustainable and ESG indices, can have different meanings ranging from the measurement of investment risks to ESG practices to positive societal impacts. In the process, ESG scores can vary from one company to the next and ultimately these influence the financial and non-financial results recorded by index funds. Therefore, it behooves investors to delve into the methodology used by index providers to construct their benchmarks.