Sustainable Bottom Line: Additional ESG integration-oriented investment fund offerings are available for sustainable investors in cases where focused sustainable taxable bond fund options are limited.

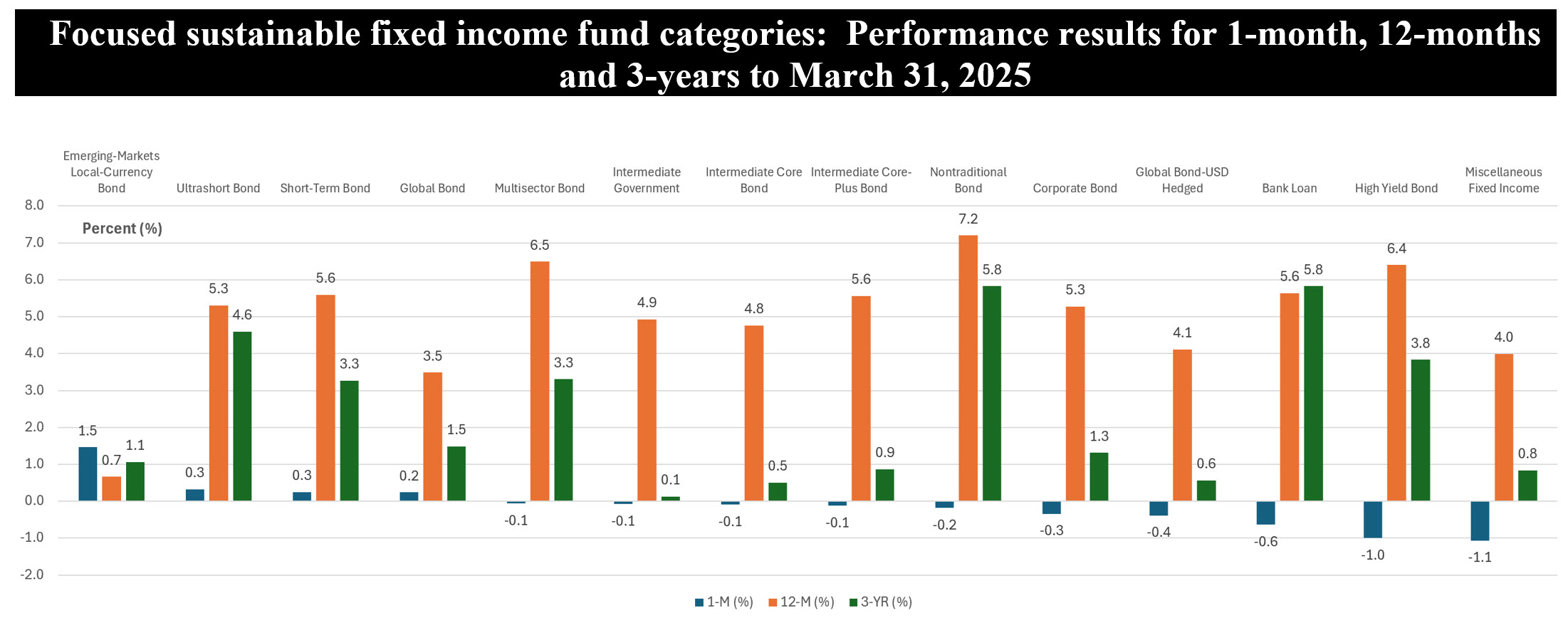

Notes of Explanation: Investment categories displayed in order of March 2025 average total return performance. 3-year results are presented in the form of average annual returns Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Notes of Explanation: Investment categories displayed in order of March 2025 average total return performance. 3-year results are presented in the form of average annual returns Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Observations:

• Ongoing questions surrounding tariffs have triggered higher volatility and led to policy uncertainties in domestic markets as most economists forecast a rising likelihood of a recession, higher unemployment and inflation. 10-year U.S, Treasury yields dipped in March, and bond prices rose as investors flocked to traditional safe havens. The Bloomberg US Aggregate Bond Index posted a 0.04% gain while focused sustainable taxable bond funds, or funds that explicitly disclose their sustainable investing approach in their Principal Investment Strategy and/or reflect their sustainability mandate in their fund name, recorded a narrow decline in March and gave up an average of 0.16%. Only four taxable investment fund categories, as defined by Morningstar, out of 14 categories, registered gains. These include Emerging-Markets Local Currency Bond funds (1.5%), Ultrashort Bond funds (0.3%), Short-Term Bond funds (0.3%) and Global Bond funds (0.2%).

• The focused sustainable taxable fixed income performance leader in March consists of just a single fund, the Templeton Sustainable Emerging Markets Bond Fund with its five share classes. This small $12.4 million actively managed fund run by Franklin Advisers. Inc. carries a higher than average 1.2% expense ratio, across its five share classes, has produced uninspiring performance results over the previous one- and three- year intervals (the fund was rebranded as of the end of 2021). The fund utilizes a research-intensive, fundamentals-based approach to capitalize on temporary inefficiencies and capture long-term potential value across yield curves (interest rates), currencies, and sovereign credit spreads. The fund’s portfolio is constructed with specific rules primarily based on the team’s proprietary ESG scoring methodology for sovereign issuers that not only relies on current ESG levels as a screen but also focuses on projected changes in ESG scores.

• The small fund’s largest position going into the first quarter was a government of India bond that accounted for 16% of the fund’s value. India’s markets experienced a notable rebound in March, with foreign buying fueling an uptick in prices.

• For the more aggressive intermediate to-long-term sustainable investors seeking an emerging markets local currency bond fund (versus a US dollar hedged fund) that employs an ESG integration approach, one that factors in financially material ESG factors in investment decision making, consideration of funds beyond Morningstar’s focused sustainable funds universe, may be an option.

• For example, funds like the DoubleLine Emerging Markets Local Currency Bond Fund and the MFS Emerging Markets Debt Local Currency Fund fall into such a category, they are larger in size, carry lower expense ratios and have achieved better risk adjusted rates of return over the last three years.