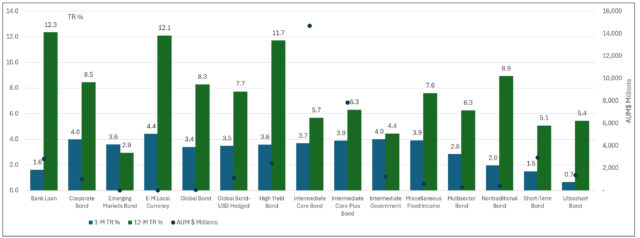

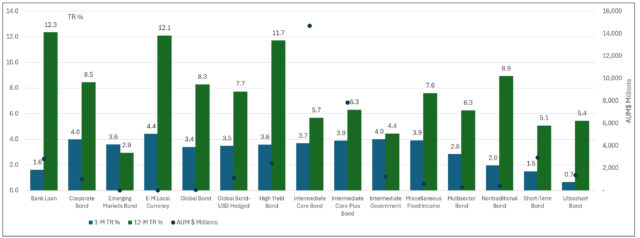

The Bottom Line: Sustainable actively managed taxable bond funds gained an average of 7% in 2023, while returns by category ranged from 4.4% to 12.3%.

Sustainable actively managed taxable fixed income funds by category: 1-M and 12-M TR% 2023 Notes of Explanation: Average total return performance results apply to taxable actively managed sustainable fixed income mutual funds and ETFs for December 2023 and calendar year 2023. Circles reflect each taxable fixed income fund category’s combined assets under management at year-end 2023. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Average total return performance results apply to taxable actively managed sustainable fixed income mutual funds and ETFs for December 2023 and calendar year 2023. Circles reflect each taxable fixed income fund category’s combined assets under management at year-end 2023. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Average total return performance results apply to taxable actively managed sustainable fixed income mutual funds and ETFs for December 2023 and calendar year 2023. Circles reflect each taxable fixed income fund category’s combined assets under management at year-end 2023. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Average total return performance results apply to taxable actively managed sustainable fixed income mutual funds and ETFs for December 2023 and calendar year 2023. Circles reflect each taxable fixed income fund category’s combined assets under management at year-end 2023. Sources: Morningstar Direct, Sustainable Research and Analysis LLC. Observations:

- Markets continued to rally in December, and both stocks and bonds posted strong gains. Stocks, as measured by the S&P 500, added 4.5% in December and a full year increase of 26.3%, with 65% of the gain being registered during the last two months of the year. The results overcame last year’s 18.1% decline. Credit markets also continued to rebound, gaining 3.8% in December and 5.53% for the full calendar year, according to the Bloomberg US Aggregate Bond Index. Last year’s gain, however, was not yet sufficient to overcome 2022’s 13% decline for bonds. Lower rated and some longer dated bonds, for example corporate bonds, scored double digit returns in 2022.

- Sustainable taxable and municipal bond funds across all segments, including both active and passively managed funds, a total of 332 funds and share classes with $46.7 billion in net assets under management at year-end, posted an average gain of 2.9% in December and 7.0% over calendar year 2023. Actively managed sustainable taxable bond funds on the other hand, recorded an average gain of 3.2% in December and 7.1% in 2023. The average 12-month results compare to an average gain of 7.6% recorded by taxable actively managed conventional bond funds—a significantly larger more varied universe of actively managed mutual funds and ETFs consisting of 4,539 funds and share classes with $3.1 trillion in assets as of year-end 2023. These factors alone challenge efforts to draw valid performance comparisons between sustainable and conventional funds.

- Returns by segment comprised of actively managed sustainable taxable bond funds ranged from an average low of 4.4% achieved by intermediate government funds to an average high of 12.3% recorded by bank loan funds. The best performing actively managed sustainable bond fund category consisted of funds investing in bank loans. The small universe comprised of just 2 funds with 9 share classes registered an average gain of 12.3% in 2023. The leading fund and the best performing taxable actively managed fund overall, the Calvert Floating-Rate Advantage Fund I, posted an increase of 13.7%.

- Sustainable emerging market bond funds investing in local currency bonds, an even smaller category represented by one small fund, the $16.4 million Templeton Emerging Markets Bond Fund offering five share classes, delivered an average gain of 12.1% while the R6 share class with its lowest 89 basis points expense ratio with initial investment minimums of $1 million recorded a gain of 12.5%.

- Actively managed sustainable taxable high yield bond funds posted an average gain of 11.7% for the year. Comprised of 13 funds/29 share classes with $2.4 billion in net assets, returns for the category ranged from a high of 13.3% registered by the PGIM High Yield Fund R6 to a low of 6.5% delivered by the AXS Sustainable Income Fund I.

- Bringing in the rear were actively managed emerging market bond funds, comprised of a small $7.3 million Ashmore Emerging Markets Corporate Income ESG Fund with three share classes that recorded an average gain of 2.9%.

- While the sustainable actively managed taxable bond funds universe is small and still limited as to category types and in several instances offer limited investing options, interested investors can still benefit from opportunities to diversify their taxable fixed income exposure class by expanding beyond the intermediate-core bond position to include, for example, sustainable high yield funds as well as short-term and ultrashort bond funds.