The Bottom Line: Green investment funds continue to gain assets and also potentially two new green bond ETF entrants that will add to investor choices.

Summary

Green bond mutual funds and ETFs gained $53.2 million in net assets to end the month of August at $1,418.8 million–the highest level for this themed fund segment since the launch of the first fund in 2013. The segment is potentially about to expand. According to a recent SEC filing, two index tracking green bond ETFs may soon be coming to market. Both to be managed by Tuttle Capital Management LLC, the funds include the Green Bond ETF that will track the U.S. Corporate Green Bond Income Index and the Green Short-Term Bond ETF comprised of maturities up to five years. In the meantime, the seven green bond funds posted an average -0.19% total return in August, matching the results recorded by the Bloomberg US Aggregate Bond Index while outperforming the ICE BofAML Green Bond Index Hedged US that dropped -0.36%. Cumulative green bond volume for the year through August reached $262.4 billion with the addition in August of $10.7 billion in green bonds. Green bond volume in 2021 is expected to exceed last year’s level and is likely to reach over $300 billion. With COP 26 coming up, green bond volume could even reach $400 billlion.

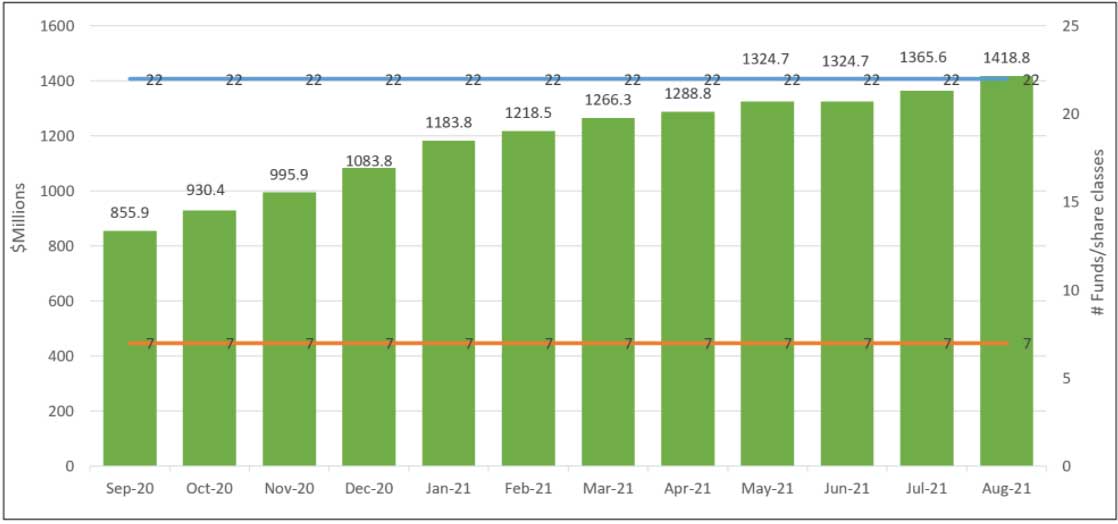

Green bond fund assets gained $53.2 million to end month at $1.4 billion

The universe of seven green bond mutual funds and ETFs, 22 funds and share classes in total, gained $53.2 million in net assets to end the month of August at $1,418.8 million—the highest level for this themed fund segment since the launch of the first fund in 2013. August’s increase represents a 4% gain relative to July and the best dollar addition since January of this year. The year-to-date gain in net assets stands at $335.0 million. Consistently, this month’s uptick in assets accrued almost entirely to the two largest green bond funds. Of the $53.2 million, 91.4% of the increase was realized by the Calvert Green Bond Fund that added $27.4 million, almost entirely sourced to institutional investors, and $21.2 million flowed into the second largest iShares Global Green Bond ETF. The third largest green bond fund, the VanEck Vectors Green Bond ETF, added $2.6 million. The fund is now on the verge of breaking through the $100 million net assets level. In fact, since the start of the year, VanEck Vectors Green Bond ETF and iShares Global Green Bond ETF registered the best increases in assets on a percentage basis, 74% and 54%, respectively, with gains of $42 million and $84.4 million, in that order.

Investor considerations: Two green bond ETFs offer the lowest cost options

Currently the only two green bond ETFs listed for trading are the iShares Global Green Bond ETF and VanEck Vectors Green Bond ETF. The funds are both subject to the lowest 20 bps expense ratios in the segment and they represent for interested investors attractive investment options, even as returns over the trailing short-term 12-month interval have lagged behind their competitor funds. The two funds seek to replicate indices provided by different index vendors using their independent evaluation and selection criteria, S&P Global an MSCI, and, equally important, VanEck limits eligible securities to US dollar denominated issues while iShares maintains a more expansive investment strategy that extends to non-US dollar denominated securities and employs a hedging strategy to limit currency risks. That said, iShares also publishes a periodic impact report while the VanEck ETF does not.

New green bond ETF registrations: Two potentially new ETFs in SEC registration

Existing green bond ETFs may soon be joined by two new additions to the roster of green bond ETF options. According to an SEC registration statements filed by Collaborative Investment Series Trust as of June 29, 2021 followed by an updated intended effective date of September 30th, two index tracking green bond ETFs may soon be coming to market. Both to be managed by Tuttle Capital Management LLC, the funds include the Green Bond ETF that will track the U.S. Corporate Green Bond Income Index and the Green Short-Term Bond ETF that will track the Green Short-Term Corporate Green Bond Income Index consisting of maturities up to five years. The funds’ expense ratios have not been disclosed as of the latest filings.

In both cases, the funds will be limited to US dollar denominated securities whose eligibility will be determined as follows: “In order for a bond to be eligible for inclusion in the Index, the bond issuance proceeds must have a clearly designated use that is intended solely for projects or activities that promote climate change or adaptations or other environmental sustainability purposes. Guidelines for acceptable use of proceeds and disclosure have been outlined in the Green Bond Principles of the International Capital Market Association. The Index may use internal and other third-party data providers to verify that use-of-proceeds adhere to “Green” guidelines. At this point, there is insufficient information to evaluate the full scope of the parameters that will be used to qualify the eligibility of green bonds.

Tuttle Capital Management, LLC, doing business under Tuttle Tactical Management, LLC is a five person Riverside, CT, management firms with $192.3 million in assets under management as of March 23, 2021.

Performance: Green bond funds matched the results recorded by the Bloomberg US Aggregate Bond Index, pan average -0.19% total return in August

Posting an average -0.19% total return in August, green bond funds matched the results recorded by the Bloomberg US Aggregate Bond Index (recently renamed to exclude a reference to Barclays from whom the indices were acquired) while outperforming the ICE BofAML Green Bond Index Hedged US that dropped -0.36%. The trailing 12-month and 3-year average returns reflected mixed results with green bond funds outperforming in the short-term, up to 1-yeear, but lagging in the intermediate-term.

The best returns were posted by two funds who are also the only two funds that managed to eke out positive results in August, including the PIMCO Climate Bond Fund, up as much as 14 bps recorded by the Institutional share class, and the VanEck Green Bond ETF, up a narrow 3 bps. At the same time, PIMCO largely leads in performance over the trailing twelve months while the VanEck Green Bond ETF lags. The performance of the two funds in August was likely aided by their limited or zero exposures to non-US dollar-denominated securities or currencies relative to other funds, excepting the Franklin Municipal Green Bond Fund. This small fund, still just under $10 million in assets, lagged the Bloomberg Municipal Total Return Index across 3 of its four share classes.

Green bond issuance: A drop relative to July, $10.7 billion in green bonds were issued in August to reach $262.4 billion Y-T-D; 2021 volume could reach $400 billion

Cumulative green bond volume for the year through August reached $262.4 billion, with the addition in August of $10.7 billion in green bonds. Even as month-over-month issuance declined by 53% relative to July’s $22.7 billion, year-to-date issuance volume reached 97.4% of the level achieved in 2011. Green bond volume in 2021 is expected to exceed last year’s level will reach over $300 billion. In fact, corporate, sovereign and sub-sovereign commitments ahead of and following COP26, the UK hosted UN Climate Change Conference of the Parties in Glasgow on 31 October to 12 November 2021, could push green bond issuance in 2021 closer to $400 billion. Just last week, the European Commission reported that it would issue up to €250 billion in green bonds this fall as part of its plans to finance the 27-nation bloc’s recovery from the coronavirus crisis. The first tranche could come to market as early as October, subject to market conditions. Also last week, Walmart Inc. (NYSE: WMT) announced that it had priced the company’s first green bond, a $2 billion aggregate principal amount note offered at 1.8% due 2031 that was reported to be the largest corporate green bond that came to market in the US. Issued in minimum denominations of $2,000, which would qualify these for retail investment accounts, the net proceeds will be allocated to new or existing eligible projects financed with three years of the issue date that fall into the following categories: renewable energy, high performance buildings, sustainable transport, zero waste and circular economy, water stewardship, and habitat restoration and conservation.

| Fund Name | 1-Month Return (%) | Y-T-D Return (%) | 12-Month Return (%) | 3-Year Return (%) | AUM ($M) | Expense Ratio (%) |

| PIMCO Climate Bond Institutional | 0.14 | 1.07 | 3.62 | 17.3 | 0.54 | |

| PIMCO Climate Bond I-2 | 0.13 | 1.01 | 3.52 | 2 | 0.64 | |

| PIMCO Climate Bond I-3 | 0.13 | 0.97 | 3.46 | 0.1 | 0.69 | |

| PIMCO Climate Bond A | 0.11 | 0.79 | 3.21 | 0.7 | 0.94 | |

| PIMCO Climate Bond C | 0.04 | 0.31 | 2.41 | 0.1 | 1.69 | |

| VanEck Green Bond ETF | 0.03 | 0.03 | 1.21 | 3.95 | 99 | 0.2 |

| TIAA-CREF Green Bond Advisor | -0.07 | 0.35 | 2.21 | 2.2 | 0.55 | |

| TIAA-CREF Green Bond Institutional | -0.07 | 0.36 | 2.23 | 30.1 | 0.45 | |

| TIAA-CREF Green Bond Premier | -0.08 | 0.28 | 2.12 | 1.1 | 0.6 | |

| TIAA-CREF Green Bond Retirement | -0.08 | 0.29 | 2.03 | 15.1 | 0.7 | |

| TIAA-CREF Green Bond Retail | -0.09 | 0.09 | 1.85 | 7.1 | 0.78 | |

| Calvert Green Bond I | -0.3 | -0.37 | 1.32 | 5.3 | 852 | 0.48 |

| Calvert Green Bond R6 | -0.3 | -0.34 | 1.37 | 8.7 | 0.43 | |

| Calvert Green Bond A | -0.32 | -0.54 | 1.07 | 5.02 | 89 | 0.73 |

| Franklin Municipal Green Bond R6 | -0.37 | 1.15 | 2.98 | 0 | 0.44 | |

| Franklin Municipal Green Bond Adv | -0.38 | 1.1 | 2.93 | 7.7 | 0.46 | |

| Mirova Global Green Bond Y | -0.38 | -1.21 | 1.95 | 5.38 | 29.6 | 0.68 |

| Franklin Municipal Green Bond A | -0.4 | 1.05 | 2.89 | 1.2 | 0.71 | |

| iShares Global Green Bond ETF | -0.43 | -0.97 | 1.25 | 240.9 | 0.2 | |

| Franklin Municipal Green Bond C | -0.45 | 0.99 | 2.82 | 0.2 | 1.11 | |

| Mirova Global Green Bond A | -0.47 | -1.51 | 1.62 | 5.08 | 7.1 | 0.93 |

| Mirova Global Green Bond N | -0.47 | -1.28 | 1.99 | 5.39 | 7.6 | 0.63 |

| Average/Total | -0.19 | 0.16 | 2.28 | 5.02 | 1,418.8 | 0.66 |

| Bloomberg US Aggregate Bond Index | -0.19 | -0.69 | -0.08 | 5.43 | ||

| Bloomberg Municipal Total Return Index | -0.37 | 1.53 | 3.4 | 5.09 | ||

| ICE BofAML Green Bond Index Hedged US | -0.42 | -2.33 | 0.52 | 4.56 |