The Bottom Line: Transparency, measurement and reporting, as well as proxy voting preferences are index tracking ETF features that are uniquely relevant for sustainable investors.

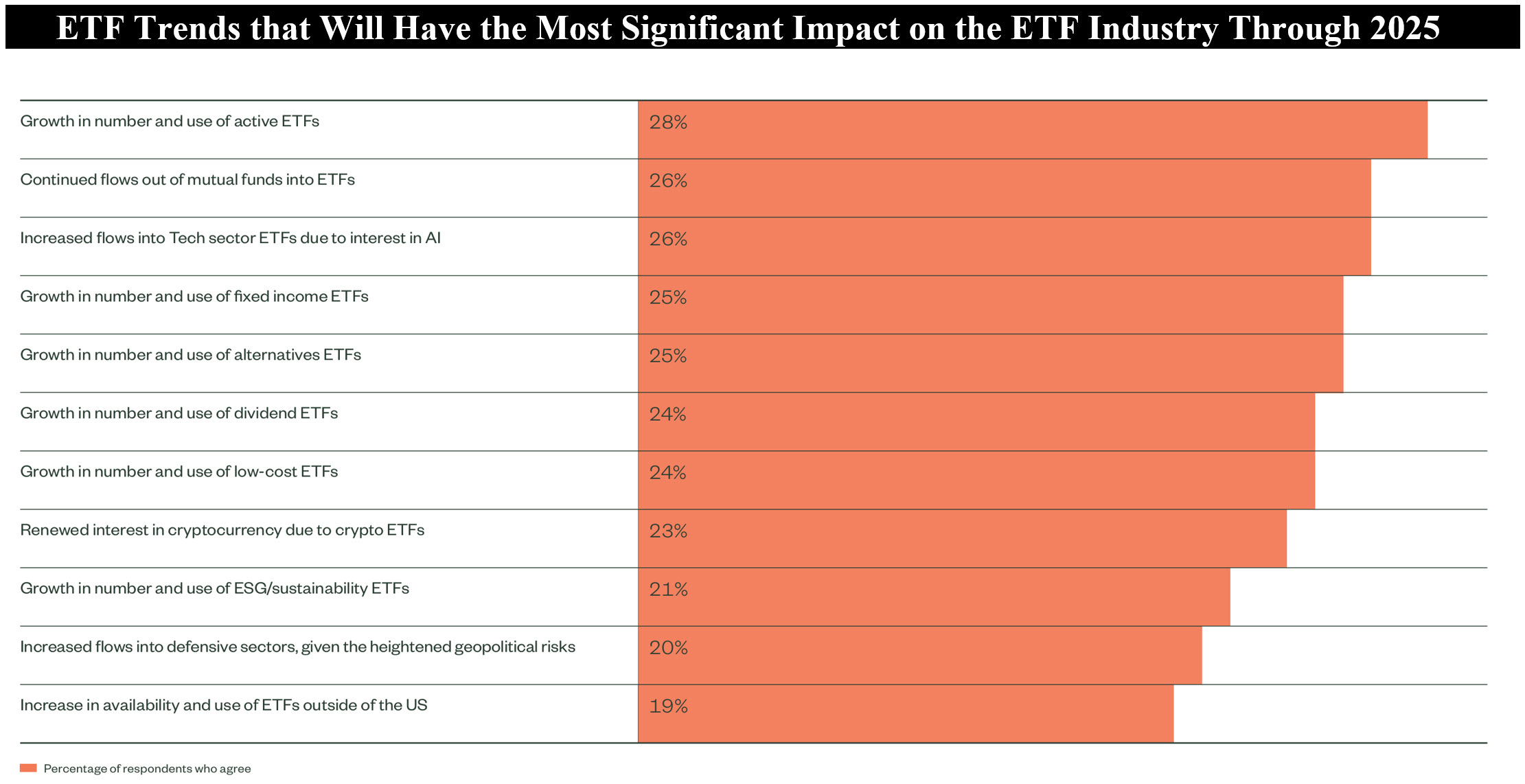

Notes of explanation: Source: State Street Global Advisors ETF Impact Report 2024-2025 The Next Wave of Innovation. Responses were provided to the following questions: Which of the following do you think will have the most significant impact on the ETF industry through 2025? (Please select up to three).

Observations:

State Street report notes that ETFs have become a cornerstone of global finance

State Street Global Advisors’ ETF Impact Report 2024-2025 discloses that global ETF assets under management, according to Morningstar, reached US$11.1 trillion as of December 31, 2023 while the number of ETF offerings globally has risen to 9,149 funds. This represents a cumulative annualized growth rate of 19.8% since 2018. As for the US, ETF assets reached US $8.1 trillion and 3,108 funds at the end of 2023 according to the ICI. By way of contrast, US sustainable ETF assets ended 2023 at US$101.8 billion, or 1.3% of ETF assets, and at the end of July stood at US$106.5 billion.

At their core, ETFs offer investors transparency, liquidity and cost efficiency</strongThey cater to the full spectrum of investment strategies, they are adaptable and have been evolving to meet diverse investor needs. ETFs have become “instrumental in democratizing access to investments, enabling retail and institutional investors alike to tailor their portfolios with once-unimaginable precision and flexibility.” For these reasons and more, State Street notes that ETFs have become a cornerstone of global finance.

According to an online survey conducted among individual investors, financial advisors and institutional investors in April 2024 by State Street Global Advisors, in partnership with field partners A2Bplanning and Prodege, only 45% of US individual investors currently have ETFs in their investment portfolios. At the same time nearly 70% of US financial advisors recommend ETFs to their clients and 67% of US institutional investors use ETFs in their investment strategies. Yet, ETFs still only account for 11.25% of investable assets globally. So State Street posits that there is still room for significant growth.

Growth in the number and use of ESG/Sustainability ETFs is one of the trends that will have a significant impact on the ETF industry through 2025

While not at the top of the list with a 21% response rate to the survey, an ETF trend identified by investors that will have a significant impact on the ETF industry through 2025 is the growth in the number and use of ESG/sustainability ETFs. According to Sustainable Research and Analysis, in addition to the features that otherwise can potentially benefit all other types of investors, index tracking sustainable ETFs, in particular, offer investors at least three benefits that uniquely meet the objectives of sustainable investors.

Rules-based index tracking sustainable ETFs offer investors a better opportunity to align portfolio practices with their sustainability preferences

The first is the opportunity to invest in a fund that pursues a rules-based sustainable investing approach. This, in turn, offers investors greater transparency into the selection criteria and qualifications of securities based on screening, selection, and exclusionary approaches as well as any optimization techniques governing portfolio construction. As a result, investors gain an edge in their efforts to determine whether portfolio practices align with their sustainability preferences. To be sure, the same level of transparency around sustainable investing practices is available through index tracking mutual funds, however, mutual funds offer fewer sustainable index tracking investing options. At present, only 49 funds/share classes with $40.8 billion in net assets, or 20.2%, of sustainable mutual funds are index tracking funds versus 90.8% of ETF assets. Actively managed funds, in general, provide lower levels of transparency. Further, index tracking ETFs offer a greater variety and diversity of investment categories at 39 different investment categories versus 10 for index tracking mutual funds.

Rules based indexing approach translates with greater ease into the creation of metrics to measure outcomes

Second, the rules-based approach to investing can be translated with greater ease into the creation of metrics to track and quantify portfolio level outcomes and provide the basis for more informed reporting to investors on these, even as outcomes reporting is still developing and evolving. These are not the only firms, but management companies like BlackRock (iShares) and Nuveen, the largest and second largest providers of sustainable ETFs that on a combined basis account for 56% of the sustainable ETF market by assets, measure various outcomes and they report on these to investors. For example, the Nuveen ESG Dividend ETF aims to represent the performance of a set of securities with high dividend income and quality characteristics selected from the broad universe that make up the MSCI USA Index while maximizing the exposure to positive environmental, social and governance (ESG) factors as well as exhibiting lower carbon exposure than the MSCI USA Index, is positioned to quantify this information. The fund discloses its MSCI Carbon Intensity Score, or level of CO2 emissions per $MM, and comparison to the score achieved by an appropriate index.

Pass through voting rights

Third, recently some ETFs have begun to offer investors pass through proxy voting rights, giving investors the power to express their sustainable voting preferences with respect to their investments.