Sustainable Bottom Line: A narrow decline still leaves institutional investors accounting for over 50% of focused sustainable L-T mutual fund assets and benefits all investors.

Notes of Explanation: Sources: Morningstar, Sustainable Research and Analysis LLC.

Observations:

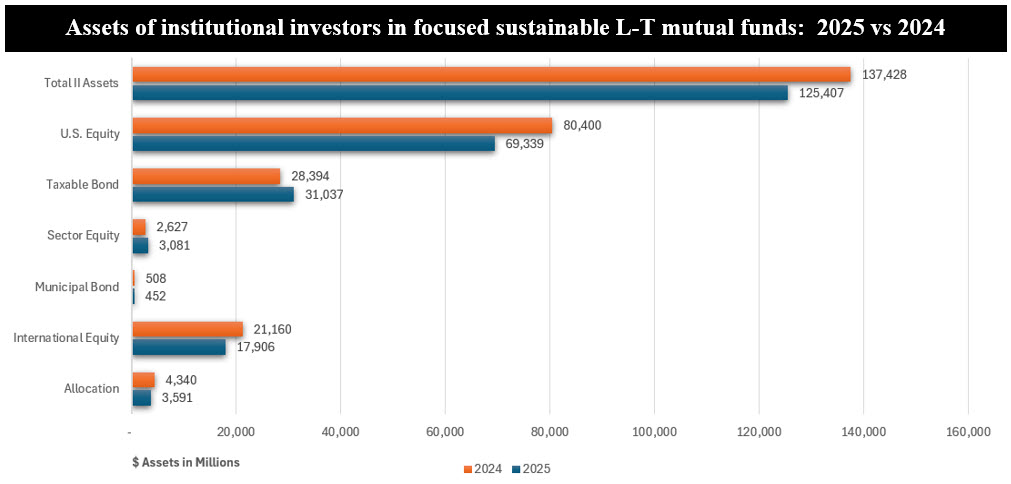

• The assets of focused sustainable long-term mutual fund share classes linked to institutional investors, at a combined total of $125.4 billion, declined by $12 billion in 2025. Accounting for 57% of mutual fund assets at the end of 2024, the share of market sourced to institutional investors dropped by 5%, to reach 52% at the end of 2025. Some, but not all of that, is attributable to the reclassification of one fund.

• Institutional investors are defined as professional organizations pooling large sums of money, like wealth funds, pension funds, insurance companies, endowments and wealth managers, that invest on their own behalf or for the benefit of others, often through specific share classes subject to high minimum investment requirements and lower fees, differentiating them from retail investors.

• Focused sustainable long-term mutual fund and ETF assets (excluding money market funds) ended 2025 with $374.6 billion in net assets, adding $21.3 billion, or 6%, in net assets compared to year-end 2024. Notwithstanding an average gain of 14.7% in 2025, long-term mutual funds ended the year at $239.6 billion in net assets compared to $241 billion, a narrow $1.4 billion decline, attributable to outflows/shareholder redemptions and liquidations/re-brandings. A rough back of the envelope calculation indicates that 2025 outflows from mutual funds were around $37 billion.

• At the end of 2025, institutional investors accounted for over 50% of mutual fund assets held in Taxable Bond funds (79%), Sector Equity funds (64%) and International Equity funds (51%). The dominance of institutional investors across these three categories didn’t change year-over-year, but the levels did. U.S. Equity funds, which represents the largest investment category by assets under management, sourced 47% of assets from institutional investors.

• The institutional investor decline in net assets is largely attributable to a drop of $11.1 billion in US Equity fund holdings. At the same time, the decline in International Equity fund holdings by institutional investors is largely attributable to the reclassification of a single large fund while investments in taxable bond funds added a net of $2.6 billion.

• In the end, a diversified base of institutional investors, who typically exhibit longer investment horizons and greater capital stability, can materially benefit all mutual fund shareholders. Institutional participation helps anchor the fund’s asset base, reduces cash-flow volatility, and lowers the risk of large, unexpected redemptions. This, in turn, limits forced asset sales, reduces transaction costs, mitigates the realization of capital losses, and lowers the risk of fund liquidation or disruption. While there are distinctions to be made between index funds and actively managed funds regarding redemption volatility, these effects enhance portfolio management efficiency and improve outcomes for retail and other investors who pay a higher fee for these benefits.