The Bottom Line: Notwithstanding a challenging year, sustainable fixed income mutual funds and ETFs ended the year with $46.7 billion, benefiting from positive cash inflows.

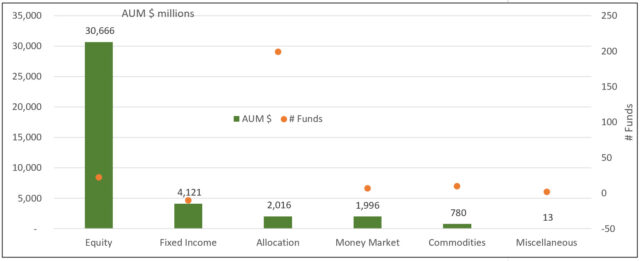

Sustainable mutual funds and ETFs Y-O-Y changes in net assets and number of funds  Notes of Explanation: Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Sources: Morningstar Direct, Sustainable Research and Analysis LLC. Observations:

- Bolstered by the combination of a strong economy and reduced concerns around a looming recession, better-than-expected corporate earnings, lower inflation and an apparent end to the Federal Reserve’s interest rate hikes that were expected to lead to multiple Fed rate cuts in 2024, stocks, as measured by the S&P 500, rallied 26.3% in 2023. Technology stocks drove the broader market’s returns, catapulting 55.1% higher for the year per the Nasdaq 100 Index, based on optimism surrounding the boom in artificial intelligence technologies as well as Fed rate cuts. At the same time, credit markets rebounded in the fourth quarter, ending 2023 with a gain of 5.5% according to the Bloomberg US Aggregate Bond Index while longer dated and lower rated bonds posted double digit returns.

- Sustainable mutual funds and ETFs recorded a combined gain of 5.1% in December and 13.5% over calendar year 2023. Sustainable equity funds added an average 16% in 2023, the same increase recorded by Allocation funds, while sustainable fixed income funds gained an average 7.0%.

- Sustainable mutual funds and ETFs ended 2023 with almost $340 billion in assets. Sustainable equity funds closed 2023 with $271.0 billion in assets under management, for a net increase of $30.7 billion. Based on a back of the envelope analysis, this gain was insufficient to offset investors redemptions.

- On the other hand, sustainable fixed income funds ended 2023 with $46.7 billion in assets, or a gain of $4.1 billion. Again, based on a back of the envelope analysis, this gain benefited from an estimated $1.1 billion in new money.

- Allocation funds experienced the greatest number of net new funds/share classes introduced in 2023, adding 199 funds/share classes and ending the year with 328 funds/share classes.

![COW-2023-12-26_13-40-46[1] COW-2023-12-26_13-40-46[1]](https://sustainableinvest.com/wp-content/uploads/elementor/thumbs/COW-2023-12-26_13-40-461-rd4j6w2t8ggdtxe8sv1uegfwt32cpud8cwm9zstp64.jpg)