BlackRock collaborated with Rhodium Group leveraged the latest climate research to model the severity, dispersion and trajectory of climate-related physical risks and help assess whether such risks are adequately priced by markets

In April BlackRock Investment Institute published a research article entitled Getting physical Scenario analysis for assessing climate-related risks in which the firm set out a framework for assessing the impact of climate related physical risks on investment portfolios. The article describes BlackRock’s collaboration with Rhodium Group to leverage the latest climate research to model the severity, dispersion and trajectory of climate-related physical risks and help assess whether such risks are adequately priced by markets. In particular, BlackRock focused on three market segments in the US, including US public finance, commercial real estate in the form of Commercial Mortgage Backed Securities (CMBS) as well as the electric utility sector, and concluded that climate risks, and in particular, risks that have become more pronounced in just that last few decades due to hurricanes, wildfires and droughts, are not being priced into financial assets.

BlackRock’s modeling approach relies on a severe “no climate action” scenario but other scenarios can be adopted for analysis

According to BlackRock, while physical risks posed by climate change were tough to model until recently, advances in big data and cloud computing enables users to reach levels of geographic granularity not previously possible. Millions of simulations were run that drew on Rhodium’s work with the Climate Impact Lab to combine historical climate and socioeconomic data with physical climate modeling. The analysis included knock-on impacts of rising average temperatures that relied on global climate scenarios along four representative carbon emission pathways, an approach that was central to the BlackRock analysis.

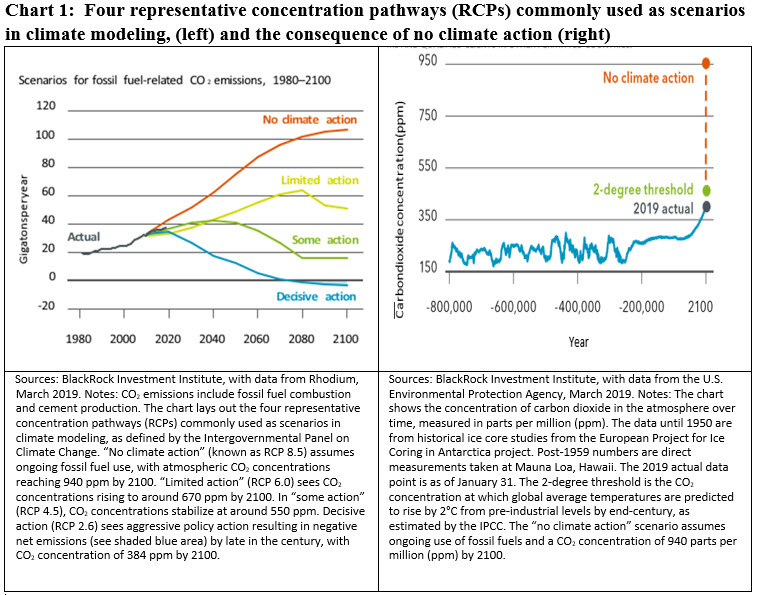

BlackRock notes in its research report that the climate modeling community has settled on several plausible pathways for the future direction of carbon emissions. To account for uncertainty around these future pathways, four scenarios were considered. These range from the “no climate action” scenario that assumes continued burning of fossil fuels, to some action and limited action scenarios and finally to a “decisive action” scenario that assumes aggressive policy actions to curb emissions, in line with the goal of the 2015 Paris Climate Agreement, which aims to keep the average increase in global temperatures to well below 2°C by the end of the 21st century.

Given BlackRock’s focus on physical risks in this research article, the firm relied on the “no climate action” scenario as defined by the Intergovernmental Panel on Climate Change (known as RCP 8.5) which assumes ongoing fossil fuel use, with atmospheric CO2 concentrations reaching 940 ppm by 2100. Refer to Chart 1. This is viewed by BlackRock as a tough, but plausible, scenario for stress testing investment portfolios.

Rhodium draws on 21 advanced global climate models to calculate probability-weighted indicators of physical climate changes, such as temperature, rainfall and hurricane risk, for each of these emissions scenarios. The goal: to answer what we know both about the physical risks today, and how those risks may evolve in the future.

Research findings focused on three sectors with long-dated assets that can be located with precision, based on a “no climate action” scenario, indicate that risks that have become more pronounced in just that last few decades due to hurricanes, wildfires and droughts, are not being priced into financial assets

BlackRock’s findings, which are based on a “no climate action” scenario focus on three sectors with long-dated assets that can be located with precision: U.S. municipal bonds, commercial mortgage-backed securities (CMBS) and electric utilities. Key observations from the report, include:

Municipal bond market

Extreme weather events pose growing risks for the credit worthiness of state and local issuers in the $3.8 trillion U.S. municipal bond market. BlackRock translated the physical climate risks into implications for local GDP and it shows how a rising share of muni bond issuance over time will likely come from regions facing economic losses from rising average temperatures and related events. Some 58% of metropolitan areas face climate-related GDP hits of 1% or more by 2060–2080. BlackRock zooms in on the highest risk areas and explains the importance of assessing muni issuers’ resolve and financial ability to fund adaptation projects to mitigate climate risks. This analysis, according to BlackRock, has potential to be extended to cover sovereign issuers, including emerging markets.

CMBS

Hurricane-force winds and flooding are key risks to commercial real estate. BlackRock’s analysis of recent hurricanes hitting Houston and Miami finds that roughly 80% of commercial properties tied to affected CMBS loans lay outside official flood zones — meaning they may lack insurance coverage. This makes it critical to analyze climate-related risks on a local level. BlackRock shows how the economic impacts of a warming climate could lead to rising CMBS loan loss rates over time.

Utilities

Aging infrastructure leaves the U.S. electric utility sector vulnerable to climate shocks such as hurricanes and wildfires. BlackRock assessed the exposure to climate risk of 269 publicly listed U.S. utilities based on the physical location of their plants, property and equipment. A key conclusion: The risks are underpriced. Electric utilities with exposure to extreme weather events typically suffer temporary price and volatility shocks in the wake of natural disasters. BlackRock finds some evidence that the most climate-resilient utilities trade at a premium. The firm believes this premium could increase over time as the risks compound and investors pay greater attention to the dangers.

The complete report, including a bibliography of related articles, may be accessed via the following link