The Bottom Line: More active versus passively managed sustainable ETFs will be launched in 2022, but costs are higher and they are likely to underperform.

0:00

/

0:00

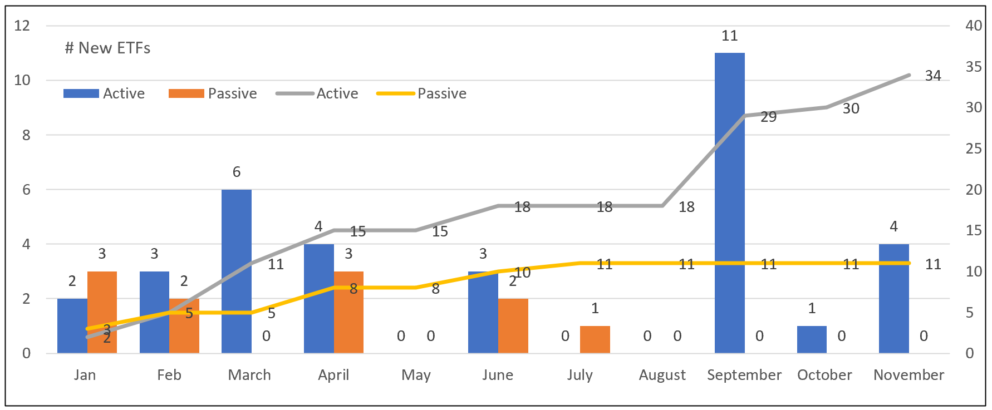

Number of active vs. passive sustainable ETF launches: January 1 – November 30, 2022

Notes of Explanation: Data source: Morningstar Direct. Research by Sustainable Research and Analysis.

Notes of Explanation: Data source: Morningstar Direct. Research by Sustainable Research and Analysis.

Observations:

- This year for the first time, actively managed sustainable ETF launches will outpace new passively managed ETFs, based on data through the end of November 2022. The latest entries into the actively managed sustainable ETF space include three funds managed by Dimensional Fund Advisors LP and one by Thrivent Asset Management. At the end of November, there were 135 passively managed sustainable ETFs with $94.6 billion in assets and 86 passively managed sustainable ETFs with $5.4 billion in assets, for a combined total of $100 billion.

- During the 11 months through the end of November, 45 sustainable ETFs were launched. Of these, 34 are actively managed while 11 are passively managed, or just about 3:1 active versus passive. This compares to almost an equal number of passive and actively managed ETF launches in 2021 and almost 2:1 sustainable passive versus active ETFs in 2020.

- The new issue momentum favoring actively managed ETFs is unfolding even as most active managers underperform most of the time relative to securities market indices. According to S&P Indices Versus Active (SPIVA) research that measures the performance of actively managed funds against their relevant S&P index benchmarks, this is the case not only for equity funds but also fixed income and global/international managers. These conclusions also apply across geographies. Moreover, when good performance does occur, it tends not to persist. Above-average past performance does not predict above-average future performance.

- The average expense ratio covering this year’s cohort of actively managed sustainable ETFs is 60.2 basis points as compared to 27 basis points for passively managed funds, or 55% lower. Offsetting higher expenses are three acknowledged benefits that accrue to actively managed ETF investors, namely tax efficiencies, but applicable to taxable funds, lower minimum investment requirements and a greater level of transparency.

- In addition to fundamental investment factors, the Dimensional Emerging Markets Sustainability Core 1 ETF (DFSE), Dimensional International Sustainability Core 1 ETF (DFSI) and the Dimensional US Sustainability Core 1 ETF (DFSI) take into account the impact that companies may have on the environment and other sustainability considerations when making investment decisions. Dimensional may overweight, exclude or underweight companies based on sustainability impact considerations. The Thrivent Small-Mid Cap ESG ETF (TSME) identifies companies that have sustainable long-term business models for the benefit of all primary stakeholders while driving financial success and risk management and also considering various ESG factors. The fund reports that it will measure its performance relative to a conventional benchmark as well as an ESG index—a practice adopted by a very small segment of actively managed sustainable funds.

- Unless an actively managed strategy is highly desirable but difficult or impossible to replicate, is offered by a fund manager with an established track record, has achieved sufficient scale and diversity of shareholders and is subject to a reasonable expense ratio, preference by investors should be given to sufficiently scaled passively managed sustainable ETFs offered at attractive fees.