Sustainable Bottom Line: When markets are at historic highs, long-term investors should stick to diversified portfolios for the best financial outcomes with lower risk levels.

Notes of Explanation: Sources: Fund documents, S&P Global, Bloomberg, Morningstar and Sustainable Research and Analysis LLC.

Observations:

• By some accounts, investors have pushed the market to historic highs that are not supported by current government policies. For example, based on just one valuation gauge, S&P 500 Index stocks are trading at an estimated forward 12 months Price-to-Earnings (P/E) Ratio of 24.06 versus a long-term average of around 18. If not checked, these policies could lead to an inevitable crisis.

• Under these circumstances, what, if anything, should investors do? Responses will differ from one person to the next. Some of the key considerations that will shape a response include an investor’s current financial profile and investment portfolio, investment time horizon, longevity and tolerance for risk. For sustainable investors, another factor might be the matter of their sustainability preferences.

• That said, at least two useful guides might inform their considerations. First, investors should avoid letting emotions rule their investment decisions. Studies show that trying to time the market invariably leads to poor results. Second, long-term investing can produce some of the best financial outcomes while maintaining diversified portfolios consisting of stocks and bonds will likely reduce risk.

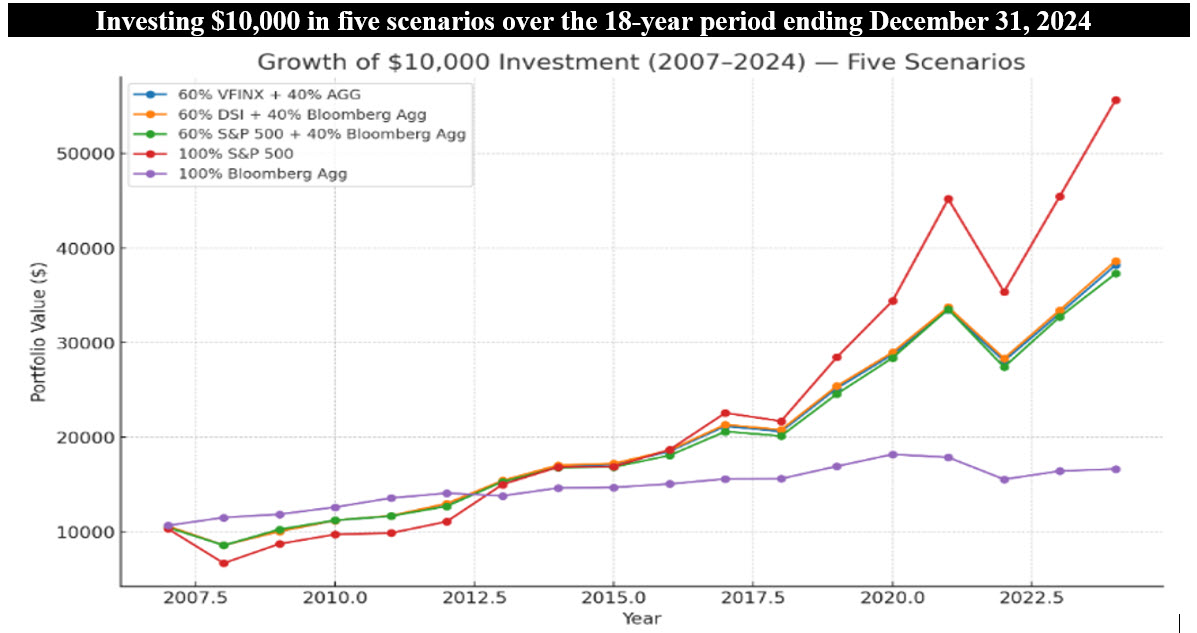

• The above chart quantifies the second point, using a set of both index and funds data covering the last 18 years to illustrate the results achieved by five investing strategy approaches or scenarios, assuming an investment and reinvestment of $10,000 at the start of 2007 and continuing to 2024. The 18-year period was chosen so that the results could also illustrate an outcome linked to a long-term sustainable investing strategy, using the $4.8 billion iShares ESG MSCI KLD ETF (DSI) as a proxy for a sustainable investing scenario. The fund was launched on November 14, 2006.

• The five investing scenarios or strategies are as follows: (1) An all-stock strategy implemented by investing and reinvesting the entire $10,000 in the S&P 500 Index, a benchmark consisting of large and medium cap stocks. This approach produces the best long-term outcome, but investors are also exposed to the highest risk at 19% measured based on standard deviation of annual returns. The S&P 500 gained an average annual rate of return of 10% and the initial $10,000 invested grew to $55,632. (2) At the other end of the range is an all-bond strategy implemented by investing and reinvesting the entire $10,000 in the Bloomberg US Aggregate Bond Index, consisting of intermediate term investment grade bonds. The benchmark gained an average annual rate of return of 2.9% and the initial investment of $10,000 grew to $16,631, the lowest level of the five strategies but also subject to the lowest risk level at 5.2%, measured based on standard deviation of annual returns. (3) A combined stock and bond strategy by investing and reinvesting 60% or $60,000 in the S&P 500 Index and 40% or $40,000 in the Bloomberg US Aggregate Bond Index. This strategy reflects a common, well balanced, 60%/40% allocation for long-term investors with a moderate appetite for risk. The strategy produced an average annual growth rate of 7.6% and the initial level of investment grew to $37,281 with a risk level of 11.9%, or the fourth best outcome of the five strategies. (4) A combined stock and bond strategy attained by investing and reinvesting 60% or $60,000 in the Vanguard 500 Index Fund Investor Shares (VFINX), a low-cost mutual fund that seeks to replicate the performance of the S&P 500 Index, and 40% or $40,000 in the Bloomberg US Aggregate Bond Index (1). The strategy produced an average annual growth rate of 7.7% and the initial level of investment grew to $38,188 with a risk level of 11.4%, or the third best outcome of the five strategies, and lastly (5) A combined stock and bond strategy that offers investors a diversified sustainable investing option by investing and reinvesting 60% or $60,000 in the iShares ESG MSCI KLD Index ETF and 40% or $40,000 in the Bloomberg US Aggregate Bond Index. The iShares ESG MSCI KLD ETF is used here as a proxy for a single sustainable investment scenario with a 18-year investment track record. The fund seeks to track the performance of large, mid-cap and small US companies that have positive environmental, social and governance characteristics based on ESG scores provided by MSCI while also applying following business involvement screens to exclude entirely or partially based on revenue or a percentage of revenue thresholds: adult entertainment, alcohol, civilian firearms, controversial weapons, conventional weapons, fossil fuel extraction, fossil fuel reserves ownership, gambling, genetically modified organisms (GMOs), nuclear power, nuclear weapons, thermal coal power and tobacco. The strategy achieved an average annual growth rate of 7.8% with a risk level of 11.4%, the second-best outcome of the five strategies. It also illustrates that with some sustainable strategies and during some time intervals, sustainable investors can achieve results that are equal to or exceed conventional investing outcomes. This, however, may not always be the case.

• Of course, investors should keep in mind that past performance is not an indicator of future results.

(1) The Bloomberg US Aggregate Bond Index is used in lieu of the performance of an index fund, such as the iShares Core U.S. Aggregate Bond Index (AGG), as the returns are almost identical or track each other very closely.