The Bottom Line: Sustainable mutual fund and ETF investors interested in ESG integration may have to conduct research that extends beyond their fund’s prospectus language.

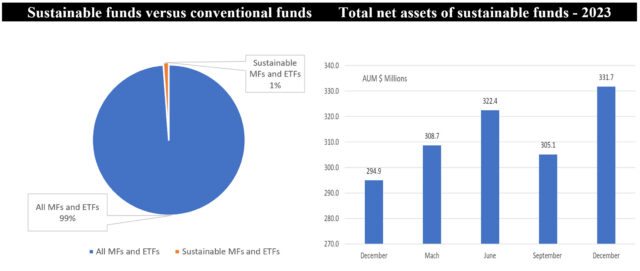

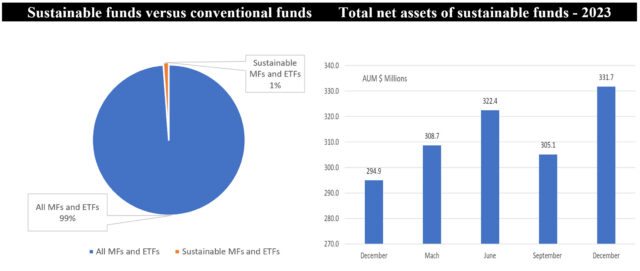

Long-term sustainable funds vs. conventional funds and growth of sustainable fund assets in 2023 Notes of Explanation: Notes of explanation: Sustainable funds include long-term mutual funds and ETFs but exclude money market funds. Sources: ICI, Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Notes of explanation: Sustainable funds include long-term mutual funds and ETFs but exclude money market funds. Sources: ICI, Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Notes of explanation: Sustainable funds include long-term mutual funds and ETFs but exclude money market funds. Sources: ICI, Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Notes of explanation: Sustainable funds include long-term mutual funds and ETFs but exclude money market funds. Sources: ICI, Morningstar Direct, Sustainable Research and Analysis LLC. Observations:

- The net assets attributable to long-term mutual funds and ETFs expanded during 2023, benefiting almost entirely from capital appreciation, to end the year at an estimated $27.7 trillion in net assets. Sustainable funds, as defined by Morningstar, also gained, and ended 2023 at $331.7 billion.

- On this basis, long-term sustainable mutual funds and ETFs account for just 1.2% of fund assets at the end of 2023. This is almost identical to the ratio at the end of 2022.

- That said, it seems highly likely that the degree of adoption of one or more sustainable investing strategies by US-based mutual fund and ETF management companies is understated. This is certainly the case with regard to ESG integration, defined as the process by which relevant and material ESG factors are systematically and consistently analyzed as part of investment decisions. The focus is on both risks and investment opportunities that may contribute to long-term financial returns. Sustainable mutual funds and ETFs pursue a range of investing approaches ranging that include values-based investing, ESG screening and exclusions, thematic investing, impact investing and ESG integration. These strategies, which are not mutually exclusive, are oftentimes augmented by proxy voting and company engagement practices.

- According to some data, the adoption of ESG criteria in US portfolios in 2022 runs as high as 61% of North American investors.

- US based mutual funds and ETF investors interested in fund management firms that promote investment stewardship and sustainable investing need to look beyond Morningstar’s universe of classified sustainable funds. Some companies, for example, J.P. Morgan Asset Management, considers the management of financially material ESG risks and opportunities an important part of its investment decision-making process across its platform. The firm offers as many as 134 and 436 bond funds and share classes, respectively. Yet only 16 funds/share classes are explicitly identified as sustainable funds.

- Interested sustainable investors have to engage more directly with their advisors and fund managers to better understand their investment management firm’s current and prospective investment stewardship practices and how ESG may be accounted for in portfolio decisions.