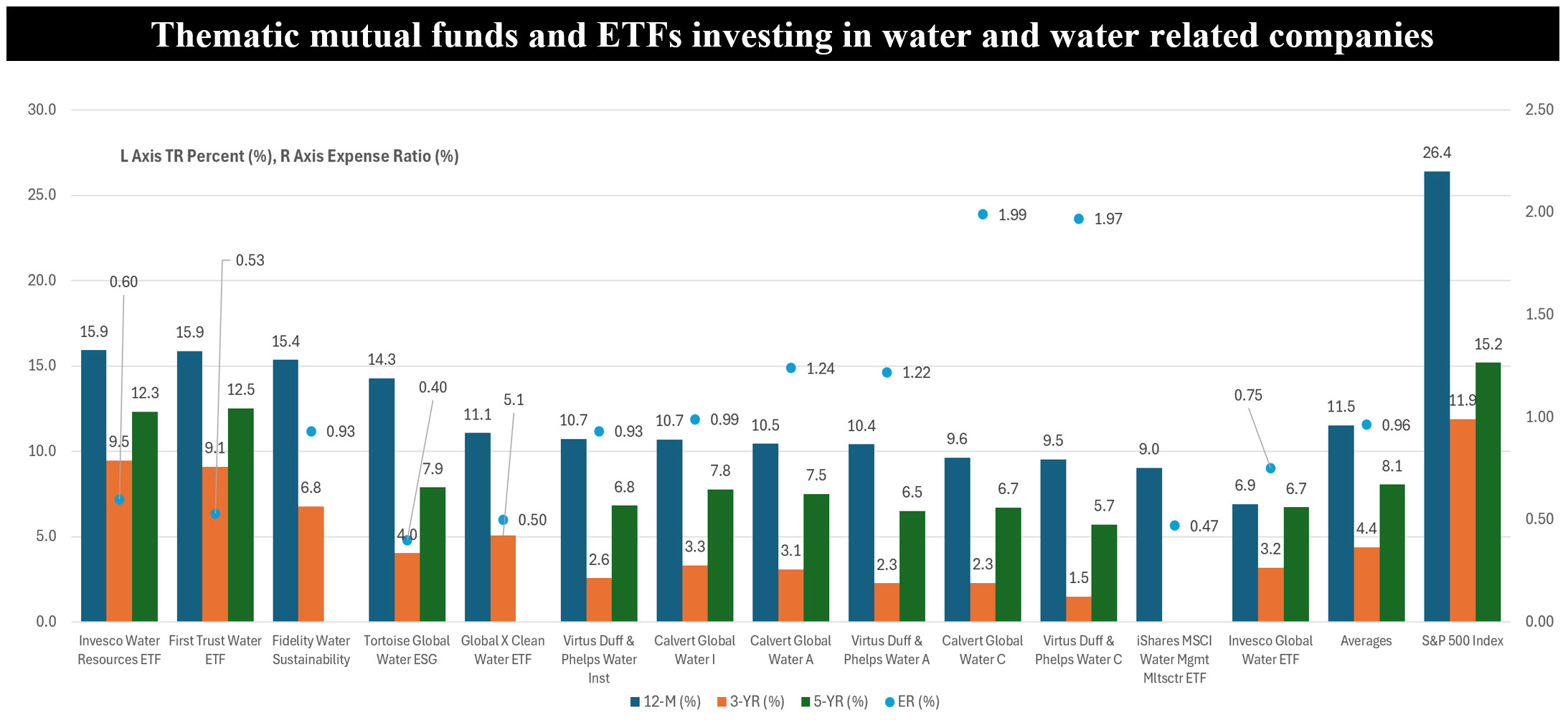

The Bottom Line: Nine active and passively managed thematic water funds offer investors options, but the segment’s performance has lagged over the last five years.

Notes of Explanation: Funds listed in order of 12-Month performance to January 31, 2025. 3 and 5-year results are expressed as average annual returns. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Observations:

• During the World Governments Summit 2025 which took place last week in Washington DC, the Mohamed bin Zayed Water Initiative and the World Bank signed a Memorandum of Understanding (MoU) that was described as “solidifying a strategic partnership to address the escalating global water scarcity crisis.” The signing was viewed as a pivotal step toward advancing sustainable water management solutions worldwide. The Mohamed bin Zayed Water Initiative is a UAE not-for-profit organization dedicated to addressing global water scarcity.

• The strategic partnership aims to address the challenges linked to water scarcity, declining water quality, and inefficient water use. Proponents argue that as the global population grows and climate change intensifies, the demand for clean, reliable water will only increase. It would seem that companies focused on innovative water technologies, infrastructure improvements, and sustainable management practices are positioned to capture market share in a sector that is increasingly recognized as essential for economic and social development. Government initiatives, favorable regulations, and rising public and private investment in environmental sustainability further bolster the investment case.

• Sustainable investors with a preference for advancing sustainable water management solutions and who wish to focus on water and water-related companies that have the potential to realize long-term growth and societal impact as part of their equity allocation in sustainable portfolios or on a stand-alone basis, companies such as widely held Ecolab, Ferguson Enterprises and Pentair PLC, to mention just three, can look to a small universe of nine focused sustainable thematic mutual funds and ETFs for potential investment opportunities. The nine funds fall into one of three sustainable investing buckets. The first includes funds that focus on the water theme without extending their mandate to reflect additional sustainability considerations. Funds in this bucket include Invesco Global Water ETF and Invesco Water Resources ETF. The second bucket consists of funds that employ sustainable investing exclusions criteria or screening. These are the Fidelity Water Sustainability Fund, First Trust Water ETF, Global X Clean Water ETF, iShares MSCI Water Management Multisector ETF and Tortoise Global Water ESG Fund. The third and final bucket covers two funds that go beyond employing sustainable investing exclusions and screening criteria to include values-based considerations, ESG integration and, in one case (Calvert), impact considerations. These include Virtus Duff & Phelps Water Fund and Calvert Global Water.

• That said, these thematic funds, which oversee some $5.6 billion in net assets through the end of January, have lagged the broad market in the last five years. High expenses levied by some of the funds in this small group haven’t helped. The segment’s average expense ratio stood at 0.96%, ranging from a low of 0.4% applicable to the index tracking Tortoise Global Water ESG Fund to a high of 1.99% charged by Calvert Global Water C Class, another index tracker.

• During the month of January 2025, the nine funds/13 share classes, including seven index tracking funds, posted an average return of 2.71%, trailing the S&P 500 by seven basis points. Average results compared to the S&P 500 over the trailing 12-months, three and five years have been quite poor and these have been achieved at higher levels of volatility. The same observation applies to the individual funds within the segment which have not been able to outperform the broad benchmark during the same time intervals.

• While investing in water and water-related companies presents a compelling opportunity to address a critical global challenge, there are notable risks and challenges to consider. The water sector often requires significant capital expenditure and long project cycles before realizing returns, which may not align with investors seeking quicker gains. Regulatory environments can be unpredictable, with changes in government policies potentially affecting profitability. Moreover, water utilities and technology companies may face operational risks, such as extreme weather events, aging infrastructure, and geopolitical tensions that disrupt supply chains and affect water pricing. Competitive pressures and technological disruptions can also erode margins over time.