Sustainable Bottom Line: Green bond funds continue to offer investors a results driven thematic investment option to integrate into sustainable-oriented but also conventional investment portfolios.

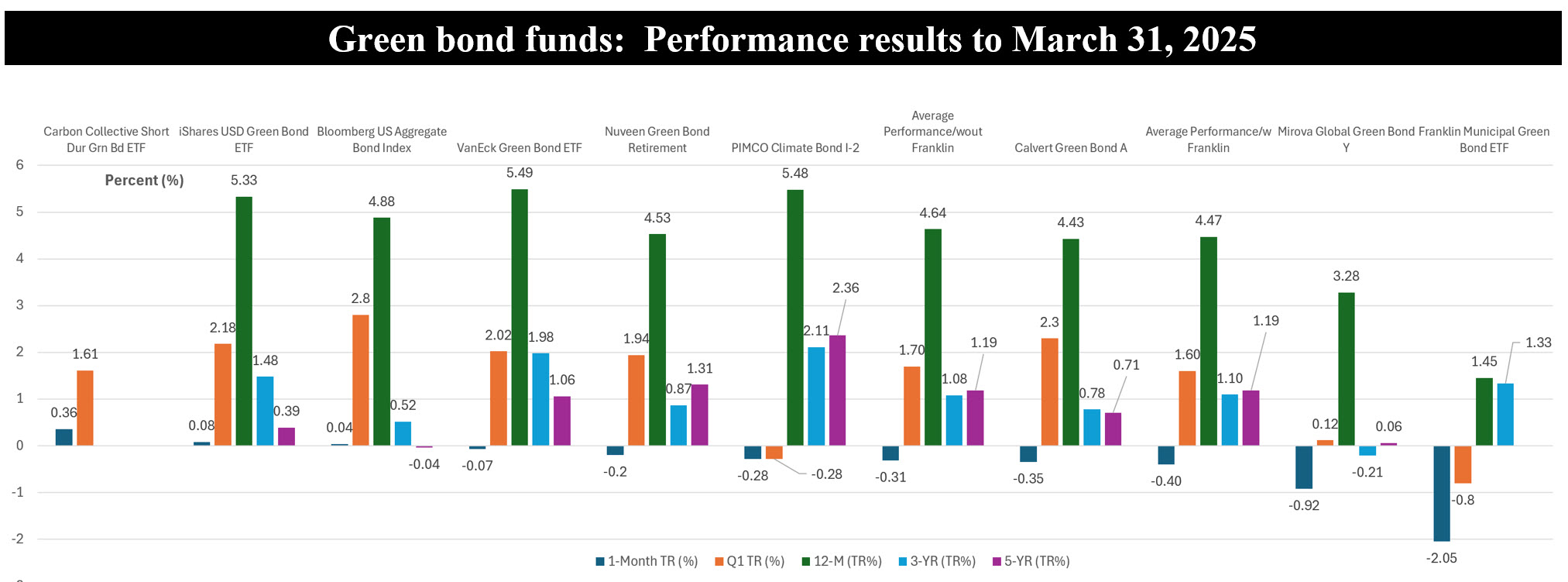

Notes of Explanation: Fund performance to March 31, 2025. Fund rank ordered based on their performance in March 2025. 3-year and 5-year results are average annual returns. Some funds may not have 3 and 5-year track records. In the case of the Franklin Municipal Green Blond Fund, the fund was rebranded as of May 3, 2022, and the fund’s five-year-track record is excluded. The fund’s three-year record, however, is included given the proximity to the three-year mark. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Notes of Explanation: Fund performance to March 31, 2025. Fund rank ordered based on their performance in March 2025. 3-year and 5-year results are average annual returns. Some funds may not have 3 and 5-year track records. In the case of the Franklin Municipal Green Blond Fund, the fund was rebranded as of May 3, 2022, and the fund’s five-year-track record is excluded. The fund’s three-year record, however, is included given the proximity to the three-year mark. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Observations:

• Green bond funds, a combination of taxable and municipal funds that offer investors a results driven thematic investment option to integrate into sustainable-oriented but also conventional investment portfolios, posted a negative average return in March of -0.40% versus -0.31% for taxable funds only. During the quarter and trailing 12 months, green bond funds were up an average of 1.6% and 4.5%, respectively. These average performance outcomes compare to gains of 0.04% and 2.8% recorded in March and the first quarter by the Bloomberg US Aggregate Bond Index. That said, two funds, the short-term oriented Carbon Collective Short Duration Green Bond ETF and the iShares US Green Bond ETF outperformed the intermediate investment grade benchmark. In general, it was challenging to beat the benchmark in March and during the first quarter. Longer dated higher quality bonds outperformed during the quarter, against a backdrop of falling 10-year Treasury yields while yields began and closed the month of March largely unchanged. Also, corporate and lower quality bonds registered declines.

• Assets of green bond funds gained $13.5 million during the first quarter, or a net gain of 1%. Using a back of an envelope approach, this indicates that green bond funds experienced estimated outflows in the first quarter of around $13.9 million.

• Three green bond funds continue to dominate this small segment, accounting for almost $1.4 billion or 81% of net assets that are largely sourced to institutional investors. These funds include the actively managed Calvert Green Bond Fund with its three share classes ($791.6 million), iShares US Dollar Green Bond Fund ETF ($401.8 million), an index tracking fund, and the actively managed Nuveen Green Bond Fund with its five share classes ($166.3 million). These funds also correspond to the most highly rated funds in the segment, according to rankings calculated by Sustainable Research and Analysis.

• The universe of funds declined from nine funds to eight funds as the Lord Abbett Climate Focused Bond Fund liquidated in March. The $25.3 million fund with its nine share classes apparently couldn’t gain much traction since its launch in April 2020.

• Green bond funds had fewer securities to purchase in the first quarter of 2025. During the first three months of the year, the supply of green bonds dropped relative to the volume registered in the first quarter of 2024. According to SIFMA*, global green bond issuance in Q1 was $225.5 billion, versus $270.4 billion during Q1 of last year. At the same time, first quarter issuance in the US, at $47.7 billion, gained some momentum relative to last year when issuance reached $44.1 million.

*Source: SIFMA Quarterly Report: US Fixed Income Markets-Issuance Trading