The Bottom Line: While divestment approaches have an important symbolic meaning and serve as a signaling mechanism, the financial impact on companies is likely limited.

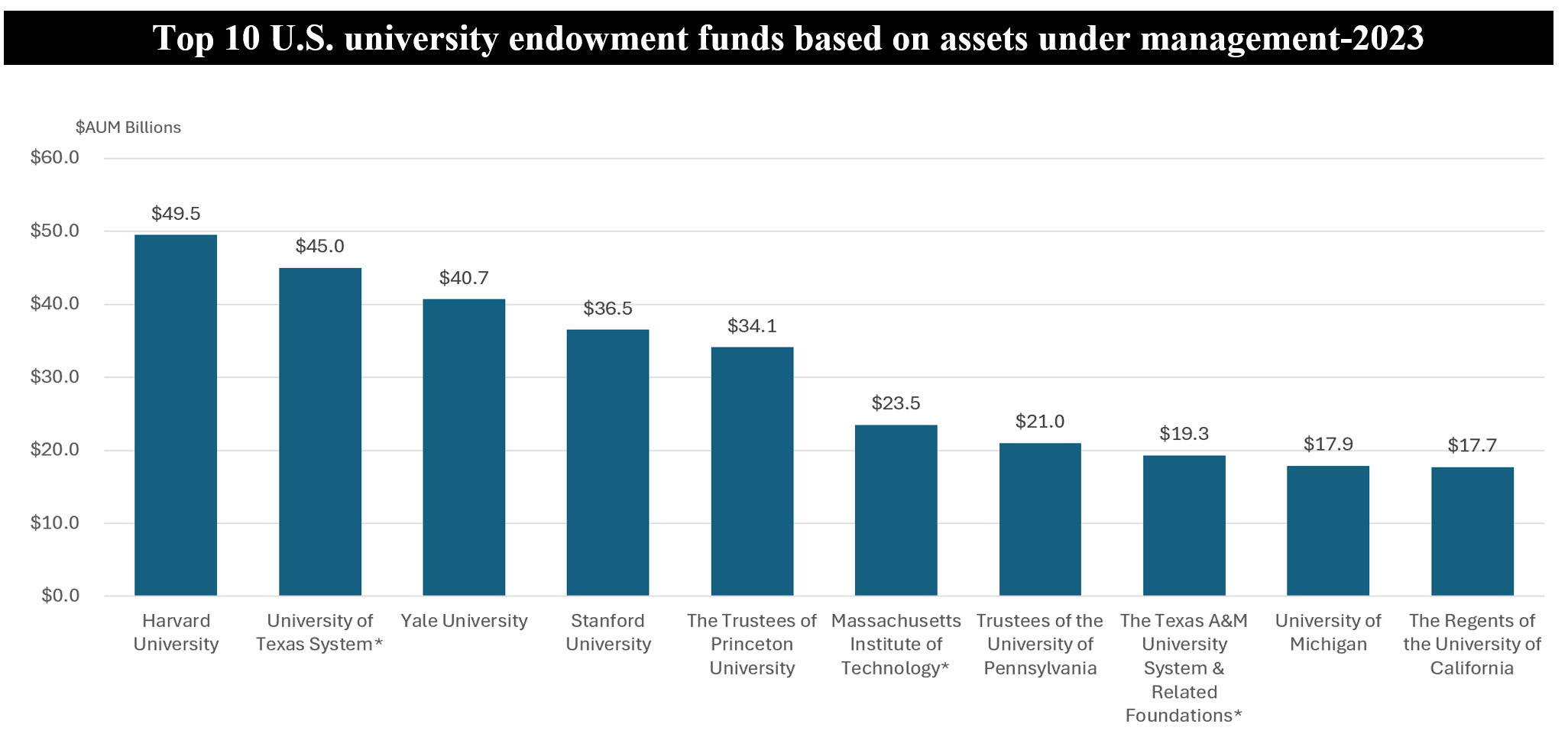

Notes of explanation: *Indicates no divestment of fossil fuel companies. Source: UB University Business, 2/15/2024, based on a report published by the National Association of College and University Business Officers and Commonfund (NACUBO-Commonfund).; Sustainable Research and Analysis LLC.

Background: Pro-Palestinian protesters demand that university endowments divest from companies doing business with Israel

Following the October 7, 2023 attack on Israel by Hamas and Palestinian Islamic Jihad terrorists that resulted in the deaths of more than 1,200 men, women and children as well as hostage taking and the subsequent military response in the Gaza Strip, pro-Palestinian protesters have sprung up at colleges and university campuses across the US. One of the common demands made by the protesting groups is that university endowments divest from companies doing business with Israel.

Israel is not the first target of divestment campaigns: Apartheid movement and fossil fuel divestments

Israel is not the first target of divestment campaigns. During the 1970s and 1980s, there was a significant movement in universities across the United States to divest from companies doing business with the South African Apartheid government. By 1985, a reported 55 universities and colleges had partially or fully divested from companies doing business in South Africa. In more recent years, attention has shifted to fossil fuel divestment. According to one report issued in 2023, over 140 U.S. higher education institutions had announced divestment commitments. Specific details regarding fossil fuel divestment policies vary from one institution to the next, and at some universities divestment initiatives have been combined with the adoption of exclusionary or screening approaches that extend beyond fossil fuels to include, for example, screening against firms that operate private prisons, engage in tobacco manufacturing or companies that do business in the Sudan. A review of the top 10 US endowments, with combined assets of about $305 billion, reveals that seven institutions have divested or are in the process of divesting from their direct fossil fuel holdings. The same top 10 US endowments have rejected calls to divest from Israel.

Divestment versus exclusions and screening

Divestment refers to decisions to sell assets from a portfolio or fund based on non-economic judgements, usually for moral, political, or values-based reasons. Exclusionary approaches, on the other hand, involve the elimination of companies or certain sectors or industries as eligible securities from portfolios, before investing in them, based on specific ethical, religious, social or environmental guidelines or preferences. Such an action is taken in advance of constructing a portfolio of securities, except in cases where the strategy is adopted after the portfolio is up and running, for example, in cases where a fund’s strategy is formally modified. Traditional examples of exclusionary strategies or screening, which have been widely adopted by ESG focused mutual funds and ETFs, cover the avoidance of any investments in companies that are fully or partially engaged in gambling and sex related activities, the production or manufacturing of alcohol, tobacco, firearms, weapons and even atomic energy. These exclusionary categories have been extended in recent years to incorporate additional considerations, for example, fossil fuel firms, firms that are the subject of serious labor-related actions or penalties by regulatory agencies or demonstrate a pattern of employing forced, compulsory or child labor, or firms that exhibit a pattern and practice of human rights violations or are directly complicit in human rights violations committed by governments or security forces, including those that are under US or international sanctions for grave human rights abuses, such as genocide and forced labor.

While important symbolically, the financial impact on companies is likely limited

While divestment approaches have an important symbolic meaning and signaling mechanism that might encourage other universities as well as other large institutions to divest, the financial impact on companies is likely limited. Other pools of capital are ready to step in as equity investors (who may be prepared to invest in improvements) or holders of fixed income securities. Also, debt capital may be sourced from private lenders or privately placed securities that, by some accounts, are becoming serious rivals to mainstream lenders. While debt financing may be secured at a slightly higher cost, research suggests that this may not be the case for equity-based capital raising.