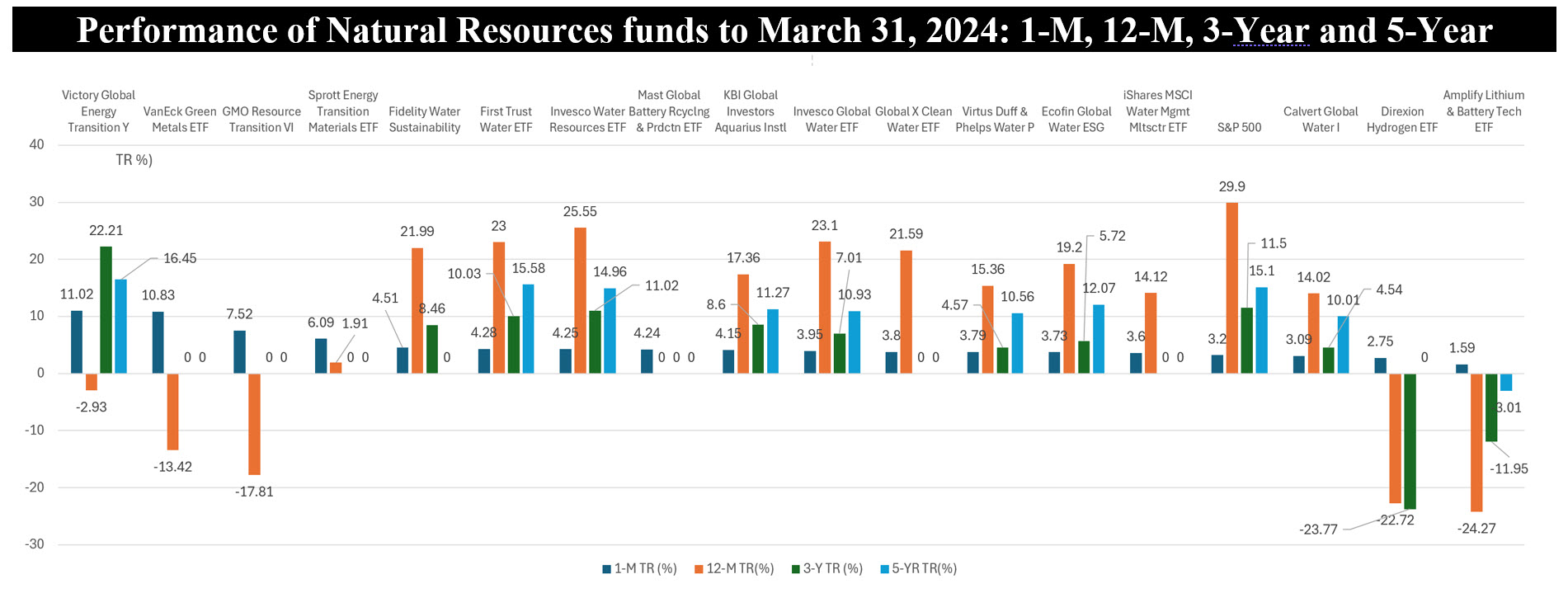

The Bottom Line: Natural Resources funds, one of 75 fund categories, posted the fifth best average return in March, but results vary by fund mandate.

Notes of explanation: Funds listed in order of total return performance posted in March 2024. For mutual funds with multiple share classes, only the top performing share class is listed. 12-M, 3-Y, and 5-Y are average annual total returns to March 31, 2024. 0 performance indicates that the fund was not in operation during the period. Sources: Morningstar Direct; Sustainable Research and Analysis LLC.

Observations:

- Natural Resources, the thematic sustainable funds category that, according to Morningstar, is comprised of 17 equity-oriented funds/25 funds and share classes with $6.1 billion in assets, blends together funds that pursue investments in low carbon economy natural resource companies as well as the water resources sector. The category posted the fifth best average total return in March, out of 75 investment categories, with its average return of 5.3% versus 3.2% for the S&P 500 Index. Like other thematic investment funds, Natural Resources funds tend to concentrate their investments in a few industries and may be exposed to large positions in a small number of companies. As a result, they tend to expose investors to higher levels of volatility, or risk, as measured by the standard deviation of monthly returns over the past three years.

- The results in March were driven by the performance of funds investing in companies operating in natural resource industries that will be required to achieve the transition to a low carbon economy, including even narrower so-called green energy metals and technologies, rather than funds that focus on the water resources sector. In March these funds delivered an average increase of 7.7%, led by the strong performance of the actively managed but rather pricey Victory Global Energy Transition Fund. This is a $316 million fund offering multiple share classes that is subject to an average 1.7% expense ratio across its four share classes (Note: Expense ratios, on average, for the category fall within the upper range for sustainable funds). The Victory Global Energy Transition Fund Class Y (RSNYX) was the second best performing sustainable fund in March, gaining 11.02%. While it registered a decline of 2.93% over the trailing twelve-month period, the fund is up 22.21% and 16.5% achieved during the previous three and five-year time intervals to March 31, respectively. Refer to the SRI Funds Directory for additional details regarding the fund’s investing approach.

- Also in March, the ten funds focused on investing in the water resources sector registered an average 3.8% on a total return basis.

- Investments in the water sector have been driven by the continued scarcity of water, water quality concerns and infrastructure issues that are exacerbating global water challenges. On the other hand, companies operating in the natural resources industries that will be required for the energy transition including, for example, companies that provide the raw materials and infrastructure necessary to create energy systems with a net zero greenhouse gas emissions profile. The performance drivers for these two segments can and do vary over time as are fund-related performance results, even as these appear to converge over the intermediate term. For the twelve months, three- and five-year intervals, Natural Resources funds posted average gains of 7.4%, 6.9% and 11.4%, respectively, versus the S&P 500 Index that was up 29.9%, 11.5% and 15.1%, respectively. Over the same three time periods, the average performance of funds investing in the water resources sector diverged from low carbon economy natural resource companies by 28%, -2.2% and 0.9%, respectively.

- Selecting a Natural Resource fund calls for a deeper dive before investing, with particular emphasis on the fund’s mandate, volatility and expense ratio, along with other factors relevant to fund selection.