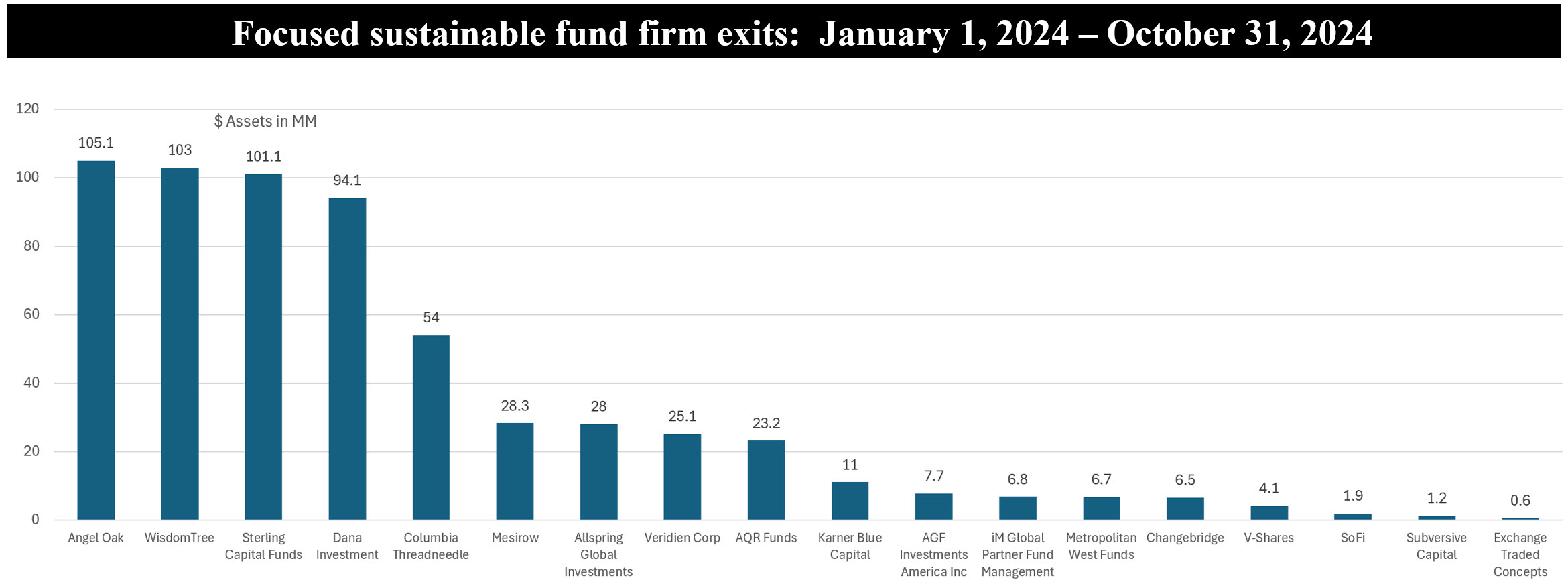

The Bottom Line: 18 fund management firms, or 11% of firms with focused sustainable funds withdrew from offering sustainable funds since the start of 2024.

Notes of explanation: The number of fund firm exits excludes fund firms that were acquired, merged or consolidated with other firms. Data source: Morningstar Direct. Otherwise, Sustainable Research and Analysis LLC.

Observations:

• The pause affecting new listings of focused sustainable mutual funds as well as ETFs, which started after May of last year and has continued through October 2024, has also been exhibited in fund firm exits from the universe of focused sustainable funds.

• Since the start of the year, a total of just seven new funds were launched, consisting entirely of ETF listings. This compares to 65 listings during the same period in 2023, comprised of 36 mutual funds/share classes and 29 ETFs. At the end of October, there were a total of 1,409 sustainable funds/share classes that ended October 2024 with $357.4 billion in assets under management.

• At the same time and over the same time interval, 18 firms, or 11% of fund firms offering focused sustainable funds as of the start of 2024, terminated their sustainable fund offerings*. Upon their exits, fund firms managed an average of $33.8 million in assets across one or more funds, with a range extending from $0.6 million managed by Exchange Traded Concepts, to a high of $105.1 million managed by Allspring Global Investments.

• Most of the fund firm withdrawals, a total of 13 firms or 72% of the 18 firms that have exited, involve fund groups that offered one or two sustainable funds that failed to achieve break-even levels following, as few as, two years in operation. Notable exceptions include WisdomTree that managed three ESG-oriented ETFs with $89.5 million in assets offered by WisdomTree Asset Management and AQR Capital Management with its one sustainable mutual fund. WisdomTree liquidated its three ESG-oriented funds about 6-months after being charged by the SEC with making misstatements and for compliance failures relating to the execution of an investment strategy that was marketed as incorporating environmental, social, and governance (ESG) factors. WisdomTree settled with the SEC and paid a penalty of $4.0 million. AQR, which managed the $23.2 million AQR Sustainable Long-Short Equity Carbon Share Fund, had not managed to grow the fund’s assets beyond initial funding since its inception at the end of 2021. The AQR Sustainable Long-Short Equity Carbon Aware Fund was repurposed in August 2024 when it was renamed the AQR Trend Total Return Fund and its principal investment strategy was altered accordingly.

• While the pause in fund formations and follow-on fund company exits coincide with the anti-ESG movement in the US that had gained momentum in the second quarter of 2023 and fund companies may have opted to lower their profile by curtailing focused fund offerings, the two factors alone do not fully explain these developments. In the opinion of Sustainable Research and Analysis, additional considerations likely include: (a) the 2022 downturn in the stock and bond markets, when both equities and fixed income securities sustained double digit declines. These declines led to drawdowns across sustainable mutual funds and ETFs that were exacerbated due to their underperformance relative to conventional equity and fixed income funds, (b) flows attributable to retail investors in sustainable funds were more volatile and staged a slower recovery in 2023-2024 relative to institutional investors, (c) continuing confusion and misunderstanding regarding focused sustainable funds, their nature, financial performance as well as outcomes, and (d) the inability on the part of some firms, especially smaller firms lacking in deep pockets, to achieve financial break-even levels. That said, sustainability remains important to corporate executives, asset owners, investors as well as other stakeholders.

*The number excludes fund firms that were acquired, merged or consolidated with other firms.