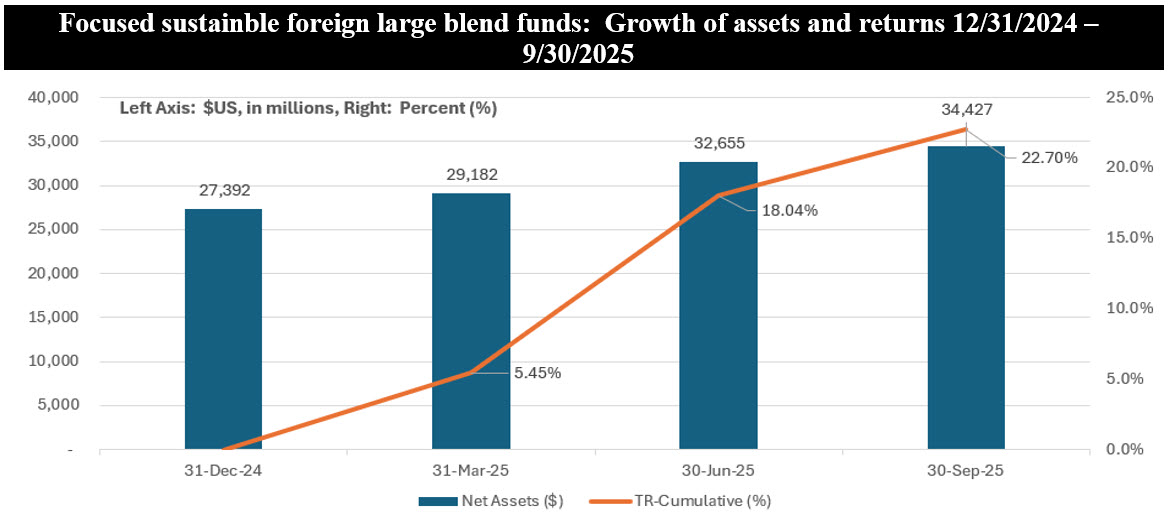

Sustainable Bottom Line: Focused sustainable foreign large blend funds have delivered strong year-to-date gains, yet a 22.7% gain has not translated into meaningful new inflows.

Notes of Explanation: Total returns reflect average quarterly cumulative results for the focused sustainable Foreign Large Blend funds category. Sources: Morningstar and Sustainable Research and Analysis LLC.

Observations:

• Focused sustainable international equity funds posted an average gain of 19.03% since the start of the year, outpacing U.S. equity funds that added an average of 10.65%. The largest segment of mutual funds and ETFs within the broad international equity funds category, which is in turn comprised of 11 investment sub-categories, is the Foreign Large Blend category, which was up 2.51% in September and 22.70% since the start of the year. It covers 34 funds, 67 funds/share classes, including 13 ETFs, with $34.4 billion in assets under management or about 50% of the category’s $69.3 billion in assets (1).

• Foreign equity markets—especially in emerging economies—have outperformed the U.S. so far in 2025, driven by a favorable mix of macroeconomic and valuation factors. A weaker U.S. dollar has enhanced dollar-converted returns for U.S. investors, while lower starting valuations abroad allowed for multiple expansion as earnings expectations improved. Refer to Chart of the Week – June 23, 2025: Sustainable foreign large blend funds for globally diversified portfolios.

• Strong cyclical momentum in Asia, Latin America, and the Gulf has reinforced this trend. China’s recovery, propelled by regulatory easing and fiscal support, has been particularly influential; China-region funds, comprised of one fund, lead the international category with a 39.4% year-to-date gain.

• At the same time, easing inflation, improving credit conditions, and more accommodative monetary policies across several emerging markets have lifted investor sentiment. Many global investors are rotating capital out of concentrated, high-valuation U.S. equities into international markets offering diversification and higher potential upside.

• According to a recent Reuters report based on data from the Financial Times, global investors have shifted an unprecedented amount of capital into non-U.S. equity funds throughout 2025, a reversal of the decade-long trend of U.S. market dominance. Global investors are pouring unprecedented amounts into equity funds that exclude the US, with over $175 billion flowing into ‘ex-US’ global equity mutual funds and ETFs in the past month.

• That said, significant inflows into international equity funds have not been seen within focused sustainable funds. Since the beginning of the year, focused sustainable Foreign Large Blend funds have gained about $6.2 billion in net assets, a 26% gain, almost entirely due to capital appreciation. In September, $971 million was added, again reflecting market gains. It may be that flows into conventional ex-US funds may be more tactical or momentum-driven (investors chasing performance) while sustainable investors (or ESG‐focused mandates) may act more strategically, with longer time horizons, so they might not react as quickly to short-term performance gaps. Additionally, focused sustainable fund assets, held by both retail and institutional investors, may form a relatively stable part of broader diversified conventional portfolios and are less prone to rapid shifts.

(1) Transamerica International Sustainable Equities has announced that the fund is being liquidated on or about October 10 and its liquidation will reduce the number of funds to 33.