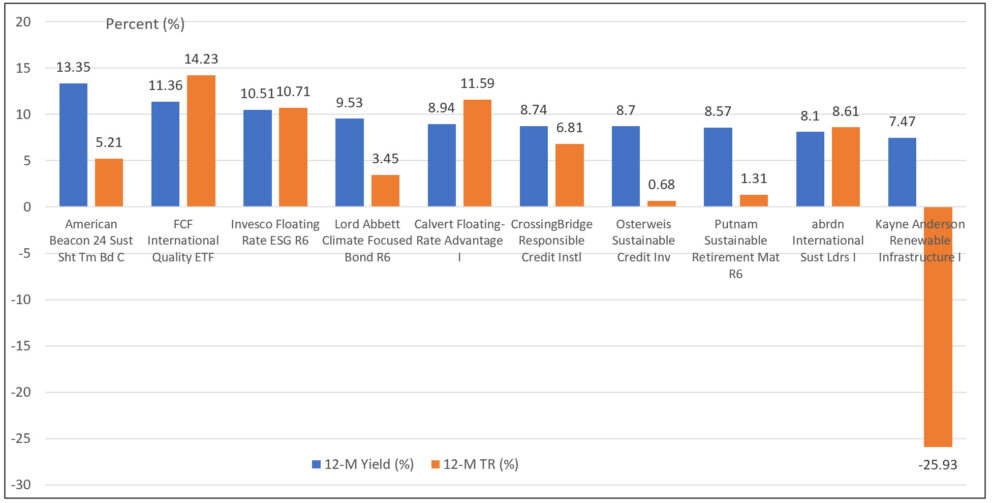

The Bottom Line: Top yielding funds posted 12-month trailing yields ranging between 7.5% and 13.3%, but corresponding total rates of return can be much lower.

Highest yielding sustainable mutual funds and ETFs: Trailing 12-M yields and total returns to October 31, 2023  Notes of Explanation: Trailing 12-month yields (listed in descending order (but exclude KraneShares Global Carbon ETF) and total returns to October 31, 2023. In the case of multiple share classes, only the top yielding fund/share class is listed. Source: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Trailing 12-month yields (listed in descending order (but exclude KraneShares Global Carbon ETF) and total returns to October 31, 2023. In the case of multiple share classes, only the top yielding fund/share class is listed. Source: Morningstar Direct, Sustainable Research and Analysis LLC.

Observations:

- The ten highest yielding sustainable mutual funds and ETFs recorded an average trailing 12-month yield of 9.5%. Limiting the compilation to the highest yielding share class in the event of mutual funds with multiple share classes, yields ranged from a low of 7.5% to a high of 13.4%.

- The ten highest yielding funds are dominated by taxable bond funds (6), followed by international equity funds (2) and one each classified as an allocation fund and sector equity fund.

- The two highest yielding funds fall into the dominant fund classifications. The $21.2 million American Beacon TwentyFour Sustainable Short Term Bond C (TFBCX) is a fixed income fund managed by American Beacon Advisors, Inc. along with TwentyFour Asset Management that invests fixed income securities and derivatives with an average maturity of under three years. The fund combines fundamental investment analysis and ESG integration, employing an exclusionary approach and screening based on an ESG scoring model and also emphasizing companies striving to improve industry such as energy production and transportation. The second highest yielding fund is an actively managed ETF investing in foreign equity securities. The $185 million FCF International Quality ETF (TTAI), managed by FCF Advisors LLC, combines reliance on a free cash flow quality model to compile a list of highly ranked securities that are optimized to achieve an overall above average ESG score based on third party inputs.

- Trailing twelve-month yields, that are calculated by aggregating the weighted average yields of a fund’s underlying holdings, should be considered an estimate of yield, as it may not always represent income received by all investors. Moreover, trailing twelve-month yields don’t necessarily correlate with the fund’s total rate of return.

- The average total return posted by the highest yielding funds over the previous twelve months settled in at 3.7%. Total returns ranged from a low of -25.9% to a high of 14.23%. The correlation between these returns and TTY turns out to be a low 0.47. The divergence between TTY and total return is punctuated by the performance of Kayne Anderson Renewable Infrastructure Fund I. The fund’s TTY was 7.5% as of October 31st while posting a negative 25.9% total rate of return over the previous 12 months.