Sustainable Bottom Line: Balancing financial goals and objectives while at the same time integrating sustainability preferences into investments may involve tradeoffs that affect investment results.

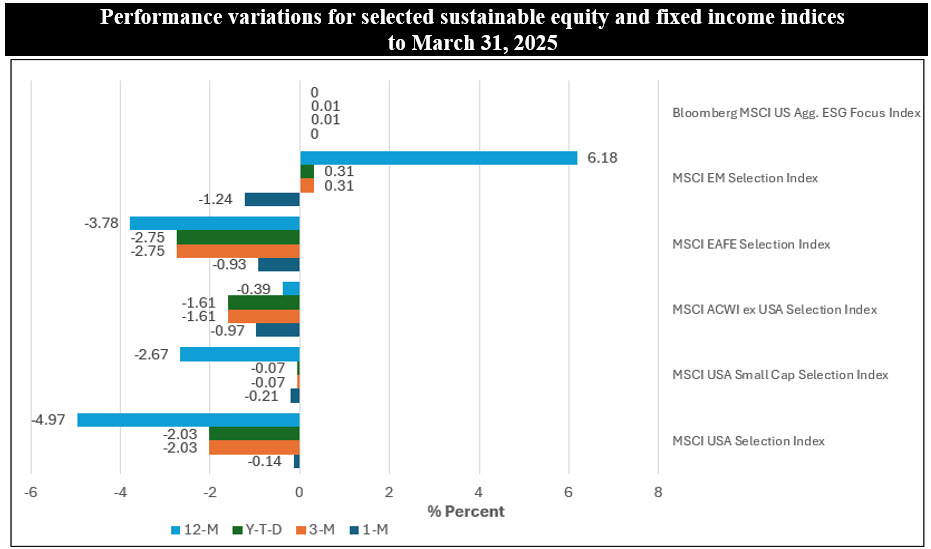

Notes of Explanation: Performance variations are shown relative to underlying MSCI indices (formerly MSCI Leaders indices). Sources: MSCI and Sustainable Research and Analysis LLC.

Notes of Explanation: Performance variations are shown relative to underlying MSCI indices (formerly MSCI Leaders indices). Sources: MSCI and Sustainable Research and Analysis LLC.

Observations:

• A selected set of six sustainable stock and bond indices mostly underperformed their conventional counterparts in March. This was against a backdrop of retreating equities (S&P 500 Index: -5.6%) and mixed fixed income returns (Bloomberg US Aggregate Bond Index: 0.04%) amid a flurry of headlines around the imposition of tariffs, weakening sentiment among households, consumers as well as small businesses, and mixed fixed income returns given a modest steepening in the Treasury yield curve.

• Five of the six selected sustainable indices track domestic and foreign equities that are screened with an emphasis on company level ESG scores and exclusions based on specific business activities and exposure to ESG controversies. These indices posted returns in March ranging from 0.63% to -6.62%, trailing their conventional counterparts within a range starting at 14 basis points to a high of 124 basis points. The sixth benchmark, tracking fixed income securities that are screened on a similar basis, was up 0.04% and matched the performance of its conventional counterpart.

• Year-to-date and trailing 12-month performance results delivered by sustainable indices were also generally lower than their conventional underlying indices, with only two sustainable indices managing to exceed the results achieved by their counterparts. Of note is the MSCI Emerging Markets Select Index that established a wide 6.2% lead over the trailing 12-months, benefiting from significant stock overweighting in three companies, Taiwan Semiconductor, Tencent Holdings and Alibaba, as well as some variations in country weightings.

• In general, the negative or positive differences in the performance of the five sustainable equity indices are related to differences in security holdings and their weightings within the index, sector exposures and, in the case of international indices, also country exposures. In March, the variations led to negative outcomes. For example, in March, the MSCI USA Selection Index, consisting principally of large-cap stocks, maintained heavier stock specific exposures to companies in the Information Technology sector, such as NVIDIA, Microsoft and Alphabet, firms with higher ESG ratings, as well as a lower level of exposure to Energy stocks. Information Technology was down 12.7% in March while the Energy sector, which includes large cap stocks such as Exxon Mobil and Chevron, was the best performing sector, up 10.2%. Over time, positive variations occur as well, for example, when overweighted technology stocks outperformed the market in 2021. The combination of positive and negative variations over time tends to smooth out intermediate-to-long-term returns.

• That said, pursuing financial goals and objectives as well as sustainability preferences in investments may involve tradeoffs that affect investment results. Such outcomes will vary in line with the chosen sustainable approach. At one end of the range, portfolios can be constructed by integrating financially material ESG considerations or leveraging ESG information to improve the understanding of an investment’s risk-return characteristics and, in this way, still produce optimal risk and return outcomes. This can also be relevant when evaluating securities for thematic as well as impact-oriented portfolios that are not subject to constraints. Beyond this approach, portfolios may be modified further within some range toward desirable sustainability outcomes with limited negative financial consequences. An example is the exclusion of one or possibly two minor sectors, such as small weapons manufacturers or companies engaged in pornography. However, as portfolios shift beyond a limited set of screens and exclusions by superimposing additional constraints, returns can be expected to suffer. Fortunately, these tradeoffs can be measured, and investors can decide on the risk-return tradeoffs they are willing to accept to achieve their financial and sustainability preferences.