The Bottom Line: Vanguard reduced fees charged by 87 funds, including two focused sustainable funds, one of which now carries a 7 bps expense ratio.

Notes of Explanation: Data as of year-end 2024. For funds with multiple share classes, net assets are applicable to the fund’s indicated share class. Total fund sizes for the American Century Large Cap Equity, Vanguard FTSE Social Index, Neuberger Berman Sustainable Equity Fund, and FlexShares ESG & Climate US Large Cap Core Index Fund are: $4.4 billion, $22.7 billion, $2.4 billion and $67.4 million. Fidelity Series Sustainable US Market is excluded as fees are charged by underlying funds. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Observations:

• Last Monday February 3, 2025, Vanguard announced that it was reducing the fees charged on nearly half of its U.S. mutual funds and ETFs. The firm reduced expense ratios by an average of 20% across 87 funds. According to published accounts, the fee cuts are the steepest in the firm’s 50-year history.

• Included in the fee reductions are two of Vanguard’s focused sustainable equity-oriented index funds. These are the Vanguard FTSE Social Index Fund Admiral Shares and Institutional Shares as well as the Vanguard ESG International Stock ETF. For these funds, expense ratios dropped from 0.14%, 0.12% and 0.12% to 0.13%, 0.07% and 0.10%, respectively.

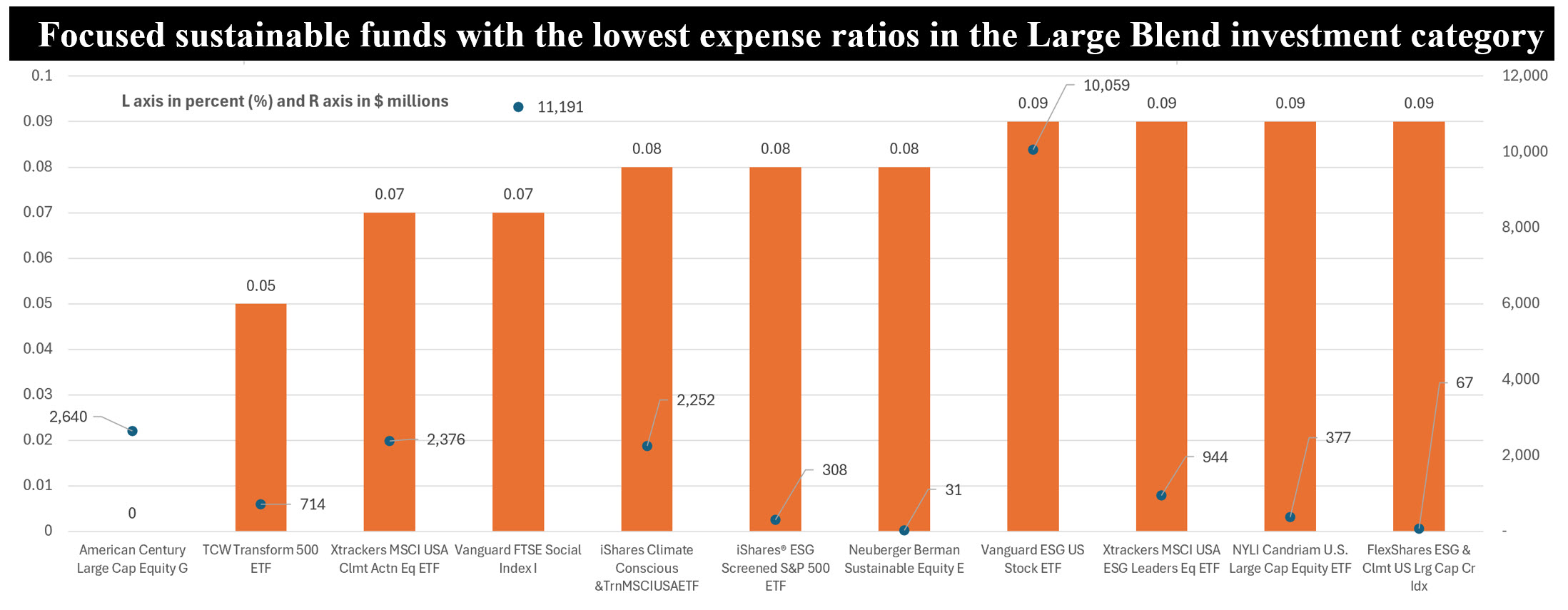

• The expense ratios applicable to these two funds were already at the lower end of the range within their respective investment categories. But by lowering the expense ratio to 0.07% from 0.12% on the Admiral share class of the Vanguard FTSE Social Index Fund, Vanguard dropped the fund’s expense ratio to one of the three lowest in the Large Blend investment category, with its average expense ratio of 0.76%.

• Ten funds/share classes in the Large Blend category are offered to investors with an expense ratio that falls below 10 bps, ranging from 0 bps to 9 bps. All but two are index tracking funds that seek to replicate the performance of the US equity market’s large- and mid-cap stocks with (a) ESG overlays by which the funds screen companies for ESG factors, and/or they may also employ exclusions based on involvement in certain business activities or participation in defined business segments, for example, adult entertainment, alcohol, tobacco, cluster munitions, anti-personnel landmines and nuclear weapons, to mention just a few, and/or (b) companies that emphasize climate transition initiatives. With $22.7 billion in assets, the Vanguard FTSE Social Index Fund is the largest fund in the Large Blend investment category and the second largest focused sustainable fund within the universe of 591 focused sustainable long-term funds.

• At the same time, the $3.9 billion Vanguard ESG International Stock ETF, classified as a Foreign Blend Fund, dropped its expense ratio by 20% to 0.10%.

• Vanguard, which oversees seven focused sustainable funds, four index funds and three actively managed ones in the form of three ETFs and four mutual funds, managed some $39.2 billion in assets (AUM). It ranks second, based on AUM, behind BlackRock that leads in this segment with $62.8 billion in net assets at year-end 2024.