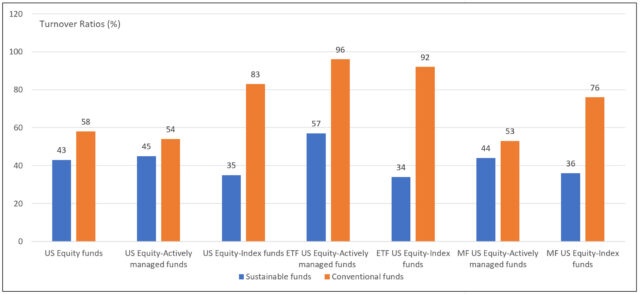

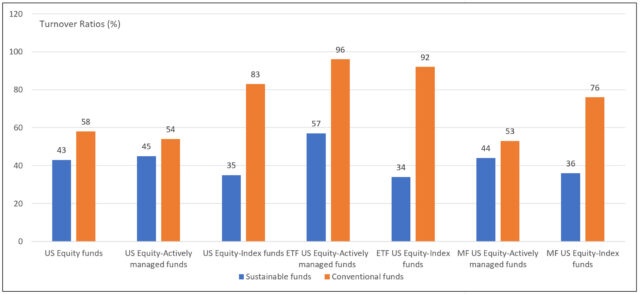

The Bottom Line: Lower turnover ratios are recorded by sustainable US equity funds relative to their conventional counterparts and should be factored into investment decisions.

Turnover ratios for US equity mutual funds and ETFs as of November 30, 2013  Notes of Explanation: Turnover ratios calculated for active and passively managed mutual funds and ETFs, which have been combined. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Turnover ratios calculated for active and passively managed mutual funds and ETFs, which have been combined. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Turnover ratios calculated for active and passively managed mutual funds and ETFs, which have been combined. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Turnover ratios calculated for active and passively managed mutual funds and ETFs, which have been combined. Sources: Morningstar Direct, Sustainable Research and Analysis LLC. Observations:

- An analysis of the latest turnover statistics applicable to sustainable US equity funds versus conventional US equity funds shows that various sustainable mutual funds and ETFs classified as US equity funds, per Morningstar, consistently report lower turnover ratios relative to their conventional counterparts. The average turnover ratio calculated for sustainable US equity funds is 43% versus 79% for conventional funds.

- This observation takes into consideration mutual funds as well as ETFs and actively managed funds versus passively managed funds. In total, 397 sustainable funds/share classes with $188.6 billion in net assets as of November 30, 2023, and 5,901 conventional US equity funds/share classes with $12.3 trillion in net assets were taken into account, with differentiation across actively and passively managed mutual funds and ETFs. In each instance, the lower turnover ratios reported by sustainable funds range from 9% to 58%.

- Turnover ratio refers to the trading activity of a mutual fund, calculated by dividing the lesser of purchases or sales for the fund’s fiscal year by the monthly average of the portfolio’s net assets. Excluded are securities that mature within a year. A turnover ratio of 100% is the equivalent of a complete portfolio turnover.

- A lower turnover ratio is generally desirable. First, it translates into lower transaction costs and therefore higher returns to investors. Second, it can potentially reduce the tax liability of investors as the buying and selling of securities can lead to capital gains, which are subject to taxes. A lower turnover rate can potentially help minimize these taxable events. Third, it may reflect the employment of a value creation strategy that entails longer holding periods for portfolio securities that have the potential to appreciate over time. The latter approach is also aligned with the documented more patient posture associated with a segment of the sustainable investors.

- The turnover ratio, along with other factors, should be taken on board when deciding which funds to consider for investment.