BlackRock announces new money market fund: BlackRock Liquid Environmentally Aware Fund (LEAF)

Adding to a small stable of sustainable money market funds as well as short-term funds, BlackRock announced on January 23, 2019 that it has filed an initial registration statement for the BlackRock Liquid Environmentally Aware Fund (LEAF), a prime type money market fund. The fund, which intends to offer both a retail and institutional share classes (expense ratios have not yet been disclosed), will invest in companies and counterparties with a better than average performance in environmental practices and, at the same time, avoid certain companies and counterparties. At the same time, BlackRock is making a commitment to purchase or retire carbon offset credits with a portion of its revenues from the fund and make an annual payment to the World Wildlife Fund (WWF) to help further global conservation efforts. Once it’s up and running, this will be the third money market fund targeted to sustainable investors in particular and it also adds to an expanding list of short-term funds.

LEAF will invest in a broad range of money market instruments whose issuer or guarantor has better than average performance in environmental practices. According to the preliminary prospectus filing, BlackRock will use data from independent ESG ratings vendors and may employ the use of its own models. The fund will also prohibit any investments in companies that earn significant revenue from the mining, exploration or refinement of fossil fuels or from thermal coal or nuclear energy-based power generation.

The fund also introduces two very unique features. The first is that BlackRock will allocate 5% of the net revenue derived from the fund’s management fee toward the purchase and retirement of carbon offsets either directly or through a third-party organization. Second, the firm disclosed that it has entered into an agreement with World Wildlife Fund (WWF), which it describes as a leading environmental non-profit with recognized expertise and experience in environmental protection, pursuant to which it will make an annual payment to help further the global conservation efforts of WWF.

BlackRock LEAF will be the third sustainable money market fund available to investors

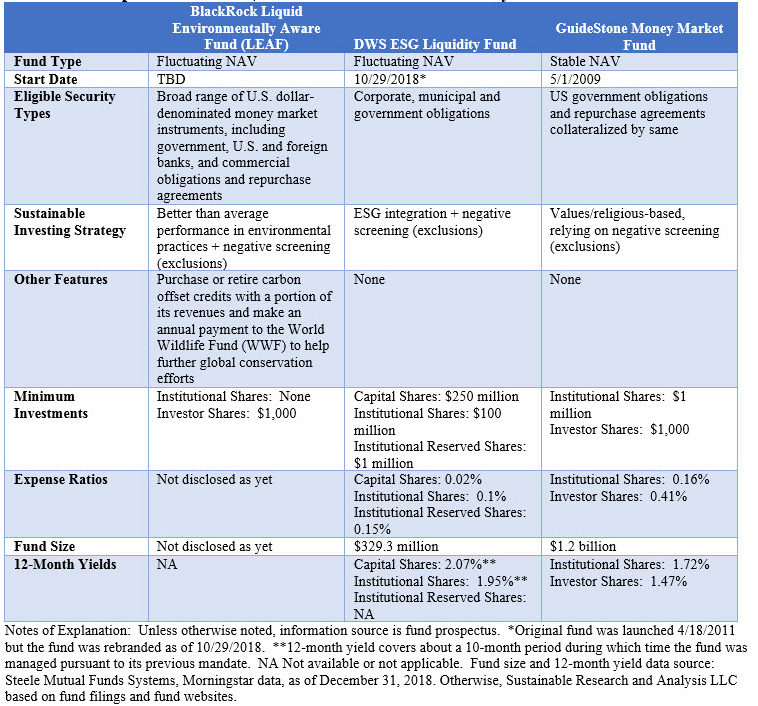

Once launched, LEAF will be the third sustainable money market fund available to investors. The announcement follows the rebranding in November 2018 of the $329.3[1] million DWS ESG Liquidity Fund, a variable net asset value money market fund consisting of three share classes. While both are variable net asset value funds, the sustainable approaches and methodologies vary. Unlike BlackRock’s LEAF, the DWS ESG Liquidity Fund integrates ESG considerations in making investment decisions. That is to say, the fund’s investment selections also account for social and governance considerations rather than being limited to environmental practices. That said, the fund also employs negative screening. Formerly called the DWS Variable NAV Money Market Fund, the DWS fund, with its high minimum investments, is managed by DWS (formerly Deutsche Asset Management) for the benefit of institutional investors subject to varying minimum investments.

Coincidently, the oldest of the third money market funds currently on offer, the GuideStone Money Market Fund, is managed by GuideStone Capital Management, LLC and sub-advised by BlackRock Financial Management. This is a values-based fund that relies exclusively on negative screening and restricts its investments to US government obligations and repurchase agreements collateralized by same. The fund, which has been in operation since May 2009, consists of share class targeting individual as well as institutional investors and unlike the two other funds, it maintains a constant net asset value. Refer to Table 1. Also, for further details refer to previously published article, ESG Liquidity Fund Targeted to Institutional Investors Offered by DWS.

Comparison of DWS, GuideStone and BlackRock LEAF Money Market Funds

3 Short as well as ultra-short duration sustainable mutual funds and ETFs also launched in the last year

It is also noteworthy to mention that a number of short as well as ultra-short duration sustainable mutual funds and ETFs were also launched in the last year. These include the Hartford Short Duration ETF, the Calvert Ultra-Short Duration Income NextShares ETF and the TIAA-CREF Short Duration Impact Bond Fund. Each of these funds seek to maintain a weighted average durations of less than three years and, in the case of Calvert’s NextShares, less than one year. These funds take on greater credit and duration risks relative to money market funds but should, in exchange, post higher returns. Still, they also expand the roster of existing short duration funds that include: the Calvert Short-Duration Income Fund, Calvert Ultra-Short Duration Income Fund and the GuideStone Low Duration Bond Fund.

What’s driving the new offerings?

While the BlackRock fund offers both an investor share class (minimum investment = $1,000) and an institutional share class, the initial and by far the largest audience for LEAF as well its competitor money funds is likely to consist of the various institutional investor segments that have embodied sustainable investing strategies ranging from values-based investing/negative screening, impact and thematic approaches to investing, ESG integration and shareholder engagement/proxy voting, or some combination of these. This is a growing segment that, in particular, includes foundations, university endowments, family owned offices/wealth management platforms, public defined benefit plans as well as defined contribution 403(b) plans. In addition, other institutional investors identified by US SIF Foundation include insurance companies, labor funds, hospitals and healthcare funds and faith-based institutions. For all these institutional investors and their asset managers, a sustainable money market fund provides a registered investment vehicle option for investing day-to-day cash in a manner consistent with their overarching investment mandates. Refer also to an article that appeared in Barron’s/On Line edition as of February 9, 2019, entitled Earning Income While Being Socially Responsible.

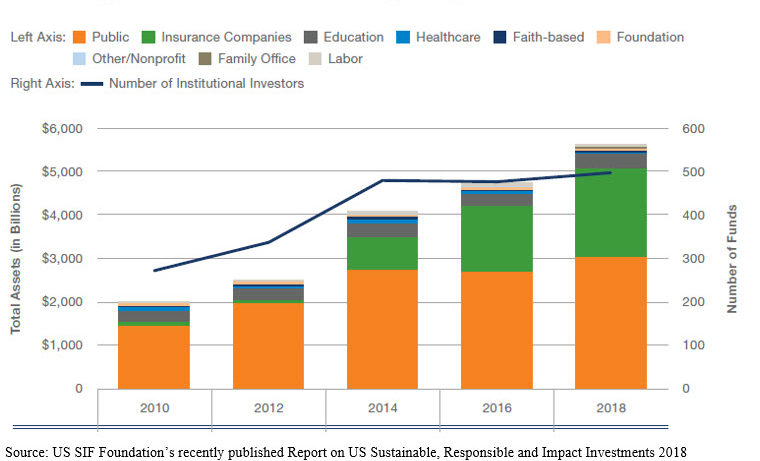

According to US SIF Foundation’s recently published Report on US Sustainable, Responsible and Impact Investments 2018, based on reporting as of the beginning of 2018, assets linked to sustainable, responsible and impact investing (SRI) strategies have reached $12.0 trillion. Much of this growth is driven by asset managers, who now consider ESG factors in their investment decision making. According to this research, institutional assets subject to ESG criteria reached a total of $5.61 trillion, representing a 19% increase over the corresponding total identified by US SIF in its 2016 research across 477 institutions. Refer to Chart 1. While these statistics may be overstated somewhat due to definitional issues and double counting, the overall increase reported by US SIF is consistent with the growing attention to this area and represents a large and growing market segment for sustainable money market funds as well as short duration bond funds.

Types of Institutional Investors Incorporating ESG Criteria 2010-2018

[1TNA as of December 31, 2018.