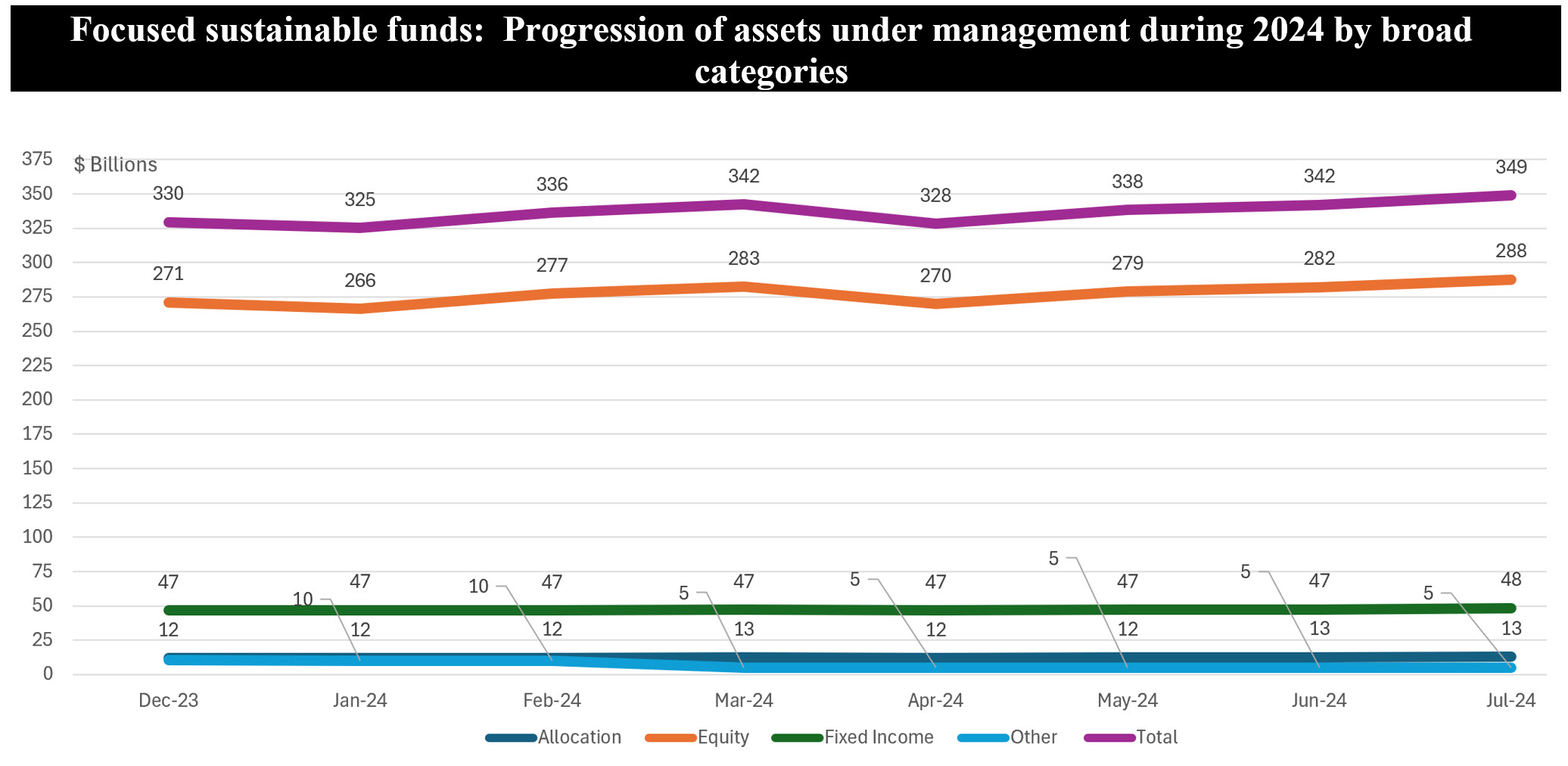

The Bottom Line: Sustainable equity investment funds experienced a modest increase in assets Y-T-D due to market, but no run of inflows to bond funds.

Notes of explanation: Notes of explanation: Source: Other includes Money Market, Miscellaneous and Commodities funds categories. Morningstar Direct and Sustainable Research and Analysis LLC.