Summary

Beyond implementing sustainable investing strategies by investing directly in individual securities, mutual funds, exchange-traded funds (ETFs) as well as other asset types, investors with a desire to achieve positive societal outcomes with their investments have another option, albeit a limited one at this time. This is the opportunity to invest via investment management advisory firms and their product offerings that, in turn, contribute part of their revenues or management fees to charitable organizations. While not entirely a new concept, at least four firms have in the last two years or so introduced charitable giving programs. These firms include Aspiration Fund Adviser LLC, Infrastructure Capital Advisors, LLC (ICA), Loncar Investments and State Street Global Advisors (SSG). It should be noted, however, that the investment product offerings available at these firms may not, in each instance, align with sustainable strategies and investors first need to conduct due diligence to assure themselves that the management firm and its product offerings are in alignment with their investment objectives and sustainability strategies. Also, as is the case with investing more generally, investors should evaluate the management profile of the firm, the firm’s skills to effectively combine financial and sustainability characteristics, the fund’s demonstrated performance track record and consistency of results, and importantly, fund expenses as well as any other relevant operational considerations.

Charitable Giving Programs

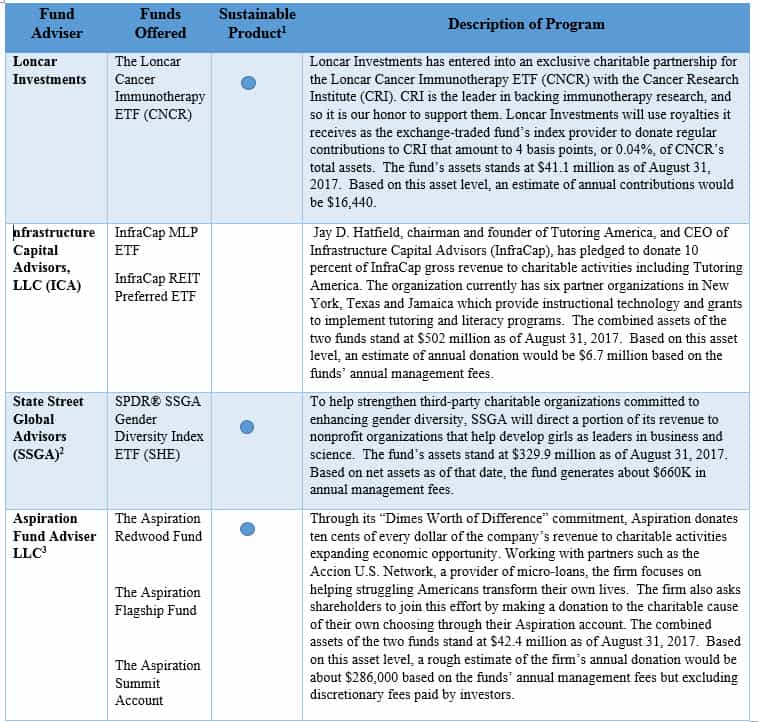

Table 1 below lists the four investment management firms and their funds, whether the firm’s offer sustainable products along with a description of the charitable program. In the case of the four programs described in Table 1, the fund adviser has committed to direct to a single charity or multiple charities a percentage of the firm’s entire revenue stream or a percentage of the fees derived from a particular product offering. The percentage of fees to be allocated or the charitable organization may or may not be specifically identified.

For example, State Street Global Advisers, a unit of State Street Bank, directs a portion of the revenue derived from the $329.9 million[1] SPDR SSGA Gender Diversity Index ETF (SHE) to nonprofit organizations. This is achieved through SHE Impacts[2], a donor-advised fund created by State Street to support gender-diverse leadership that helps develop girls as leaders in business and science. The fund, which is an index fund that tracks the SSGA Gender Diversity Index, invests in large-cap U.S. companies that are leaders in advancing women through gender diversity on their boards of directors and in management. In this instance, investing in the SHE ETF offers a dual benefit to sustainable investors interested in promoting and advocating in favor of gender diversity. That said, the exact dollar amounts or the recipient nonprofit organizations are not specifically disclosed.

In contrast, Aspiration Fund Adviser LLC through its “Dimes Worth of Difference” program reflects the firm’s commitment to donate ten cents of every dollar of the company’s revenue to charitable activities focused on expanding economic opportunity by working with partners such as the Accion U.S. Network, a provider of micro-loans to assist struggling Americans transform their lives. Aspiration’s offers two mutual funds and a savings product. The first fund is the Redwood Fund, a $32.8 million sustainable fund started in 2015 that incorporates an analysis of companies’ sustainable environmental, workplace, and governance practices with the aim of finding investments that the adviser believes are poised for growth. The second fund, the Aspiration Flagship Fund, is a non-sustainable fund, with $9.6 million in assets.

Conclusion

The investment management listed above do not concentrate exclusively on offering sustainable mutual funds or ETFs, and, in the case of ICA, none at all. Further, with the exception of State Street, Loncar and Aspiration don’t offer a sufficiently diverse menu of funds to allow for the construction of a comprehensive investment program. To the extent any of the individual charitable programs are appealing, the corresponding sustainable, thematic oriented or broad-based funds may complement an existing portfolio. That said, as is the case with investing more generally, before investing in any one of these funds, investors are advised to conduct their own due diligence. The funds should be evaluated starting with the management profile of the firm, the firm’s skills to effectively combine financial and sustainability characteristics, the fund’s demonstrated performance track record and consistency of results, and importantly, fund expenses as well as any other relevant operational considerations, such as the fund’s size and ears of operation, etc. In any case, investors have to be clear about their sustainability objectives to ensure that these are properly aligned with the fund profiles.

Table 1: Fund Advisers with Charitable Giving Programs

Notes of Explanation: (1) Refers to sustainable fund, (2) State Street offers other sustainable ETFs but SHE is the only ETF linked to a chartable program, (3) Investors in the funds may pay the Aspiration a fee in the amount they believe is fair, ranging from 0% to 2.00% of the value of the account.

[1] As of August 31, 2017. Based on net assets as of that date, the fund generates about $660K in annual management fees.

[2] The donor-advised fund is administered by the National Philanthropic Trust, a 501(c) (3) public charity, SHE Impacts will provide grants to organizations that prepare and encourage girls to take their place in industries where women have low representation today, such as STEM (Science, Technology, Engineering, and Math). SHE Impacts also will seek to support programs that promote gender diverse leadership in the workplace.