The Bottom Line: Funds with the highest volatilities are typically, but not always, thematic concentrated funds that expose investors to near-to-intermediate term volatility or risks.

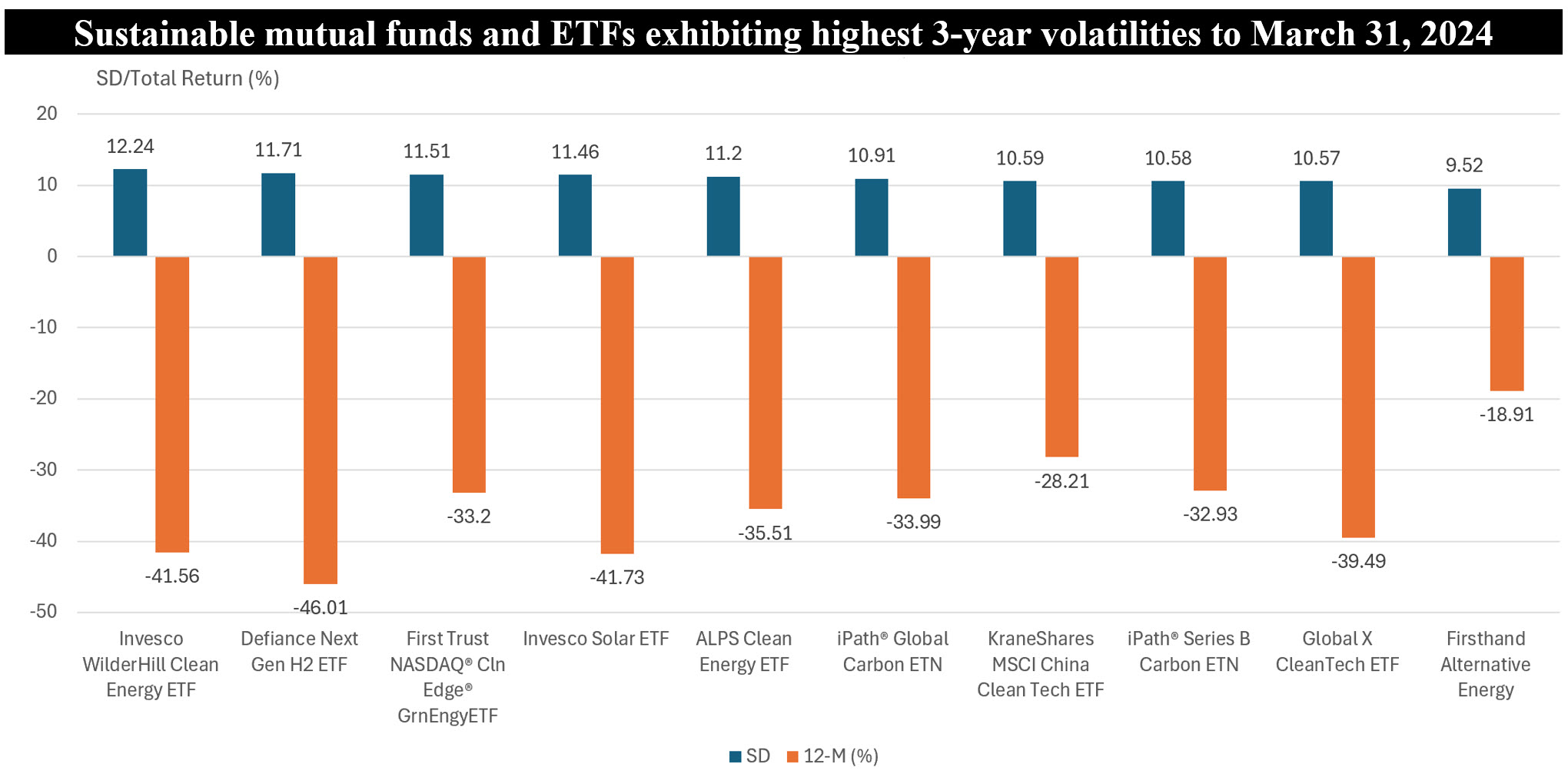

Notes of explanation: The chart displays the ten funds with the highest standard deviations of monthly returns over a three-year period along with 12-month total returns to March 31, 2024. Volatility=monthly standard deviation over 3-years. Sources: Morningstar Direct; Sustainable Research and Analysis LLC.

Observations:

- The ten sustainable funds with the highest risk profiles based on their standard deviations of monthly returns over a three-year period to March 31, 2024 are all thematic funds, typically non-diversified or concentrated funds, focusing on clean or renewable energy and the price of carbon. The three-year standard deviations, which range from 9.52 to a high of 12.2, reflect the near-to-intermediate term volatilities that investors can be exposed to when investing in thematic concentrated funds.

- The same ten funds, including one mutual fund and nine ETFs, have experienced significant total return declines during the trailing 12-months and, in some instances, trailing 3-years to March 31st.

- Posting an average 12-month decline of 35.2%, returns ranged from -18.9% to -41.6%. In the first instance, the small $10.1 million actively managed Firsthand Alternative Energy Fund (ALTEX) (2.0% expense ratio) that is down 18.9% invests in alternative energy and alternative energy technology companies, both within and outside the U.S. Included are companies involved in energy generated through solar, hydrogen, wind, geothermal, hydroelectric, tidal, biofuel, and biomass. At the other end of the range is the $364.5 million index tracking Invesco WinderHill Clean Energy ETF (PBW) (0.66% expense ratio) that invests in US listed stocks engaged in the business of the advancement of cleaner energy and conservation or are important to the development of clean energy. The fund focuses on companies that will substantially benefit from a societal transition toward the use of cleaner energy, zero-CO2 renewables, and conservation. The same funds posted total returns in 2020 of 83.9% and 205.6%, respectively. Refer to the SRI Funds Directory for additional details regarding the approach to sustainable investing taken by the two mentioned funds.

- As noted in the Chart of the Week dated February 12, 2024 [https://sustainableinvest.com/chart-of-the-week-february-12-2024/], clean energy stocks have faced headwinds and volatility due to high interest rates, supply chain disruptions, project delays, regulatory issues and repricing attributable to shifts in investor sentiments. Conditions did not improve in the first quarter of the year. Funds investing in carbon allowances that are regulated by government organizations have been equally volatile and are not for the faint of heart. The dynamics of carbon pricing are complex, and carbon prices have experienced a significant decline. Prices picked up in March.

- The global shift to renewable energy remains a positive trend and investors committed to the theme have to brace for ongoing volatility and be prepared for a commitment over an intermediate-to long-term time horizon.