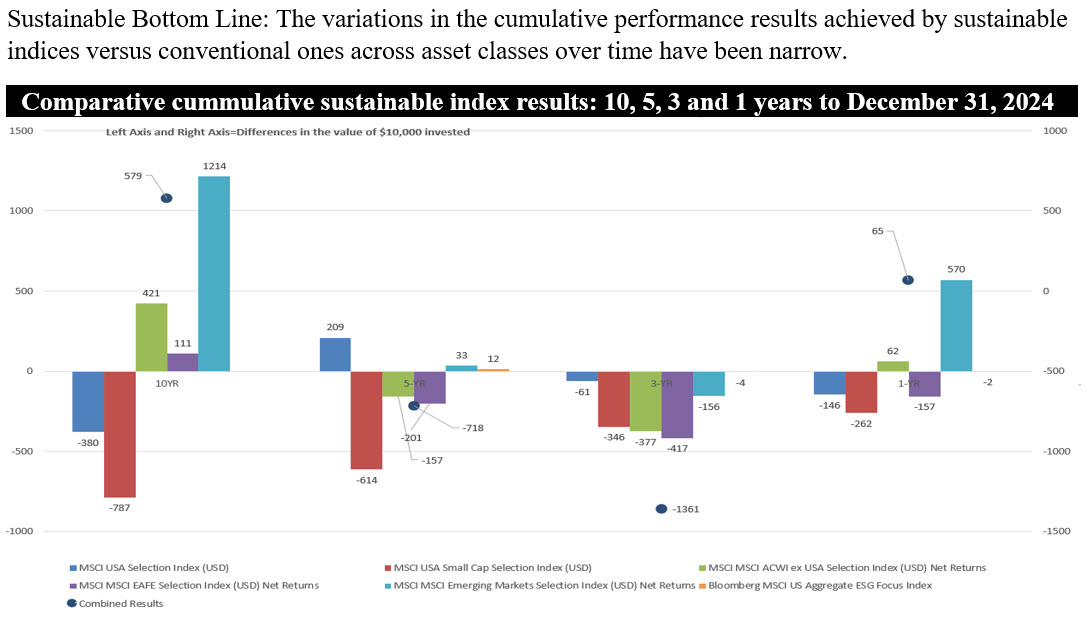

Sustainable Bottom Line: The variations in the cumulative performance results achieved by sustainable indices versus conventional ones across asset classes over time have been narrow.

MSCI,

MSCI,

Notes of Explanation: Sources: Morningstar and Sustainable Research and Analysis LLC.

Observations:

• It’s not uncommon for investors to ask what financial trade-offs, if any, they should expect from pursuing a portfolio-oriented sustainable investing strategy versus a conventional investing approach. It’s a reasonable question but a complex one to answer in large part because portfolio-oriented sustainable investing performance outcomes will largely be linked to and vary with the sustainable investing strategy that investors may wish to implement(1). Some but not all these strategies(2) will involve placing some constraints and restrictions on investment portfolios. One example is the restriction or total avoidance of stocks and bonds of companies involved in the exploration and refining of fossil fuels. A limited range of such practices may not have much impact. As portfolios shift beyond some limited range of restrictions and exclusions, however, returns are more likely to be impacted, either positively or negatively. Fortunately, these trade-offs can be measured, and investors can decide on the risk-return trade-offs they’re willing to accept to achieve their financial and sustainability preferences.

• One simple way to consider, evaluate and illustrate the answer to this question is by comparing the historical performance results achieved by two indices that are similarly calculated and drawing from the same universe of securities but are otherwise distinguished by the fact that one accounts for environmental, social and governance (ESG) considerations while the other does not. This approach is facilitated by examining the performance results achieved by MSCI’s Selection Indices versus their underlying or parent indices(3).

• Rather than limiting the examination to just a single index(4), six sustainable indices published by MSCI along with their underlying indices were selected to represent the two major asset classes, equities and bonds, and various market segments likely to find their way into diversified sustainable investment portfolios. These include US large and mid-cap stocks, US small cap stocks, international stocks, including developed markets and emerging markets, as well as US investment grade intermediate bonds. The indices include the MSCI USA Selection Index, MSCI USA Small Cap Selection Index, MSCI ACWI ex USA Selection Index (USD), MSCI EAFE Selection Index (USD), MSCI Emerging Markets Index (USD) and Bloomberg US Aggregate ESG Focus Index. These indices track the performance of companies selected from their parent or underlying conventional indices based on environmental, social and governance (ESG) criteria. These criteria exclude constituents based on involvement in specific business activities as well as ESG ratings assigned by MSCI and exposure to ESG controversies. At the same time, the indices aim to achieve sector weights corresponding to the sector weights of the underlying index. In this way, tracking errors will be minimized.

• Comparative total return performance results were stratified into four trailing time periods consisting of ten-, five-, three- and one-year intervals ending December 31, 2024. These results, which are displayed in the above chart for $10,000 invested in each index at the start of the period, lead to various observations and conclusions.

• Variations in individual index results over time are narrow. Expressed in dollar terms and assuming investments of $10,000 in each index, cumulative variations in index results are narrow across the four-time intervals. These range from a negative cumulative result of $614 registered by the MSCI US Small Cap Selection Index for the five-year period ending at year-end 2024 to a positive cumulative result of $1,214 posted by the MSCI Emerging Markets Selection Index (USD) for the ten-year period also ending at year end 2024.

• The best overall results achieved by the MSCI’s Selection indices occurred over the ten-year interval. Over that period, returns realized by each of the three international indices outperformed their conventional counterparts. In particular, the MSCI Emerging Markets Selection Index (USD) eclipsed the performance of the underlying MSCI Emerging Markets Index (USD) by a cumulative 12.11%, which translated into an advantage or reward of $1,214 accruing to the benefit of sustainable investors. The returns benefited from three years of early outperformance in 2015, 2016 and 2017 and emerging markets have not been able to replicate these results until this year.

• During the five-time intervals, the US Selection indices only managed to score an advantage for sustainable investors during one of eight measurement periods.

• The Bloomberg MSCI US Aggregate ESG Focus Index closely tracked the performance results of its parent index over the trailing five-, three- and one-year intervals. The dollar value of variations ranged from a low of just $4.0 over the trailing three years to a high of $12.0 over the trailing five-year interval.

• Finally, the combined results of investing $10,000 in each of the six indices show a range of rewards and penalties that range from a penalty of $1,361 over a three-year period to a bonus of $579 over a ten-year time interval. Of course, investors should keep in mind that past performance is not indicative of future results.

Notes of Explanation

(1) Asset allocation is another important determinant, but this consideration will be addressed in a future article. (2) Sustainable investing strategies refer to a range of sustainable investing strategies that fall into the following broad categories: Values-based investing, screening and exclusions, impact investing, thematic investing, and ESG integration. These approaches are not mutually exclusive and, in conjunction with each of these approaches, investors may also adopt various issuer engagement procedures covering stock holdings as well as bonds, and proxy voting practices. (3) Until recently MSCI Selection indices were referred to as ESG indices. (4) A previous article examined the relative performance question regarding passively managed international funds that consider environmental, social and governance (ESG)-related criteria (sustainable investing criteria). Refer to Returns of sustainable international indices and funds bring bonuses or penalties.