Opinion: ESG is gaining traction as a political issue and in the process, arguments have surfaced that ESG initiatives may be subject to anti-competitive practices.

The politicization of ESG investing is introducing additional business uncertainties and risks with financial consequences, including potential legal liabilities and reputational issues

ESG investing is gaining traction as a political issue and in the process, arguments have been raised that ESG initiatives may be subject to anti-competitive practices. For ESG investors, this development is introducing additional business uncertainties and risks with financial consequences, including potential legal liabilities and reputational issues for assets managers and other financial institutions that must be negotiated with caution. Just about three weeks ago, Vanguard announced that it was pulling out of the Net Zero Asset Managers (NZAM) initiative, a major investment-industry initiative with 291 signatories representing some $66 trillion in assets under management focused on tackling climate change. This action, which by Vanguard’s account will not affect its “commitment to helping our investors navigate the risks that climate change can pose to their long-term returns,” may be linked to the politicization of ESG investing.

For over 100 years, the U.S. antitrust laws have operated with the basic objective to protect the competition process for the benefit of consumers, making sure there are strong incentives for businesses to operate efficiently, keep prices down, and keep quality up. So, what do the antitrust laws have to do with ESG investing? Everything.

In the aftermath of COP27, corporations that decide to decarbonize and agree to a set of standards may have to undertake some costly investments to implement these initiatives. While these actions may be socially admirable and long-term fiscally sound, they may also lead to short-term higher prices or lower margins, and this is where the antitrust laws come in. If one corporation tries to pass these higher prices on to its customers, it may find itself at a competitive disadvantage. If a group of companies, that represent more than 20% of the market shares, decide to collaborate around a common theme, like decarbonization, and then pass along these short-term additional costs to its customers, it may have opened itself up to a violation of the U.S. antitrust laws. If found guilty of these charges, the costs are high. The Sherman Act imposes criminal penalties of up to $100 million for a corporation and $1 million for an individual, along with up to 10 years in prison. Under federal law, the maximum fine may be increased to twice the amount the conspirators gained from the illegal acts or twice the money lost by the victims of the crime, if either of those amounts is over $100 million.

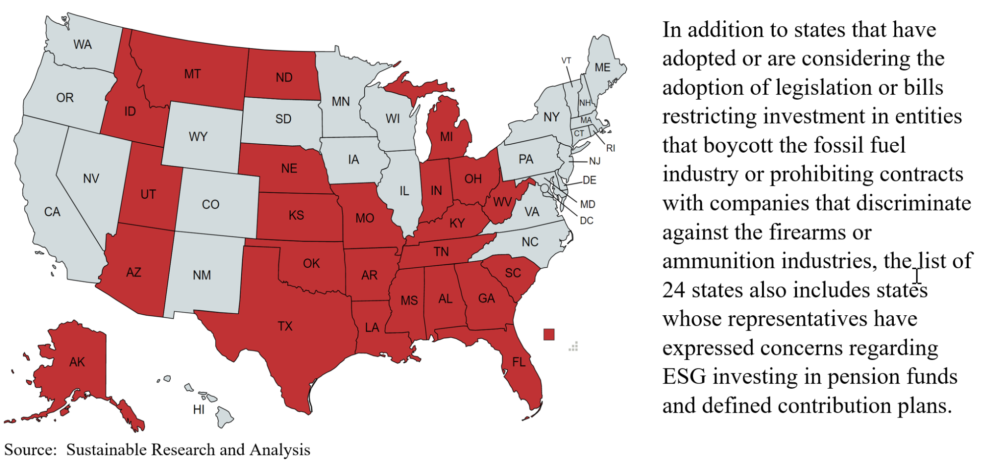

The language around the antitrust laws is clear and strong. That is why car manufacturers, insurers, individual states, and even the United Nations have amended their language around fossil fuel reduction projects, due to antitrust concerns. In September of this year, the US Senate Judiciary Subcommittee on Competition Policy, Antitrust, and Consumer Rights held a hearing on “Oversight of Federal Enforcement of the Antitrust Laws.” At this hearing, the antitrust implications of environmental, social, and governance (ESG) initiatives were discussed. As the chart below indicates, the anti-ESG movement has become a political issue.

There is currently a need for the U.S. antitrust laws to reflect a balance between the short-term and long-term protection of consumers. Of course, price gouging and manipulation through “greenwashing” campaigns must be vigorously prosecuted but the law must also take into consideration the long-term protection of the consumer. We believe there needs to be a tradeoff between the significant issues of public benefit (i.e., greenhouse gas emissions) and the private costs to consumers.

Other countries are also grappling with some of these same issues. For example, in the UK, the Competition and Markets Authority has recently established a “sustainability taskforce” to prepare new guidance and consider the case for changes in its law[i]. With the recent passage of the Inflation Reduction Act (IRA), it is likely that American firms will need to collaborate more, not less, in the future and the antitrust law will be front and center.

[i] https://www.gov.uk/government/news/cma-publishes-environmental-sustainability-advice-to-government

Author: Michael Cosack

December 29, 2022