The Bottom Line: Blended portfolios of growth and value stocks across market capitalizations offer investors the benefits of diversification and higher returns with lower risks.

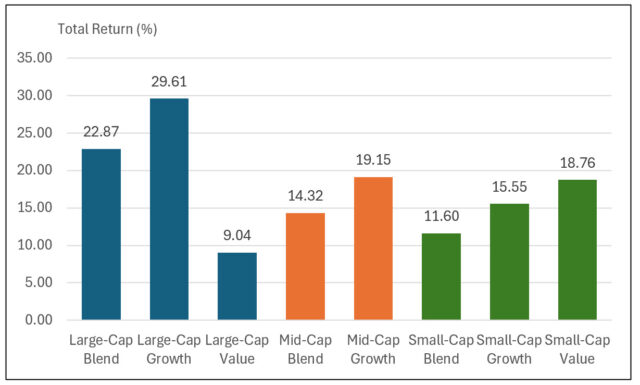

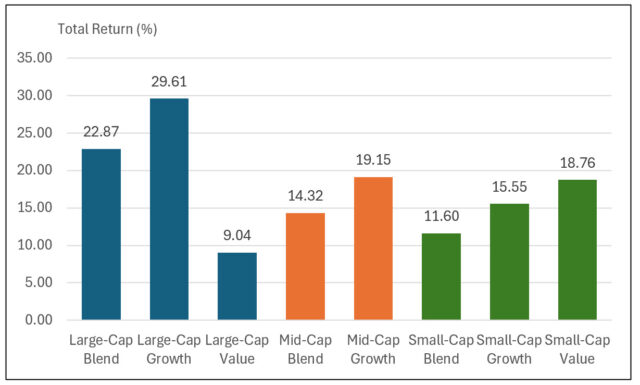

Average performance of actively managed sustainable US equity mutual funds and ETFs: 2023  Notes of Explanation: Average returns for calendar year 2023 cover all actively managed sustainable funds within their respective category from small-cap to large-cap equity funds. There are no mid-cap value funds as of YE 2023. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Notes of Explanation: Average returns for calendar year 2023 cover all actively managed sustainable funds within their respective category from small-cap to large-cap equity funds. There are no mid-cap value funds as of YE 2023. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Notes of Explanation: Average returns for calendar year 2023 cover all actively managed sustainable funds within their respective category from small-cap to large-cap equity funds. There are no mid-cap value funds as of YE 2023. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Notes of Explanation: Average returns for calendar year 2023 cover all actively managed sustainable funds within their respective category from small-cap to large-cap equity funds. There are no mid-cap value funds as of YE 2023. Sources: Morningstar Direct and Sustainable Research and Analysis LLC. Observations:

- The S&P 500 gained 26.3% in 2023, benefiting from a combination of factors ranging from a strong economy, reduced concerns of a looming recession, better-than-expected corporate earnings, lower inflation and an apparent end to the Federal Reserve’s interest rate hikes. This compares to an average gain of 20.9% posted by actively managed sustainable US equity funds, a segment consisting of 303 funds/share classes with $115.2 billion in assets under management as of year-end 2023.

- That said, the range of returns across size and growth versus value style factors, that is, large cap, mid-cap and small-cap as well as growth and value styles, varied by a significant 21%, ranging from an average 9.0% recorded by small-cap blended funds to an average high of 29.6% delivered by large actively managed sustainable growth funds.

- Sustainable large-cap growth funds, in particular, profited from their exposures to the technology sector that gained 55.1% in 2023, per the Nasdaq 100 Index.

- In general, blended portfolios consisting of growth and value stocks across market capitalizations offer investors the benefits of diversification as well as higher returns with lower levels of risk. This is also expected to be the case for actively managed sustainable US equity funds where the relationship is evident across factors over periods of one, three and five years. That said, the expected results are obfuscated due to the limited representation of style-based funds across some categories. For example, there are currently no sustainable mid-cap value funds and there is only one sustainable small cap value fund.