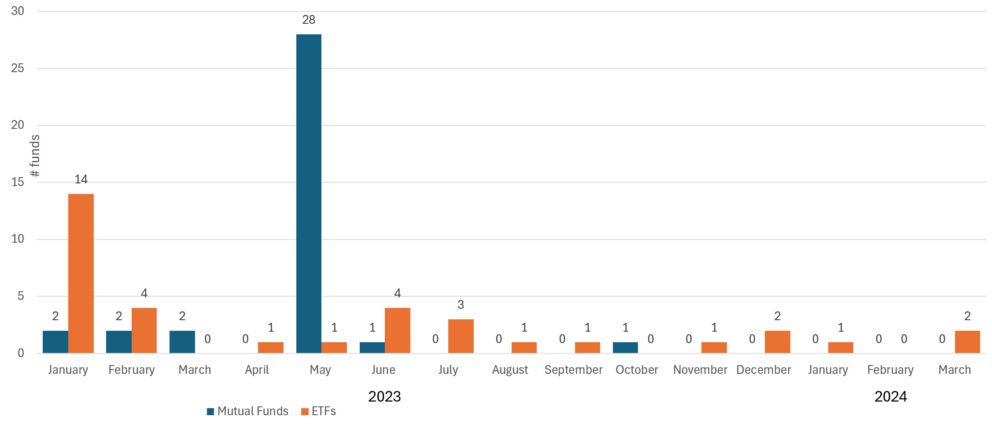

The Bottom Line: Only two sustainable fund investing options were launched in March 2024, reflecting a cooling off in sustainable mutual fund and ETF introductions.

Sustainable mutual funds and ETFs launch between January 1, 2023 – March 31, 2024

Notes of explanation: New fund launches exclude listings of new mutual fund share classes. Sources: Morningstar Direct; Sustainable Research and Analysis LLC.

Observations:

- Reflecting a cooling off in sustainable fund introductions, only two new sustainable funds were launched in March of this year. Both are ETFs, including the actively managed Nuveen Sustainable Core ETF (NSCR) and the index tracking iShares Energy Storage & Materials ETF (IBAT). At the same time, there were no new mutual fund introductions in March.

- Through the end of the first quarter, a total of only three sustainable funds have been launched, all three ETFs. There were no new sustainable mutual fund listings so far this year.

- By way of comparisons, 18 sustainable ETFs were launched in Q1 2023 along with six sustainable mutual funds, for a total of 24 funds (excluding new share classes). The number of sustainable fund launches also trails when compared to the number of conventional funds that started operations in the first quarter of this year.

- The two new ETFs include a thematic fund as well as an actively managed fund that invests in the equities of companies aligned with three sustainability themes. So far this year, two index funds were launched versus one actively managed portfolio.

- The iShares Energy Storage & Materials ETF, an $8.1 million fund subject to a 47-basis points (bp) fee that seeks to track the investment results of an index composed of U.S. and non-U.S. companies involved in energy storage solutions aiming to support the transition to a low-carbon economy, including hydrogen, fuel cells and batteries. In addition, excluded from consideration are all companies that are identified as violating or being at risk of violating commonly accepted international norms and standards or other exclusion guidelines or having a severe controversy rating. Refer to the SRI Funds Directory for additional details regarding the fund’s approach to sustainable investing.

- The $5.5 million Nuveen Sustainable Core ETF offered at a 45-bps fee is an actively managed fund that seeks to pursue its investment objective by investing in equity securities of companies aligned with sustainability themes. Sustainability themes are measurable investment themes that exhibit positive societal impact and also influence macroeconomic trends, competitive dynamics, and the financial performance of companies across industries and sectors. The three sustainability themes are (1) energy transition and innovation, (2) inclusive growth, and (3) strong governance. Refer to the SRI Funds Directory for additional details regarding the fund’s approach to sustainable investing.