Sustainable Bottom Line: Concentrated funds, whether focused on hydrogen, clean energy, technology, or biotech, are inherently volatile but have a place in diversified investment portfolios.

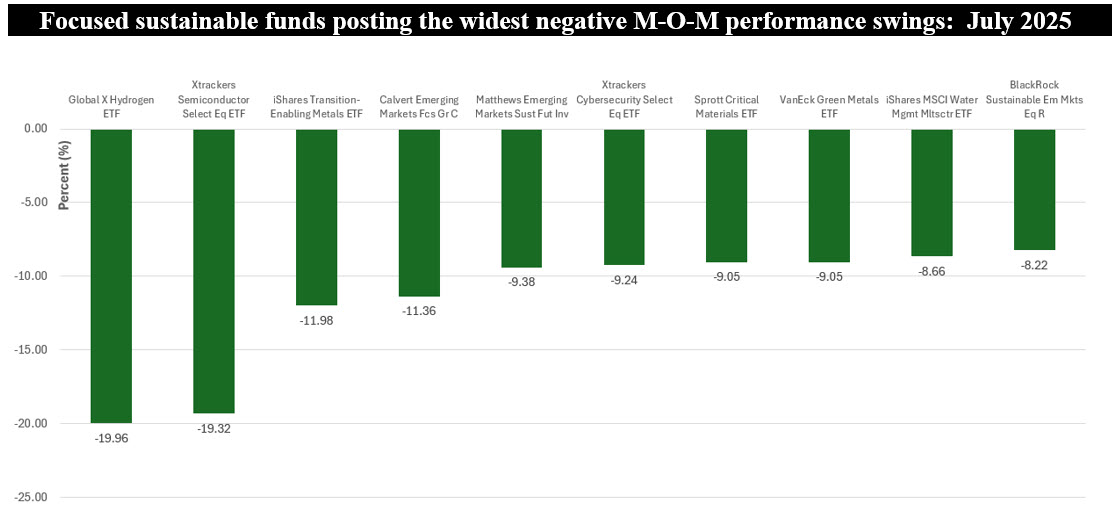

Notes of Explanation: Ten funds listed in order of the widest month-over-month (M-O-M) negative total return performance swings: June 2025 to July 2025. Sources: Morningstar and Sustainable Research and Analysis LLC.

Observations:

• Significant month-over-month swings in the total return performance of funds, either on the upside or downside, are not uncommon. This is especially so in the case of leveraged funds and concentrated funds, or funds that hold 25% or more of their total assets in a particular industry or group of industries. Dazzling returns in one month can very quickly give way to gains or declines during the following month.

• The chart above captures the ten focused sustainable funds with the widest month-over-month negative total return swings between June to July 2025. These funds include seven thematic concentrated investment funds and three funds investing in emerging market equity securities. The average shift across the ten funds was -11.6%, ranging from a low of -8.2% recorded by the BlackRock Sustainable Emerging Markets Equity Fund R to a high of almost -20% posted by Global X Hydrogen ETF.

• Global X Hydrogen ETF, a passive fund that tracks the Solactive Global Hydrogen Index generated a return of 6.7% in July, down from a gain of 26.6% in June. Since its inception in 2021, the fund has recorded monthly returns as high as a positive 28% and as low as a negative 24%. Recent reports indicate that clean hydrogen projects in the US are being pulled after Congress shortened the window for them to qualify for Inflation Reduction Act (IRA) tax credits by five years. Projects now must be under construction by the end of 2027 to qualify, a hurdle that three-quarters of proposals most likely will not meet, according to Wood Mackenzie. Using hydrogen produces water vapor instead of greenhouse gases. But the fuel is expensive, is hard to store and transport and is made using lots of energy. At 13.5%, the fund is the most volatile focused sustainable fund as of July measured based on its monthly standard deviation over the trailing 3-years.

• Concentrated funds, whether focused on hydrogen, clean energy, technology, or biotech, to mention some, are inherently volatile. Industry news, policy announcements, and investor sentiment can swing prices dramatically in short order. These funds can offer a way to express high-conviction themes or sustainable preferences but are best integrated into a diversified portfolio in moderation and calibrated to reflect an investor’s goals and objectives as well as tolerance for risk.