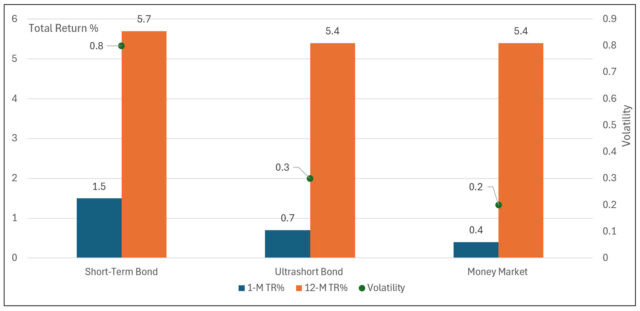

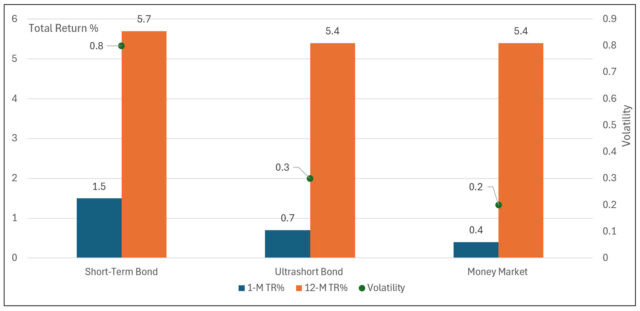

The Bottom Line: Sustainable investors with a greater tolerance for risk with cash can take advantage of higher returns available in short-term and ultrashort funds.

Sustainable short-term, ultrashort and money market funds returns and volatility: 2023 Notes of Explanation: Average 12-month return and volatility applicable to sustainable short-term bond funds adjusted for one fund’s outlier results. Volatility is a measure of the dispersion of a fund’s monthly returns around its average return over the trailing 3-year time interval. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Average 12-month return and volatility applicable to sustainable short-term bond funds adjusted for one fund’s outlier results. Volatility is a measure of the dispersion of a fund’s monthly returns around its average return over the trailing 3-year time interval. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Average 12-month return and volatility applicable to sustainable short-term bond funds adjusted for one fund’s outlier results. Volatility is a measure of the dispersion of a fund’s monthly returns around its average return over the trailing 3-year time interval. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Average 12-month return and volatility applicable to sustainable short-term bond funds adjusted for one fund’s outlier results. Volatility is a measure of the dispersion of a fund’s monthly returns around its average return over the trailing 3-year time interval. Sources: Morningstar Direct, Sustainable Research and Analysis LLC. Observations:

- Low interest rates followed by the Federal Reserve’s aggressive policy normalization created a challenging environment for bond investors in 2022 and 2021. In 2022 the intermediate investment grade bond segment gave up 13.0% after dropping 1.5% in 2021, according to the Bloomberg US Aggregate Bond Index. An improving environment lifted bond prices in the fourth quarter of 2023, and bonds gained 5.5% for the year while sustainable taxable bond funds climbed 7.1%. Sustainable short-term bond funds and ultra short bond funds also benefited from improving fundamentals and a shift in sentiment, gaining 5.1% and 5.4% in 2023, respectively.

- Money market funds offer investors one of the best options for achieving safety of principle, yield and liquidity. While more conservative options are available, such as insured bank deposits, money market funds offer flexibility that appeals to a cross section of taxable and tax-efficient investors. Defaults are rare, even in the case of prime money market funds. On the other hand, conservative, moderate and even aggressive investors with the capacity to invest over longer time horizons and have slightly higher risk tolerances, can take advantage in their cash and cash equivalents bucket of the higher risk adjusted returns offered by ultrashort and short-term funds given their credit exposures and longer-durations. In the case of sustainable funds, investors have an opportunity to allocate their investable funds into these categories in line with some or all of their sustainability preferences.

- The segment of sustainable short-term and ultrashort bond funds consists of mutual funds, ETFs, index tracking funds as well as actively managed funds.

- The sustainable short-term bond funds category tracks nine funds, a total of 31 share classes, with $3.8 billion in net assets at year-end 2023. The segment, adjusted for an outlier fund, posted an average 5.7% in 2023 with an average monthly volatility of 0.8 (by way of comparison, the average monthly volatility of large cap funds is 5.1). The category’s returns ranged from a low of 4.1% last year to a high of 7.6% recorded by the $2.2 billion Calvert Short Duration Income Fund R6, intended for investors with a minimum investment of $5,000,000. The fund is more volatile than the average short-term fund and is subject to a higher fund expense ratio of 44 bps.

- The sustainable ultrashort bond funds category is even smaller, tracking just five funds and 14 share classes with $1.4 billion in net assets, that delivered an average return of 5.4% last year with an average monthly volatility of 0.3. Returns ranged from a low of 4.2% to a high of 6.3% achieved by the $988.3 million Calvert Ultra-Short Duration Income Fund I. The fund’s expense ratio is 47 basis points and initial purchases are subject to a $1 million minimum investment.

![COW-1-29-2024-image-istockphoto-1422985058-612×612-1[1] Rising bond yields and rates for saving accounts on the screen. Finance, invest, mortgage rates and stock exchange concept. 3D illustration](https://sustainableinvest.com/wp-content/uploads/elementor/thumbs/COW-1-29-2024-image-istockphoto-1422985058-612x612-11-qkowuqd13yf4g1kn1yi0uwwo9rje0l1ygctturw9t8.jpg)