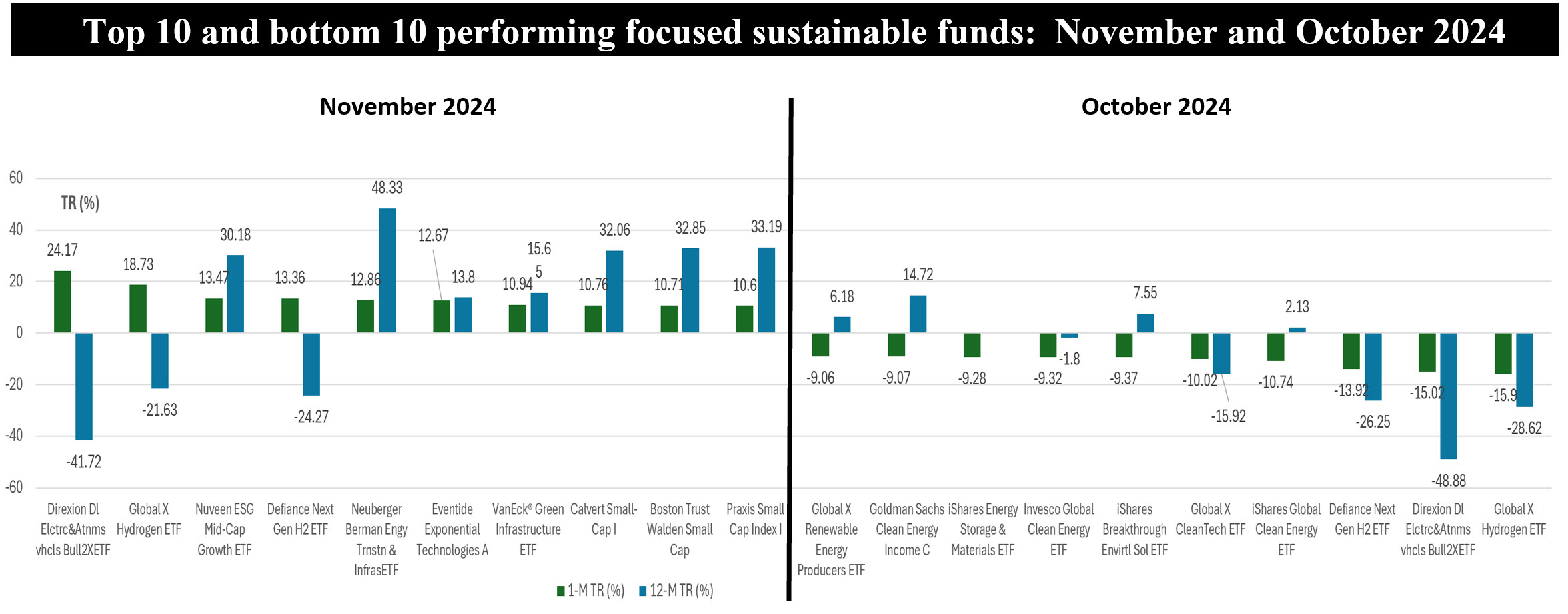

The Bottom Line: Three of October’s concentrated thematic laggards morph into some of November’s best performing funds, with total returns ranging from 13.3% to 24.2%.

Notes of explanation: Top 10 and bottom 10 performing focused sustainable funds based on November and October returns. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Observations:

• November’s broad-based post-election stock market rally that seemed to pull back a bit by mid-month regained its momentum, supported toward month-end by Nvidia’s strong third quarter 2025 earnings report, robust gains in sectors tied to broader economic growth and hints at further rate cuts by the Federal Reserve, produced the best monthly return so far this year for stocks. The S&P 500 added 5.9% on a total return basis. The Dow Jones Industrial Average gained 7.7% while the Nasdaq 100 posted an increase of 5.3%. Small and mid-cap growth indices were some of the best performers in November, with the Russell Mid Cap Growth Index and Russell 2000 Index posting very strong gains of 13.3% and 12.3%, respectively. The Russell 2000 registered its best monthly gain since December 2023, adding almost 11% recording a gain of 21.6% over the trailing 12-months versus an increase of 29.1`% for the S&P 500.

• Against this backdrop, long-term focused sustainable funds recorded an average gain of 3.0% and for the trailing 12-months grew by an average of 18%. Returns were bracketed by two concentrated thematic funds, ranging from -9.4% attributable to the $221.2 million KraneShares California Carbon Allowance ETF (KCCA) to a high of 24.2% achieved by the $4.9 million leveraged Direxion Daily Electric and Autonomous Vehicles Bull 2X Shares (EVAV).

• Some of October’s lagging sustainable funds morphed into November’s winners. Initial investor concerns regarding potential changes in renewable energy subsidies and policies following the U.S election results were allayed, it seems, by subsequent clarifications and commitments to maintain support for clean energy initiatives as well as stabilizing and declining interest rates in November. After reaching a November high of 4.44%, yields on 10-year Treasuries dropped to 4.18% at month-end.

• Two of November’s winners, both concentrated volatile thematic index funds investing in products that facilitate hydrogen-based energy production, included the $40.6 million Global X Hydrogen ETF (HYDR) and the $21.1 million Defiance Next Gen H2 ETF (HDRO). The funds were up 18.7% and 13.4%, respectively, in November after giving up 15.9% and 13.9% in October. Both funds profited from outsized exposures to Bloom Energy Corp. Class A, which makes a type of fuel cell server that can generate electricity from either natural gas, biogas, or hydrogen without combustion, that gained 176% in November, much of it following an announced large scale supply agreement with utility company American Electric Power (AEP). The funds shrunk but did not yet recover from significant trailing twelve-month declines.

• Four sustainable mid-cap and small-cap funds also landed in top 10 spots, benefiting, in part, from the lift provided by November’s broad-based stock market rally.