Research and analysis to keep sustainable investors up to-date on a broad range of topics that include trends and developments in sustainable investing and sustainable finance, regulatory updates, performance results and considerations, investing through index funds and actively managed portfolios, asset allocation updates, expenses, ESG ratings and data, company and product news, green, social and sustainable bonds, green bond funds as well as reporting and disclosure practices, to name just a few.

A continuously updated Funds Directory is also available to investors. This is intended to become a comprehensive listing of sustainable mutual funds, ETFs and other investment products along with a description of their sustainable investing approaches as set out in fund prospectuses and related regulatory filings.

Many questions have surfaced in recent years regarding sustainable and ESG investing. Here, investors and financial intermediaries will find materials that describe the various approaches to sustainable investing and their implementation. While sustainable investing approaches vary and they have thus far defied universally accepted definitions, many practitioners agree that they fall into the following broad categories: Values-based investing, investing via exclusions, impact investing, thematic investments and ESG integration. In conjunction with each of these approaches, investors may also adopt various issuer engagement procedures and proxy voting practices. That said, sustainable investing approaches will continue to evolve.

In addition to periodic updates regarding sustainable investing and how this form of investing is evolving, investors and financial intermediaries interested in implementing a sustainable investing approach will also find source materials that cover basic investing themes as well as asset allocation tactics.

Thoughts and ideas targeting sustainable investing strategies executed through various registered and non-registered sustainable investment funds and products such as mutual funds, Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs), closed-end funds, Real Estate Investment Trusts (REITs) and Unit Investment Trusts (UITs). Coverage extends to investment management firms as well as fund groups.

Bonds tumble 2.78% while large cap stocks gain 3.71% in March 2022

Concerns and uncertainties regarding the implications of the Russian invasion of Ukraine, the potential need for a faster pace of interest rate increases and a shrinking of the Federal Reserve’s balance sheet to combat higher inflation introduced heightened volatility and dragged down the prices of investment-grade intermediate bonds by the widest level in more than…

Share This Article:

The Bottom Line: Heightened volatility in recent months likely to test the resolve of investors but longer-term ESG strategies seem to preserve their value proposition.

Bonds gave up 2.78% in March while large cap US equities posted a gain of 3.71%

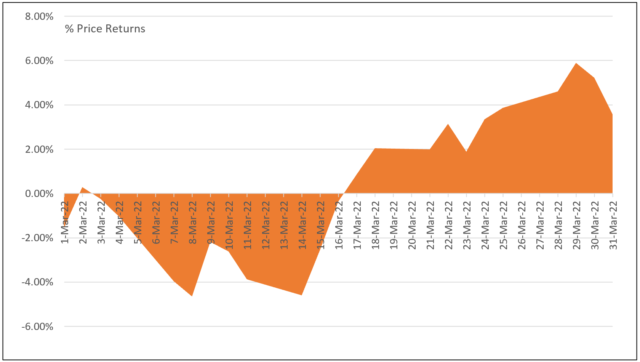

Concerns and uncertainties regarding the implications of the Russian invasion of Ukraine, the potential need for a faster pace of interest rate increases and a shrinking of the Federal Reserve’s balance sheet to combat higher inflation introduced heightened volatility and dragged down the prices of investment-grade intermediate bonds by the widest level in more than 10-years. Investment-grade bonds gave up 2.78% while large cap US equities, which were down as much as 4.59% for the month by March 14th managed to recover as sentiment shifted, to end March up 3.71% on a total return basis. Refer to Chart 1. The Dow Jones Industrial Average added 2.5% while the NASDAQ Composite gained 3.5%. That said, US stocks posted a decline of 4.60% over the first quarter while investment-grade intermediate bonds dropped an even wider 5.93%. Large cap stocks eclipsed mid-caps and small caps, in that order, while value outperformed growth, except for large cap growth stocks that outperformed value by 1.5%. While large cap growth stocks led in Q1, growth stocks across the market cap continuum suffered the widest declines.

Chart 1: S&P 500 cumulative price performance-March 2022 Source: Yahoo finance/S&P Global

Source: Yahoo finance/S&P Global

Outside the US, stocks didn’t perform as well. The MSCI ACWI, ex USA Index gained 0.3% while emerging markets posted a 2.2% decline. The MSCI EAFE Index eked out a gain of 0.6%. Quarterly results mirrored the outcomes recorded in the US, with the three indices registering declines of -5.3%, -6.9% and -5.9%, respectively.

As noted, investment-grade intermediate bond, measured using the Bloomberg US Aggregate Bond Index, gave up 2.78% in March and a much wider -5.93% during the first quarter. This was on the back of increases in yields on 10-year Treasuries during the month of March and first quarter that rose in the amounts of 49 bps and 80 bps, in that order. Municipal bonds experienced an even wider pullback while high yield corporates outperformed both. Longer-dated securities suffered more extensive declines.

Sustainable mutual funds and ETFs posted an average return of 0.74% in March

In March and Q1 2022, the universe of 1,298 sustainable mutual funds and ETFs, as defined by Morningstar, posted average returns of 0.74% and -7.14%, respectively. Returns for the month ranged from a low of -10.27% recorded by the KraneShares MSCI China Clean Tech ETF (KGRN) to a high of 11.67% registered by the ALPS Clean Energy ETF (ACES).

Quarterly returns were more volatile and harder hit, as reflected in the range of outcomes that extended from a low of -23.42% produced by Eventide Healthcare & Life Sciences Fund C (ETCHX) to a high of 12.65% recorded by the Janus Henderson Net Zero Transition Resources ETF (JZRO), up 12.65%. In the quarter, only 34 funds/share classes posted positive returns.

Table 1a: Top 10 performing MFs and ETFs Table 1b: Bottom performing MFs and ETFs

Fund Name

1-M

Q1

Fund Name

1-M

Q1

ALPS Clean Energy ETF

11.67

-1.27

Invesco Environmental Focus Muni Y

-3.85

-7.69

Invesco WilderHill Clean Energy ETF

10.11

-8.33

Artisan Sustainable Emerging Mkts Inv

-3.85

-15.85

VanEck Environmental Svcs ETF

8.88

-1.06

Invesco Environmental Focus Muni C

-3.86

-7.86

Janus Henderson Net Zero Trnstn Rscs ETF

8.27

12.65

Artisan Sustainable Emerging Mkts Inst

-3.9

-15.84

First Trust NASDAQ® Cln Edge® GrnEngyETF

8.16

-5

Global X Wind Energy ETF

-3.93

-7.55

First Trust EIP Carbon Impact ETF

7.96

7.7

KraneShares MSCI China ESG Leaders ETF

-7.32

-14.77

Engine No. 1 Transform Climate ETF

7.67

Krane UBS China A Share Institutional

-8.63

-15.26

ETFMG Breakwave Sea Dcrbnztn Tch ETF

7.56

-1.52

Krane UBS China A Share Investor

-8.64

-15.28

Invesco Real Assets ESG ETF

7.52

4.89

WisdomTree China ex-State-Owd Entpr ETF

-9.32

-17.88

ETRACS 2x Lgd MSCI US ESG Fcs TR ETN

7.51

-11.68

KraneShares MSCI China Clean Tech ETF

-10.27

-20.42

Notes of Explanation: Performance=total returns in percentage terms for periods ending March 31, 2022. 1-M=1 month, 3-M=3 months. Blank cells=fund was not in operation during entire interval. Source: Morningstar Direct

Performance of selected sustainable indices: Lagging short-term results have not overridden intermediate to long-term value proposition

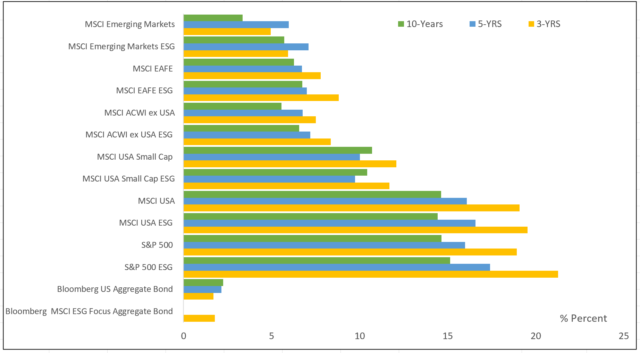

Sustainable equity and bond indices struggled to stay ahead of their conventional counterparts in the difficult first quarter of 2022, as only two of six selected ESG benchmarks maintained by MSCI beat their conventional counterparts. This applies to selected ESG Leaders indices that provide exposure to companies with high ESG performance relative to sector peers. That said, the indices bounced back in March and while the trailing 12-month total returns are mixed, their intermediate and long-term records remain compelling. Refer to Chart 2. Moreover, this performance track record offers a contrasting perspective to one expressed by Barron’s in the April 18, 2022 issue that funds focused on environmental, social and governance issues performed poorly as war and inflation hit and questioning whether this popular strategy is flawed. While it’s true that near-term results may have been negatively impacted due to overweighted equity positions in technology and underweighted positions in energy, sustainable investors, like other investors, should be focused on long-term value creation. As noted, over the long-term, the performance of selected ESG indices remains compelling.

For the month of March, five of the six MSCI ESG Leaders as well as Focus indices eclipsed the performance of their conventional counterparts. Positive variations ranged from 0.01% recorded by the MSCI EAFE ESG Leaders Index to 44 bps achieved by the MSCI Emerging Markets ESG Leaders Index. An exception is the MSCI USA ESG Leaders Index that tailed its conventional counterpart by 8 bps. The same index trails for the 10-, 5- and 3-year time intervals.

Chart 2: Selected sustainable indices intermediate and long-term total return performance results to March 31, 2022 Notes of Explanation: MSCI equity indices are the Leaders indices. Blanks indicate performance results are not available. Intermediate and long-term results include 3-5-and 10-year returns that are expressed as average annual returns. MSCI USA Small Cap returns are price only. Sources: MSCI, S&P Global, Sustainable Research and Analysis LLC.

Notes of Explanation: MSCI equity indices are the Leaders indices. Blanks indicate performance results are not available. Intermediate and long-term results include 3-5-and 10-year returns that are expressed as average annual returns. MSCI USA Small Cap returns are price only. Sources: MSCI, S&P Global, Sustainable Research and Analysis LLC.

SRA Select List of funds posted an average decline of -0.23% in March

Based on an equal weighting basis, SRA Select funds posted an average decline of -0.23% in March versus an average -0.14% registered by the average performance of corresponding conventional benchmarks¹. Excluding money market funds, returns ranged from 1.08% posted

by the iShares ESG Aware MSCI USA Small-Cap ETF (ESML) to a low of -5.94% registered by the iShares ESG MSCI EM Leaders ETF (LDEM). Refer to Table 2 for a complete rundown of SRA Select list of mutual funds and ETFs and their March performance results.

Consisting of nine funds² pursuing discrete investment strategies intend for use as building blocks in the creation of a diversified ESG-oriented portfolio, only four of the nine funds outperformed their conventional benchmarks in March (Refer to previously published article SRA Select Listing: ESG Integration Investment Fund Q1-2022

https://sustainableinvest.com/sra-select-listing-esg-integration-investment-funds-q1-2022/).

Table 2: Performance of SRA Select listed mutual funds and ETFs

Row Labels

Sum of Expense Ratio

Sum of Assets ($millions)

Sum of 1-Month Return

Sum of 3-Month Return

Sum of 12-Month Return

Sum of 3-Year Average

Shares ESG Advanced Hi Yld Corp Bd ETF (HYXF)

0.35

167.3

-1.02

-5.19

-2.1

3.54

iShares ESG Aware MSCI EAFE ETF (ESGD)

0.2

7320.1

-0.14

-7.34

-0.03

8

iShares ESG Aware MSCI USA Small-Cap ETF (ESML)

0.17

1574.5

1.3

-5.45

-0.17

14.31

iShares ESG U.S. Aggregate Bond ETF (EAGG)

0.1

1944.7

-2.75

-5.86

-4.26

1.61

iShares MSCI ACWI Low Carbon Target ETF (CRBN)

0.2

1177.7

1.97

-5.81

6.82

14.11

iShares MSCI KLD 400 Social ETF (DSI)

0.25

4058.6

3.23

-6.59

14.64

19.51

iShares USD Green Bond ETF (BGRN)

0.2

254.8

-2.75

-6.68

-6.62

0.69

iShares ESG MSCI EM Leaders ETF (LDEM)

0.16

70.1

-1.86

-7.72

-11.85

BlackRock Liquid Environmentally Aware Fund (LEAXX)

0.45

1,172.9

-0.02

-0.04

-0.06

Vanguard Treasury Money Market Fund Investor (VUSXX)

0.09

32,248.8

0.01

0.02

0.03

0.68

Average Returns*

-0.23

-5.63

-0.40

8.82

S&P 500 Index

3.71

-4.6

15.65

18.92

MSCI USA Index

3.52

-5.21

14.1

19.07

MSCI USA Small Cap Index

1.11

-6.22

-1.51

12.08

MSCI EAFE Index

0.64

-5.91

1.16

7.78

MSCI ACWI Index

2.17

-5.36

7.28

13.75

MSCI Emerging Markets Index

-2.26

-6.97

-11.37

4.94

Bloomberg U.S. Treasury Bill (1-3 M)

0.02

0.03

0.06

0.74

Bloomberg U.S. Aggregate Bond Index

-2.78

-5.93

-4.15

1.69

Bloomberg High Yield Index

-1.15

-4.84

-0.66

4.58

ICE BofML Green Bond Hedged US Index

-2.49

-6.56

-6.29

1.08

Average Returns**

-0.14

-5.22

-0.15

7.30

Notes of Explanation: $AUM in millions. Blank cells=fund was not in operation during entire interval. *Average returns exclude the Vanguard Treasury Money Market Fund Investor. **Average returns exclude the S&P 500 Index. Source: Morningstar Direct.

¹ To avoid duplications, these results exclude Vanguard Treasury Money Market Fund and S&P 500. ² A tenth fund, the Vanguard Treasury Money Market Fund, is an alternative money market fund.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainableinvest.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact