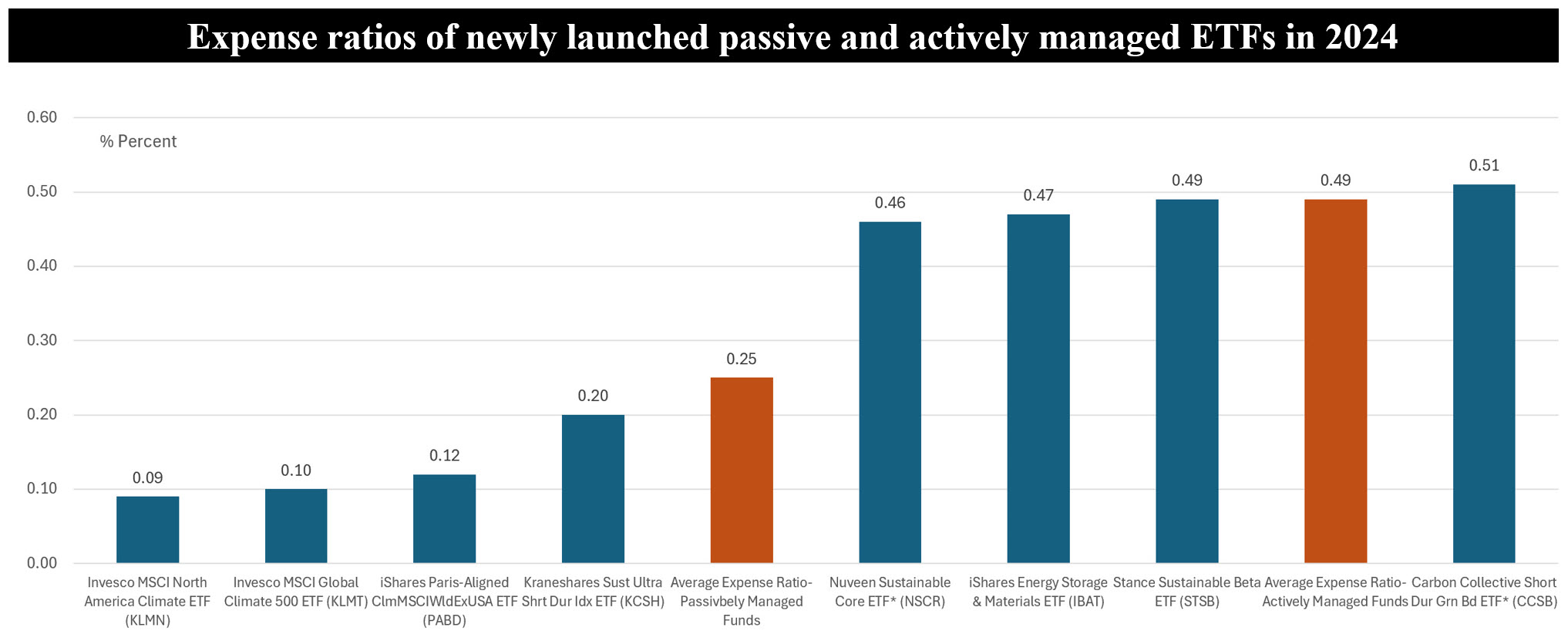

The Bottom Line: Expense ratios of new ETF listings in 2024, just nine funds, shifted lower for passive funds as well as actively managed ones.

Notes of explanation: *Refers to actively managed fund. ETFs listed in ascending order based on reported expense ratios. Morningstar Direct, Sustainable Research and Analysis LLC.

Observations:

• Newly launched ETFs in 2024, a total of just eight funds including both active and passively managed investment vehicles, carried average fund expenses of 31 bps. Fund expenses for newly launched focused index tracking ETFs shifted lower relative to ETFs listed prior to 2024. The same observation applies to actively managed sustainable ETFs, qualified by the small number of observations. The same relationships hold when average expense ratios are calculated on an asset weighted basis.

• Two of the investment funds listed in 2024 are actively managed portfolios that are subject to an average expense ratio of 0.49% versus an average expense ratio of 0.52% for ETFs launched prior to last year. On the other hand, newly listed index tracking ETFs carried an average expense ratio of 0.25% versus an average of 0.34% for previously launched ETFs. That said, two of the six index tracking ETFs included $1.5+ billion climate themed funds brought to market by Invesco and likely seeded by institutional investors, with expense ratios of 9 and 10 basis points.

• One new focused sustainable ETF was launched in December#, matching the number listed in January, April, June, July, September and November. The highest number of ETF listings, at two, occurred in March of last year. The new fund listed in December is the passively managed $2.3 billion Invesco MSCI North American Climate ETF (KLMN). At $2.3 billion, it is also the largest ETF listing in 2024.

• Relative to 2023 when 32 ETFs were launched, new ETF fund listings dropped off significantly during 2024. The scarcity in sustainable fund launches, starting after May of 2023, may be attributable to the fact that anti-ESG movement in the US had gained momentum in the second quarter of 2023 and fund companies may have opted to lower their profile, including curtailing focused fund offerings, while at the same time continuing to support sustainable investing practices. Sustainability remains important to institutional investors who led in the recovery of assets since 2022, and it also remains important to corporate executives as well as asset owners. Retail investors, on the other hand, are still struggling to recover fully from the declines suffered in 2022 due to withdrawals and capital depreciation but their flows exhibited improving interest in sustainable investing last year.

• The year 2024 ended with 230 focused sustainable ETFs with $112.1 billion in assets, after accounting for 31 ETF delistings as well as other restructurings.

*Average expense ratios for ETFs launched prior to 2024 are based on funds in existence at the start of 2024.

*Average expense ratios for ETFs launched prior to 2024 are based on funds in existence at the start of 2024. #New listings exclude funds that transferred their listings from NYSE to Nasdaq, including the Hennessy Stance ESG ETF (STNC) and VegTechTM Food Innovation & Climate ETF (EATV.

NOTE: Article revised as of 1-10-2025 to reflect a correction regarding the number of new ETF listings in December 2024.