The Bottom Line: April performance results highlight that mutual funds at this time offer sustainable investors a greater variety of investment options relative to ETFs.

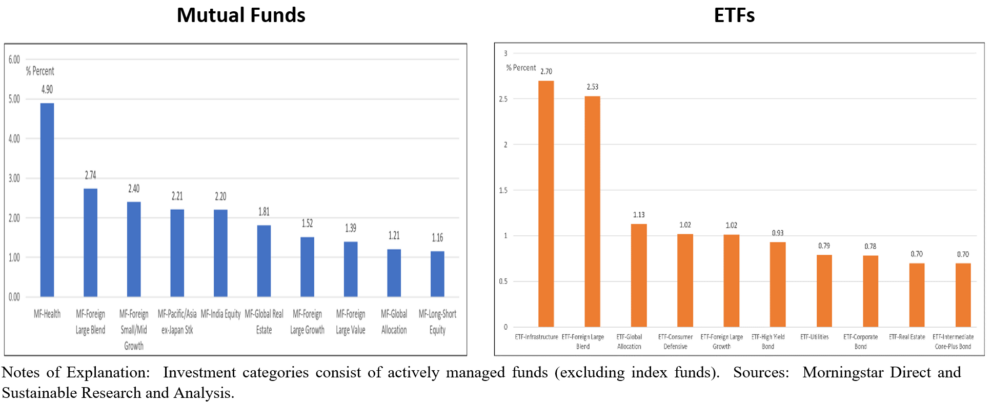

April 2023 average total return performance for top 10 performing investment categories stratified by actively managed mutual funds and ETFs

Observations:

- Strong earnings registered by several large companies overcame bank sector concerns and uncertainty regarding interest rates, the looming debt ceiling deadline and economic growth, to push the broad stock market higher in April. The broad-based US market gained 1.6% in April and 9.2% year-to-date based on the performance of the S&P 500 Index. Lage cap and large cap value stocks led the pack while mid-cap and small cap stocks did not manage to register results above 0.0%. At the same time, US bonds generated gains of 0.61% and 3.59% year-to-date, according to the Bloomberg US Aggregate Bond Index. The MSCI ACWI, ex US Index added 1.8% and 8.9% over April and on a year-to-date basis while global bonds registered gains of 0.44% and 3.46%, respectively.

- Against this backdrop, actively managed mutual funds added .40%, on average, while actively managed ETFs came in at an average -.01% in April. Sustainable actively managed US equity funds, including both mutual funds and their share classes, as well as actively managed ETFs, posted an average gain of 0.07% while sustainable taxable bond funds added an average of 0.54%. International equity funds closed the month with an average gain of 0.48%.

- The average performance of actively managed mutual funds and ETFs on a more granular level, across fund investment categories, ranged from a high of 4.9% recorded by mutual funds focused on the health sector while technology-oriented mutual funds landed on the other side of the range with an average drop of 5.09%.

- When viewed through the prism of investment fund categories, mutual funds at this time offer sustainable investors a greater variety of investment options relative to ETFs. This can be observed in the broader breadth of sustainable mutual fund investment categories that make up the top 10 performing categories versus ETFs based on average performance results in April. For example, six of the top 10 performing mutual fund investment categories with 32 funds/share classes, are not offered at this time in the form of sustainable ETFs. The April average performance of some of these investment categories contributed to the month’s outperformance of mutual funds relative to ETFs.

- As for individual top and bottom performing funds, both funds are volatile, equity oriented thematic funds that charge higher than average fund expenses. Returns ranged from a high of 7.15% recorded by the $1.7 billion Eventide Healthcare & Life Sciences Fund A that invests in stocks of companies in the healthcare and life sciences sectors. At the other end of the range is the small $13.9 million Firsthand Alternative Energy Fund that invests in alternative energy and alternative energy technology companies, both U.S. and international. The fund registered a decline of -8.63.