Sustainable Bottom Line: A number of small-focused sustainable thematic stock mutual funds and ETFs delivered the best and poorest total return performance results in March.

Notes of Explanation: For funds with multiple share classes, only the highest share class performance results are displayed. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Observations:

• Uncertainties regarding the scope of the Trump Administration’s tariffs and fears that these could accelerate inflation, slow consumer spending and economic growth or may even lead to a recession, fueled market volatility and pushed stocks lower in the US in March. Continuing a slide that began in February, the S&P 500 registered a decline of 5.6% in March that also shifted year-to-date results lower, to a negative 4.3%. For the trailing twelve months, stocks are still in positive territory, up 8.25%. Bonds, on the other hand, eked out a small positive return in March, adding 0.04% according to the Bloomberg US Aggregate Bond Index. Year-to-date and trailing twelve-month results reflected gains of 2.8% and 4.88%, respectively.

• Against this backdrop, focused sustainable mutual funds and ETFs recorded an average decline of 2.94% in March and an average drop of 1.18% year-to-date. The category remained in the black with a gain of 2.24% over the trailing twelve months.

• Segmented along category lines, focused sustainable taxable funds were down an average of 0.16%, international equity funds gave up 2.10%, while US equity funds dropped 5.90%. On a year-to-date basis, taxable bonds and international stock funds delivered average positive results of 2.08% and 0.87%, respectively, while equity funds declined 5.29%.

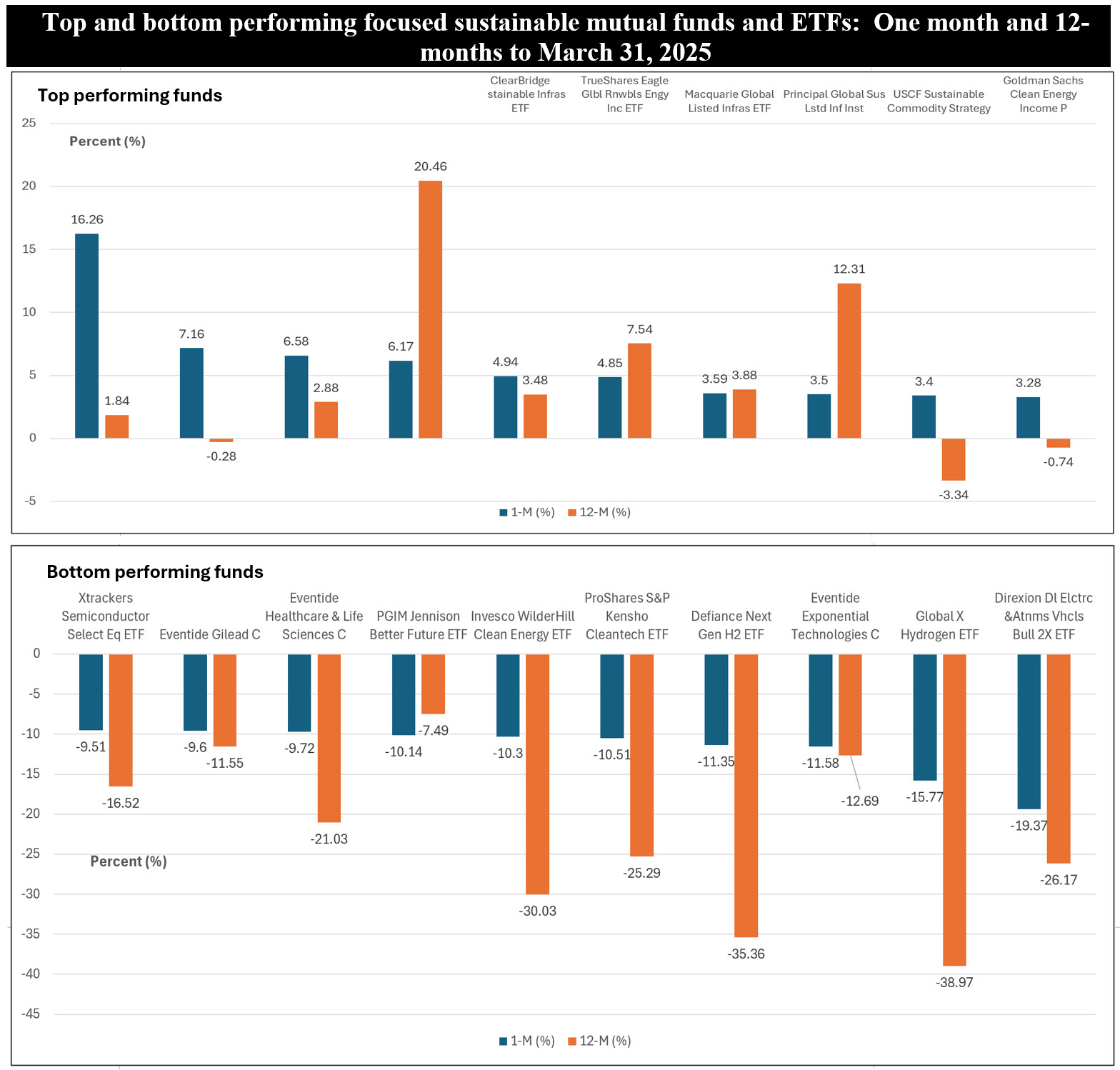

• The top and bottom total return results recorded in March were posted by a number of small-focused sustainable thematic stock mutual funds and ETFs, reflecting the higher levels of risk (monthly volatilities) associated with such funds.

• The top ten performing funds, which can be stratified into three distinct targeted investing groups, including sustainable commodities, sustainable infrastructure and clean energy as well as a focus on ESG-guided investing in India, registered an average gain in March of 5.9% and 4.8% on a year-to-date basis. The four funds investing in sustainable commodities, all small with less than $10 million in assets, gained an average of 8.24% and were led by the $1.5 million USCF Sustainable Battery Metals Strategy Fund (ZSB), up 16.3%. The fund maintained large futures exposures to Aluminum, Copper, Cobalt, as well as carbon emissions trading contracts trading on the European Climate Exchange (ECX).

• At the other end of the range, the bottom ten performing funds in March gave up an average of 11.79% and a negative 22.51% over the trailing 12 months. Dominated by funds investing in clean technologies, the worst performing fund was the levered Direxion Daily Electric and Autonomous Bull 2X ETF (EVAV), down 19.3% in March. This small $2.9 million fund was buffeted, in part, by its 22% positions in Tesla and Cerence Inc.