The Bottom Line: Actively managed sustainable ETFs continue to expand in number and assets, reaching 54 funds with $68.6 billion in net assets under management.

Actively managed sustainable ETFs continue to expand in number and assets

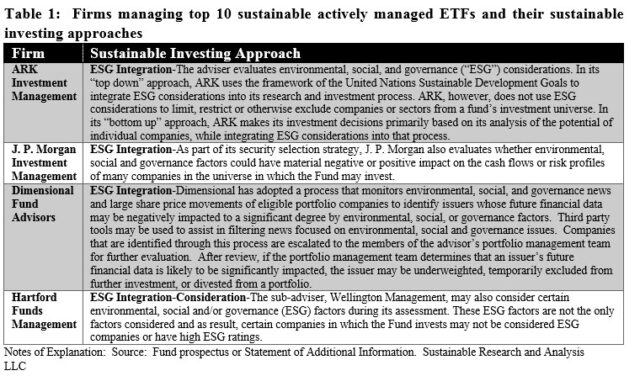

Three new SEC filings in January added to an expanding number of actively managed sustainable ETFs available to investors that, after accounting for a recalibration of actively managed ETFs by relying on the latest SEC filings, reached a total of 54 funds with $68.6 billion in assets under management as of January 31, 2021[1]. On the basis of this recalibration, actively managed ETFs added $12.7 billion in net assets under management in January, almost entirely due net cash inflows recorded by 10 investment funds that integrate ESG into investment decisions pursuant to a qualified or unqualified approach. Refer to Table 1. The same funds are some of the largest ETFs in the segment.

Three new sustainable actively managed ETF filings in January

New actively managed sustainable ETF SEC filings in January were recorded by BlackRock and Goldman Sachs. Once launched, these will expand the number of actively managed sustainable ETFs to 57. These run the gamut in their sustainable investing approach, ranging from values-based funds largely employing exclusionary approaches to ESG integration in its various forms. That said, ESG integration is the dominant investment approach.

BlackRock is planning to introduce two thematic ETFs, the BlackRock U.S. Carbon Transition Readiness ETF and the BlackRock World ex U.S. Carbon Transition Readiness ETF. The funds will invest in large- and mid-capitalization equity securities that may be better positioned to benefit from the transition to a low-carbon economy by overweighting stocks that BlackRock Fund Advisors believes are best positioned to benefit from the transition to a low-carbon economy and to underweighting issuers that it believes are poorly positioned to so benefit.

Also according to new filings in January, Goldman Sachs plans launch the Goldman Sachs Future Tech Leaders ETF that will pursue an ESG Integration-Consideration approach. The fund intends to invest in technology companies operating in the information technology or communication services sectors, or in the internet and direct marketing retail or healthcare technology industries. The fund notes in its registration statement that ESG factors as part of the fundamental research and stock selection process may be considered.

Actively managed sustainable ETFs record strong gains in assets in January

The sustainable actively managed ETF segment was recalibrated to reflect the adoption of ESG integration approaches by an expanded group of ETFs. As a result, 17 ETFs were added to the total tracked at the end of 2020 to reflect the latest SEC filings, including, for example, four additional ETFs managed by ARK Investment Management, four ETFs managed by BlackRock Funds and three by J. P. Morgan Investment Management. In each case, these funds have adopted an ESG integration approach to their investing process.

While 20 firms offer actively managed sustainable ETFs, the segment is dominated by ARK and J.P. Morgan. Together, these two firms manage 15 ETFs and, with combined assets of $65.4 billion, account for 95.3% of the segment’s assets. Further, 98% of the $12.7 billion gain in assets achieved in January, or $12.5 billion, is attributable to the top 10 ETFs that also includes funds managed by Dimensional Fund Advisors and Hartford Funds Management. Refer to Chart 1.

Notes of Explanation. ESG integration is classified into three categories, defined as follows: ESG Integration-Consideration-The fund may integrate ESG. ESG Integration-The fund will integrate ESG and may also engage with stakeholders. ESG Integration-Mixed -Core strategy consists of ESG integration, but exclusions, impact or thematic approaches may also be employed. Source: Promoting the Continued Growth and Development of Sustainable Investing in US Mutual Funds and ETFs: A Three-pronged Proposal to Address Misunderstanding and Confusion that Have Arisen in the Sector. Michael Cosack and Henry Shilling, May 2020.

[1]Recalibration based on detailed reviews of SEC filings, including fund prospectus and Statements of Additional Information.