Sustainable Bottom Line: Renewable energy/clean energy funds dominated the list of top performers in July, but their performance may not be sustainable given policy vagaries.

Notes of Explanation: Funds are listed in order of performance in July 2025. Sources: Morningstar, funds reports and Sustainable Research and Analysis LLC.

Observations:

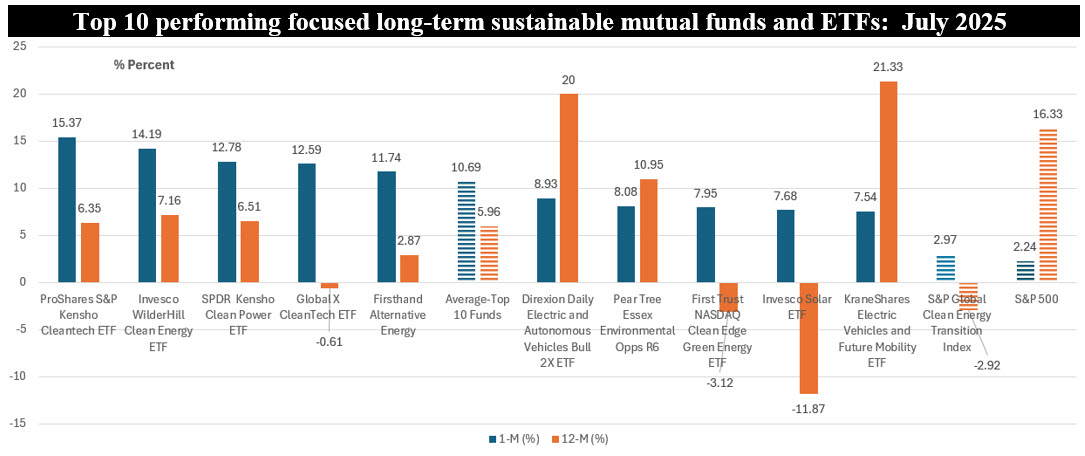

• The top ten performing focused sustainable funds recorded an average gain of 10.7% in July and almost 6.0% over the trailing 12 months. Returns ranged from a high of 15.4% posted by the very small $1.2 million ProShares S&P Kensho Cleantech ETF to a low 7.5% registered by the $67.5 million KraneShares Electric Vehicles and Future Mobility ETF.

• By way of comparison, sustainable U.S. equity funds were up an average of 1.53% in July and 9.6% over the previous 12 months while the S&P 500 added 2.2% and 16.3%, respectively. At the same time, the S&P Global Clean Energy Transition Index recorded a gain of just short of 3.0% in July and -2.9% over the previous 12 months.

• The top 10 funds, a combination of active and passively managed investment vehicles, including one leveraged fund, fall into either the broader thematic renewable energy/clean energy grouping or a more narrowly based thematic category, such as solar energy and electric vehicles. Three of the top ten funds, including Invesco WilderHill Clean Energy ETF, ProShares S&P Kensho Cleantech ETF and Global X CleanTech ETF, were also in the top 10 performance leaders lineup last month. With their successive gains, the same three funds mostly erased their trailing twelve-month declines.

• July’s outperformance occurred as the Trump administration sharply escalated its attacks in recent days against wind and solar energy power projects, and more generally since Trump’s election, has been shifting US policy away from renewable energy. That said, several transitory factors might have ignited July’s boost in renewables stock prices. These include a surge in project activity involving renewables to lock in remaining incentives under existing Inflation Reduction Act (IRA) provisions, U.S. companies benefiting from newly imposed foreign-competition rules under the new tax bill, resilient clean energy demand from corporates and evolving markets that helped maintain upward momentum despite policy concerns and improved investor sentiment toward sustainable mutual funds and ETFs. According to the Investment Company Institute (ICI), funds with an environmental focus experienced positive fund flows in June and during the first six months of the year while the other funds investing in accordance with ESG criteria experienced negative flows in June and year-to-date.

• Performance by the top 10 funds was fueled by a few commonly held stocks of companies such as Bloom Energy, American Semiconductor, Dago New Energy and GE Verona, to mention just four companies, that posted July returns of 56.3%, 54.95%, 43.44% and 24.8%, respectively.

• It remains to be seen whether the performance of renewable company stocks and thematic renewable energy funds are sustainable, but with renewables now reportedly cost‑competitive versus fossil fuels, particularly solar versus gas, the long‑term fundamentals remain attractive despite short‑to intermediate-term policy vagaries.