The Bottom Line: In the latest US SIF 2024/2025 report, 73% of respondents expect the market to grow over the next one-to-two years.

Notes of explanation: Sources: US SIF 2024/202 Report on US Sustainable Investing Trends, Sustainable Research and Analysis LLC.

Observations:

• On December 14, 2024, US SIF released the 15th edition of its Report on US Sustainable Investing Trends. The report documents $6.5 trillion in total US sustainable investment assets under management (AUM) at the beginning of 2024—defined as assets that are explicitly managed as ESG or sustainability focused investments. According to US SIF, this represents 12% of the total US assets under professional management that stand at $52.5 trillion.

• The report, which discloses that data is now being analyzed with greater precision and builds on changes made to the methodology in 2022 “by taking another critical look at the availability of verifiable investor data and public reporting using advanced data collection and analysis techniques,” highlights that 73% of respondents expect the sustainable investment market to grow over the next one to two years. The report notes that growth is driven by client demand, regulatory evolution, and advances in data analytics, even in the light of political headwinds and regulatory scrutiny. This observation is supported by other recent research and surveys. For example, as noted is last week’s Chart of the Week, survey results disclosed in a report entitled Vision 2025: Where is the World Going in 2025 and Beyond? Published by Teneo, a privately held global CEO strategic advisory and communications company, show that the majority of global CEOs, or 56%, remain committed to balancing ESG programs with core business objectives. According to a yet another recently released publication, this one in the form of a report released by the State of Washington Treasurer, more than 80% of American investors and 75% of their European counterparts reported considering ESG factors in their investment decision making processes.

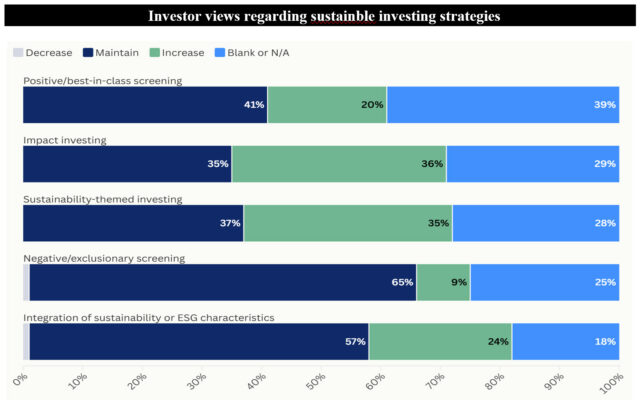

• Also reported by US SIF is that the most frequently reported sustainable investing strategies include the integration of sustainability or ESG factors, followed by the use of negative or exclusionary screening. Over 65% of respondents use three or more strategies across their investments.

• At 68%, partial or full fossil-fuel exclusions is now the most frequently reported negative screen. This surpasses tobacco exclusion which are employed by 66% of investors.

• In late 2022, US SIF reported a significant adjustment to its previously reported US sustainable investment assets under management (AUM) as of the beginning of 2022. As a result of methodological modifications, sustainable assets declined from $17.1 trillion to $8.4 trillion, a drop of $8.7 trillion or 51%. Assets under management have sunk further as of the latest reading, falling another $1.9 trillion or 23%. Even at $6.5 trillion and considering that this sum captures not only focused sustainable mutual funds and ETFs but also includes separate accounts as well as various other collective investment vehicles, sustainable assets under management, as reported by US SIF lands at a very high end of the range relative to the comparatively miniscule $370.6 billion in AUM covering US focused sustainable mutual funds and ETFs, as reported by Morningstar, that invites further reconciliation.