Bottom Line: Newly launched ARK Venture Fund represents a risky sustainable (ESG) investment opportunity that should be prudently evaluated by financial intermediaries and individual investors.

ARK Investment Management launches ARK Venture Fund

Last week, ARK Investment Management LLC launched a new fund, the ARK Venture Fund, an unlisted closed-end interval fund that intends to allocate between 20% to 85% to global but largely US private early-stage companies aligned with the fund’s theme of disruptive innovation while the rest may be invested in public companies.

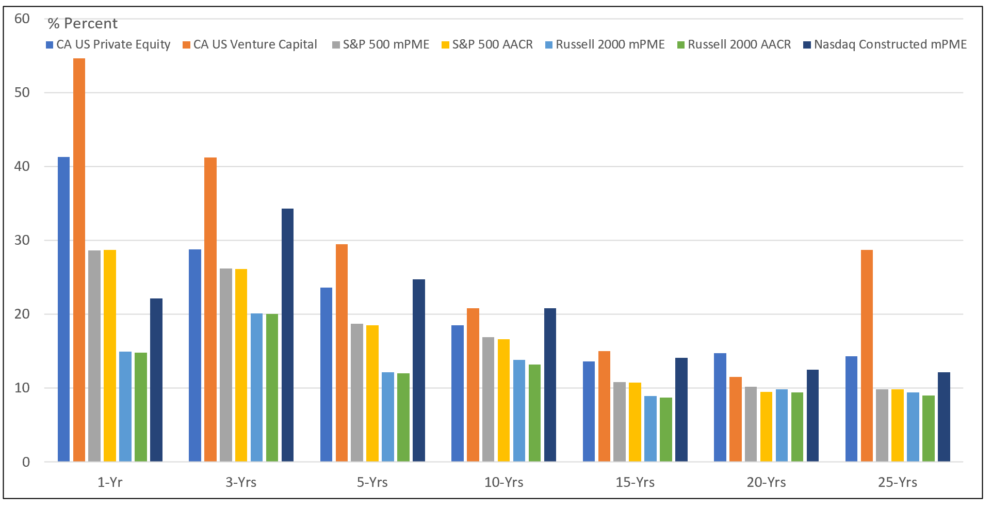

In both cases, the fund considers environmental, social and governance factors using a risk/opportunities lens rather than attempting to achieve socially motivated outcomes. Launched on September 23, 2022, this public-private crossover fund is offering long-term oriented non-accredited and accredited retail investors an opportunity to invest, as described by the fund, in the most innovative private companies throughout their private and public market lifecycles, in the style of venture capital firms. Fund shares may be purchased for minimum investments of $500 via a platform provided by Titan, a NYC-based fintech startup that offers actively managed investment strategies. In addition to serving as an avenue for investors to potentially realize venture capital like returns over an investment time horizon of 5-10 years with a low-minimum investment threshold but at higher charged fees relative to mutual funds and ETFs, the fund represents a risky investment opportunity that should be prudently evaluated by financial intermediaries as well as direct individual investors. The fund is being launched on the heels of a record-shattering year in 2021 as trillions of dollars in pandemic-related stimulus produced a historic surge in dealmaking and exits and returns for private investing, including venture capital and private equity, surged to beat conventional benchmarks by wide margins. According to index data published by Cambridge Associates, venture capital and private equity returns in 2022 exceeded the performance of public companies tracked by the S&P 500, Russell 2000 and Nasdaq by wide margins and this is also the case for longer-term intervals. For example, in 2021 the CA US Venture Capital and US Private Equity indices were up 54.6% and 41.3%, respectively, and margins of outperformance are also evident over the trailing 5–10-year investment time horizons that are the focus of the ARK Venture Fund. Refer to Chart 1. That said, some results have narrowed due to the strong performance in recent years of a small number of growth-oriented public technology firms. But the outlook is now starkly different and the future is uncertain, particularly for short-term oriented investors and early ARK Venture Fund investors. The fund invests in risky companies that are difficult to value, it offers limited liquidity and is exposed to higher potential volatility due to investment concentrations as well as the use of leverage.

Chart 1: Performance of US private equity and venture capital index returns to Dec. 2021 Notes of Explanation: The indices are maintained by Cambridge Associates LLC. Private indexes are pooled horizon internal rates of return, net of fees, expenses, and carried interest. Returns are annualized. Because the US private equity and venture capital indexes are capitalization weighted, the largest vintage years mainly drive the indexes’ performance. Public index returns are shown as both time-weighted returns (average annual compound returns) and dollar-weighted returns (mPME). The CA Modified Public Market Equivalent replicates private investment performance under public market conditions. The public index’s shares are purchased and sold according to the private fund cash flow schedule, with distributions calculated in the same proportion as the private fund, and mPME net asset value is a function of mPME cash flows and public index returns. Source: Cambridge Associates.

Notes of Explanation: The indices are maintained by Cambridge Associates LLC. Private indexes are pooled horizon internal rates of return, net of fees, expenses, and carried interest. Returns are annualized. Because the US private equity and venture capital indexes are capitalization weighted, the largest vintage years mainly drive the indexes’ performance. Public index returns are shown as both time-weighted returns (average annual compound returns) and dollar-weighted returns (mPME). The CA Modified Public Market Equivalent replicates private investment performance under public market conditions. The public index’s shares are purchased and sold according to the private fund cash flow schedule, with distributions calculated in the same proportion as the private fund, and mPME net asset value is a function of mPME cash flows and public index returns. Source: Cambridge Associates.

ARK’s investment thesis: Disruptive innovation with a 5–10-year investment horizon

Using its own internal research and analysis, ARK seeks to identify private, early-stage companies relevant to a particular theme that are capitalizing on disruptive innovation or that are enabling the further development of a theme in the markets in which they operate.

ARK’s internal research and analysis leverages insights from diverse sources, including external research, to develop and refine its investment themes and identify and take advantage of trends that have ramifications for individual companies or entire industries. The themes that ARK has identified include: Genomic Revolution Companies, Automation Transformation Companies, Energy Transformation Companies, Artificial Intelligence Companies, Next Generation Internet Companies or FinTech Innovation Companies. Further descriptive information may be found in the fund’s prospectus.

Fund risks and opportunities: Risks may outweigh opportunities, especially for early investors

The table below identifies some of the key fund related risks and opportunities.

Fund Risks Fund Opportunities

Source: Sustainable Research and Analysis LLC