Synopsis: This article explains the sustainable investing strategy of ESG integration and why it is gaining traction. In addition, it highlights some challenges and offers a framework for setting financial performance expectations.

What is ESG Integration?

ESG integration is the investment strategy by which environmental, social and governance factors and risks are systematically analyzed and, when these are deemed relevant to an entity’s performance, they will influence decisions on whether to buy or hold a security, and to what extent. Conversely, such considerations may lead to the liquidation of a security from the portfolio. As it stands today, ESG integration, regardless of the fundamental strategy approaches to stock (i.e. value versus growth, large cap versus small cap, etc.) and bond investing, is more frequently practiced in connection with equity investing and less so when it comes to bond investing. But this is changing.

Guided by the view that relevant and material environmental, social and governance factors, along with other financial and non-financial considerations, can have an impact on an entity’s performance over time, including stocks and bonds, more investors are considering these issues in their buy/hold/sell decisions or in deciding on their position weightings within a portfolio. In addition, ESG considerations are aligned with the growing desire on the part of investors to achieve a positive societal impact.

Significant Variation Surrounds Definition of ESG

While there is general agreement that ESG refers to three pillars consisting of environmental, social and governance factors, there is significant variation regarding the considerations or criteria that should be encapsulated under each of these broad pillars, what should be the individual indictors used to evaluate them or how to account for them in any form of analysis—especially if extended to reflect diverse issuers, varying security types and geography. In large part, this has to do with the fact that ESG integration as an investing concept is relatively new, there are numerous factors to consider and the definitions have been and are continuing to evolve.

For example, one investment management firm active in bringing sustainable investment practices to retail and institutional investors through various mutual fund offerings considers the following factors when integrating ESG into decision making:

Examples of Environmental, Social and Governance Criteria

At the same time, another prominent investment management firm integrates ESG factors through a somewhat different prism. For example, with regard to factors related to the environment, it takes into consideration carbon and greenhouse gases, environmental impact and footprint as well as water usage. There is also variation around its social and governance criteria. With regard to social factors, the same firm focuses on impacts on the communities in which an entity operates, labor policies and practices as well as social “sustainability.” As for governance, the structure of the board and board committees, as well as the board composition, are taken into consideration.

Adding further to the complexity, there is no consensus around the issues that underlie each of these factors and how to weight them in any investment methodology that attempts to assign levels of relative importance to each of these factors. For these reasons it is important to investigate and understand the unique and sometimes nuanced approach to ESG integration taken by each manager and/or product and how this aligns with the investor’s goals and objectives.

A variation on the ESG integration strategy is thematic investing, an approach based on expectations of growth in ESG/sustainability-related sectors. For example, this may include investments in agriculture, renewable energy, such as solar energy and wind, and clean water, to mention just a few. It should be noted, however, that portfolios constructed around thematic investment approaches do not necessarily qualify securities holdings on the basis of each individual company’s fundamental ESG practices, such that greater care may be called for to evaluate the thematic investment portfolio’s composition as well as selection practices. The recently popular version of thematic investing in the fixed income sphere, that also qualifies as an impact investment, consists of green bonds where the proceeds are used to achieve environmental beneficial purposes.

Reasons for Growth of ESG Integration Strategies

Still, the reasons this approach in particular has been gaining momentum can be sourced to a number of trends, and in particular two important overarching developments. The first is that studies on financial performance of sustainable investments seem to demonstrate improved financial portfolio and stock performance when ESG factors are analytically applied. One recent study, for example, conducted by Morgan Stanley into the performance of mutual funds, found that sustainable mutual funds had equal or higher median returns and equal or lower median volatility for 64% of the periods examined over the last 7 years compared to their non-ESG counterparts[1]. That said, other studies are less positive about the performance results achieved by strategies that attempt to integrate ESG. The second important reason has been the rapid rise in interest by institutional and retail investors in sustainable investing—motivated by a desire to achieve a positive societal impact alongside positive financial results.

One View Regarding Financial Results Achieved with ESG Integration in Stock and Bond Investing

What should investors expect from ESG integration in terms of financial results? This is a complex question that remains difficult to answer with complete confidence as the evidence is still evolving. A proxy for the financial results that investors should expect from a broad-based stock and bond oriented diversified ESG integration strategy may be derived from an examination of the results delivered by two mutual funds, the Vanguard FTSE Social Index Fund as well as the TIAA-CREF Social Choice Bond Fund.

The Vanguard FTSE Social Index Fund is a low-cost index mutual fund that attempts to replicate the total return performance of the FTSE4Good US Select Index by investing substantially all of its assets in the stocks that make up the index[2]. This index is composed primarily of large- and mid-cap stocks that have been screened for certain environmental, social and governance criteria. To this end, environmental considerations include climate change, water use, biodiversity and pollution, and resources. Social considerations include customer responsibility, human rights and community, labor standards and health and safety and governance includes corporate governance, risk management, tax transparency, and anti-corruption. The results achieved by this index fund are compared to the results achieved by a similar broad-based US index that does not take ESG factors into consideration, in this instance the S&P500 index.

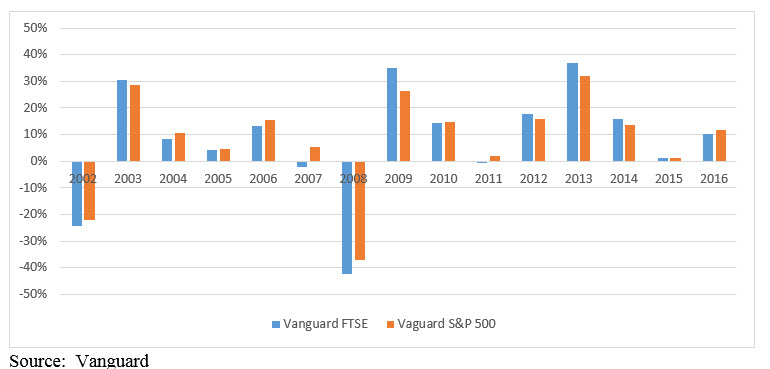

Since 2002 when the Vanguard FTSE fund was launched through the end of 2016, investors in the fund’s Investors Shares[3] would have earned an annual average rate of return of 7.84% versus 8.25% if they had invested in the S&P 500 index. Put another way, $1,000 invested in an index fund that integrates ESG into its investments would have grown to $2,264 at the end of 2016 versus $2,598 for an investment in the S&P500. So while there is a slight negative differential, in this instance, the difference is only $334 or 0.41% lower. While there are some year-by-year variations in total returns (see Exhibit 1), for this extended time period, ESG investors would have earned a return that is slightly lower but very similar to the broad market.

Exhibit 1: Performance of the Vanguard FTSE Social Index Fund versus the S&P 500: 2002-2016

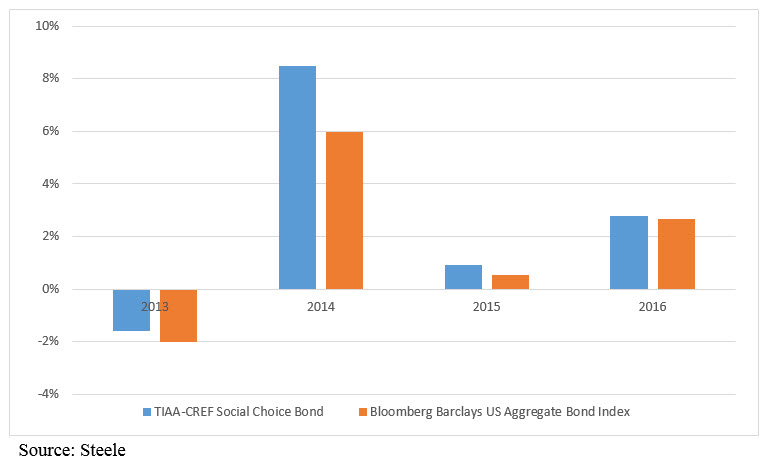

At this time it is not possible to conduct a comparative analysis for the fixed income sector because an equivalent ESG oriented fixed income index fund, either in the form of a mutual fund or ETF, is not as yet offered in the market. At best, it’s possible to analyze the performance of an actively managed lower cost fixed income portfolio that integrates ESG factors and compare this to the results achieved by a broad-based fixed income benchmark. Chosen for this purpose is the TIAA-CREF Social Choice Bond Fund, an actively managed fund investing in investment grade securities that meet certain environmental, social and governance (ESG) criteria in addition to filtering out companies that don’t meet the investment manager’s social guidelines. This fund’s total return performance was evaluated relative to the Bloomberg Barclays US Aggregate Bond Index. The results below show that the Social Choice Bond Fund, which was launched in 2012, has outperformed the benchmark in each of the last four full years, generating a cumulative return of 10.7% between the start of 2013 through 31 December 2016 versus 7.2% for the index. Refer to Exhibit 2. Put another way, ESG investors would have earned an excess return 3.5% over the 4 year period during which the fund was in operation.

Exhibit 2: Performance of the TIAA-CREF Social Choice Bond Fund versus the Bloomberg Barclays US Aggregate Bond Index: 2013-2016

[1] Source: Morgan Stanley

[2] It should be noted that this analysis focuses on the performance of an index fund only rather than an actively managed equity ESG portfolio.

[3] Investor Shares is designed for retail investors with a minimum investment of $3,000.