The bottom line: Actively managed conventional as well as sustainable ETFs have been gaining some traction, but investors should carefully consider their alternative investing options.

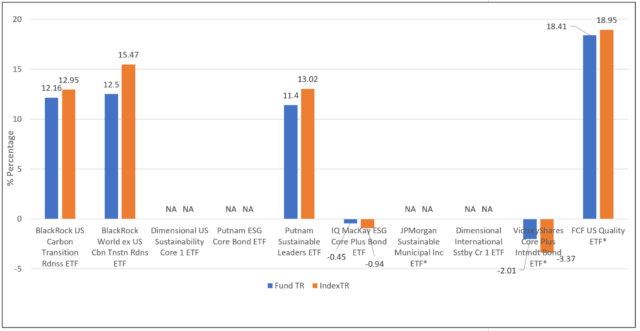

Performance of top 10 actively managed sustainable ETFs relative to designated market index: Trailing 12-months to July 31, 2023 Notes of Explanation: *Dimensional US Sustainability Core 1 ETF, Dimensional International Sustainability Core 1 ETF and Putnam ESG Core Bond ETF have not been operating for a full year. Prior to 7/14/2023, the JPMorgan Sustainable Municipal ETF operated as an open-end mutual fund. Total return performance based on NAV. Designated market index as disclosed in fund’s prospectus or summary prospectus. Sources: Morningstar Direct and Sustainable Research and Analysis.

Notes of Explanation: *Dimensional US Sustainability Core 1 ETF, Dimensional International Sustainability Core 1 ETF and Putnam ESG Core Bond ETF have not been operating for a full year. Prior to 7/14/2023, the JPMorgan Sustainable Municipal ETF operated as an open-end mutual fund. Total return performance based on NAV. Designated market index as disclosed in fund’s prospectus or summary prospectus. Sources: Morningstar Direct and Sustainable Research and Analysis.

Notes of Explanation: *Dimensional US Sustainability Core 1 ETF, Dimensional International Sustainability Core 1 ETF and Putnam ESG Core Bond ETF have not been operating for a full year. Prior to 7/14/2023, the JPMorgan Sustainable Municipal ETF operated as an open-end mutual fund. Total return performance based on NAV. Designated market index as disclosed in fund’s prospectus or summary prospectus. Sources: Morningstar Direct and Sustainable Research and Analysis.

Notes of Explanation: *Dimensional US Sustainability Core 1 ETF, Dimensional International Sustainability Core 1 ETF and Putnam ESG Core Bond ETF have not been operating for a full year. Prior to 7/14/2023, the JPMorgan Sustainable Municipal ETF operated as an open-end mutual fund. Total return performance based on NAV. Designated market index as disclosed in fund’s prospectus or summary prospectus. Sources: Morningstar Direct and Sustainable Research and Analysis. Observations:

- An article published last week in the Wall Street Journal entitled Index-Tracking ETFs Were All the Rage, Until Now sets forth that “the titans of the ETF industry are facing competition in the battle for new money.” Firms like BlackRock, Vanguard and State Street that dominate the market for exchange-traded passively managed funds are facing competition from new players like JPMorgan Asset Management and Dimensional Fund Advisors that have entered the market by focusing on actively managed ETFs. Another source, Bloomberg Intelligence, reported that the segment of actively managed ETFs drew 23% of total ETF inflows this year, despite holding just 4% of the industry’s assets in January.

- Actively managed ETFs have also gained some traction in the sustainable investing sphere. While new listings of actively managed sustainable ETFs through the end of July trailed passively managed ETF launches this year by four funds, last year new listings of actively managed ETFs dominated by a ratio of 2.2 to 1 across the universe of 61 ETF new listings in 2022. That said, the net assets of actively managed sustainable ETFs expanded by $3.2 billion to reach $8.6 billion year-to-date, posting a 60% net gain while passively managed sustainable ETFs netted $3.8 billion, or just 4%, even as sustainable index funds account for 94% of the segment’s assets under management.

- These developments are somewhat surprising given the accepted view that most actively managed funds, both equity funds and fixed income funds, tend to underperform the market, in part, due to higher expense ratios. This would also apply to sustainable funds, although funds in this category are still relatively new and their performance track record is limited. This is either because sustainable ETFs have only recently been launched or their strategies have been rebranded in recent years to reflect that adoption of a sustainable investing approach.

- According to the latest data compiled by S&P’s Indices Versus Active (SPIVA) report [1] that compares the performances of actively managed funds to their appropriate benchmarks, the vast majority of actively managed funds underperform, with margins of underperformance widening over long periods of 10 years or more. The chances are better for the outperformance in investment-grade intermediate funds but here too, levels of underperformance are high. Even in a year of declining markets, like 2022, when active management skills can be more valuable, S&P’s data shows that 51% of active managers underperformed in the US large-cap equity sphere and 79% underperformed in the investment-grade intermediate bond fund area.

- An evaluation of the top 10 sustainable actively managed ETFs as of July 31st shows that only six funds have been in operation for a full 12-months and of these funds, only two funds, or 33%, outperformed their designated benchmarks. The two outperforming funds were both bond funds. The top 10 funds manage $4.8 billion in net assets and account for 55% of the actively managed sustainable funds segment.

- Given the historical performance record of active managers, the limited track record of sustainable fund managers as well as higher expense ratios [2], on average, sustainable investors should carefully consider whether they may be better served by investing in an equivalent or similar index fund offering; and consider actively managed funds in cases where passively managed options are not available and exposure to the particular active investment strategy is highly desirable.

![Actively-managed-ETF-launches-8-2023-2[1] Bar graph moving up. Positive bar chart in blue, rising line in orange. Business, financial figures, revenue, cash flow, analyzing, growth, stock market and exchange. Abstract financial concept.](https://sustainableinvest.com/wp-content/uploads/elementor/thumbs/Actively-managed-ETF-launches-8-2023-21-qyx7jkc2afw2yya39t1uk9m2z5ee3b99mkiat84x4c.jpg)