The Bottom Line: Teneo survey results show that the majority of global CEOs, or 56%, remain committed to balancing ESG programs with core business objectives.

Notes of explanation: Notes of Explanation: Sources: Teneo and Sustainable Research and Analysis LLC.

Observations:

• In the three weeks immediately following the 2024 U.S. election, Teneo, a privately held global CEO strategic advisory and communications company, surveyed more than 300 global CEOs and 380 institutional investors representing approximately $US10 trillion in market cap and AUM to identify risks and opportunities in the year ahead. The survey results covered the following six topics: macroeconomic outlook, the Trump effect, geopolitics, innovation, ESG, as well as leadership.

• According to the just published survey results entitled Vision 2025: Where is the World Going in 2025 and Beyond? despite ongoing policy, political, legislative and regulatory challenges, CEOs and investors are bullish about the prospects for growth in 2025. Nearly 80% of CEOs predict the economy will improve in the next six months, a spike from just 45% last year. Both CEOs and investors anticipate strong M&A activity, increased levels of domestic and international investment, accelerated hiring and advancements in technology and innovation. Notwithstanding this positive outlook, CEOs and investors are closely monitoring escalating geopolitical tensions, investor activism and trade negotiations.

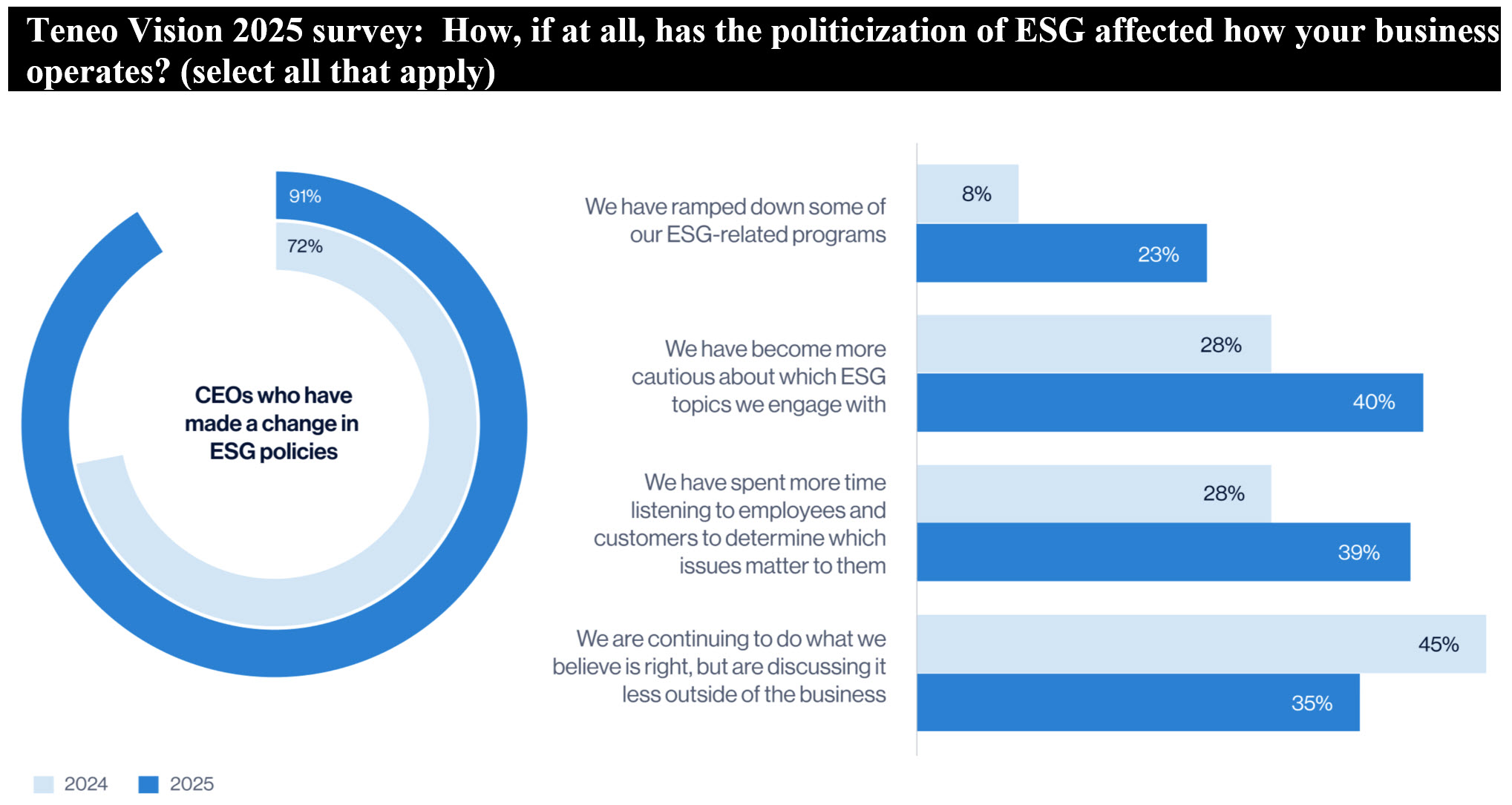

• On the topic of ESG, the survey results show that the majority of global CEOs, or 56%, remain committed to balancing ESG programs with core business objectives. Compared to last year, there is a six-point decrease in CEOs and 14-point decrease in investors who are seeking this balance. At the same time, in line with investor expectations, 91% of CEOs globally have adjusted ESG initiatives in response to the politicization of ESG. This is up from 2024 when 72% expressed such commitments.

• The survey results also disclose that 40% of CEOs have become more cautious about which ESG topics they engage on while 35% are continuing to do what they believe is right but discussing this less outside of the business.

• According to a yet another recently released publication, this one in the form of a report released by the State of Washington Treasurer*, more than 80% of American investors and 75% of their European counterparts reported considering ESG factors in their investment decision making processes. This is reported even as some 20 states in the US since 2021 have adopted 43 anti-ESG laws and eight states have adopted 17 pro-ESG laws. Against this backdrop, it seems that while facing a slight decline, the majority of CEOs remain committed to balancing ESG programs with core business objectives, however, they are lowering their public profile on this subject by restricting their external communications.

*Treasurer of the State of Washington, Material Factors in Public Finance and Investments A review of laws in other jurisdictions and their impacts A Report to the Legislature- Senate Bill 5187, Section 123(2), § Chapter 475 (2023), November 27, 2024.