The Bottom Line: Focused sustainable high yield bond funds, diminishing in number, offer diversified investors the opportunity to improve their overall risk-adjusted returns over time.

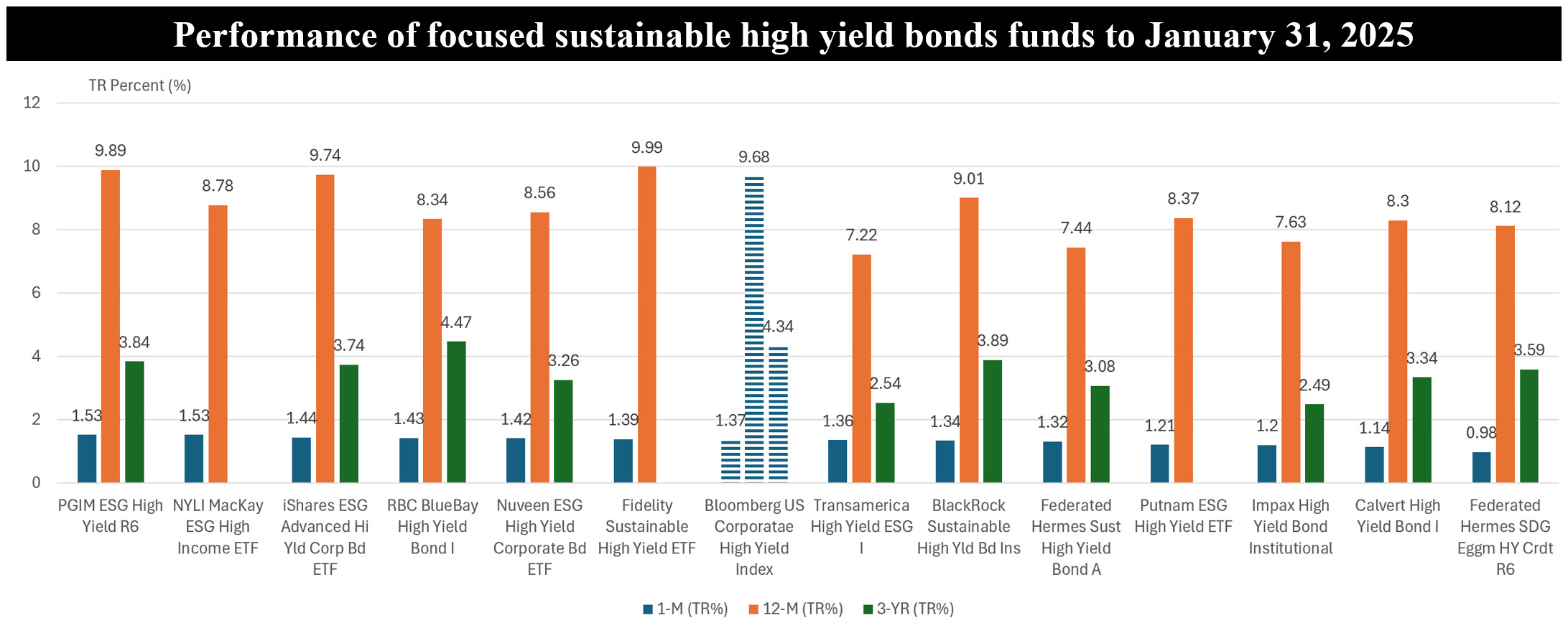

Notes of Explanation: Funds are ordered based on total return performance results in January 2025. 3-year performance results are annualized. In the case of mutual funds with multiple share classes, only the best performing share class is listed. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Observations:

•The high-yield market, consisting of below investment-grade bonds, held steady in January, seemingly unphased by developments associated with President Trump assuming office in mid-January. High yield bonds, as measured by the Bloomberg US High Yield Index, delivered a solid return of 1.37%, supported by strong technical factors with light supply and renewed inflows as well as positive macro signals and a decent start to the earnings season.

• Outside the Emerging-Markets Local-Currency Bond investment category that is comprised of the single Templeton Sustainable Emerging Markets Bond Fund that was up 3.4% in January 2025, high yield focused sustainable bond funds, on average, were the best performing category during the month. The category, consisting of 13 funds/30 share classes in total, was up an average of 1.28% in January and an average of 8.3% over the trailing twelve months. With that return, high yield funds posted the best average fixed income return over the previous twelve months.

• Six funds/share classes, including three index tracking ETFs, outpaced the high yield benchmark. These are identified in the performance chart above. However, the universe of focused sustainable high yield funds that reached 13 at the end of 2023 has now dropped to 11 funds as the two top performing funds are no longer available to sustainable investors. The best performing fund in January as well as over the trailing 12-months, the $26.3 million PGIM ESG High Yield R6 Share Class, up 1.53% and 9.89%, respectively, announced that it was ceasing operations and liquidating on or about February 25th. The fund, which was launched on December 8, 2021 and managed by PGIM Investments LLC, didn’t seem to gain any traction and 97% of the fund’s assets were sourced to one share class intended for institutional investors that likely represented the firm’s seed capital. The fund’s closing highlights the risk of investing in a smaller sized fund that may be subject to liquidation due to poor financial performance. Such a fund can be liquidated at any time without shareholder approval and/or at a time that may not be favorable for all shareholders. Such a liquidation could result in transaction costs and have negative tax consequences for shareholders.

• The second-best performing fund, the $63.5 million NYLI MacKay ESG High Income ETF has been renamed the NYLI MacKay High Income ETF. In addition to its name change effective February 14, 2025, the fund also dropped its ESG mandate pursuant to which securities were qualified based on the advisor’s environmental, social, and corporate governance (ESG) criteria.

• Excluding the above-mentioned funds does not have a material impact on the average performance results of the focused sustainable high yield bonds segment that offers less conservative diversified investors the opportunity to improve their overall risk-adjusted returns over time. That said, the near-term run up in high yield bonds may mean that the segment is overvalued right now.