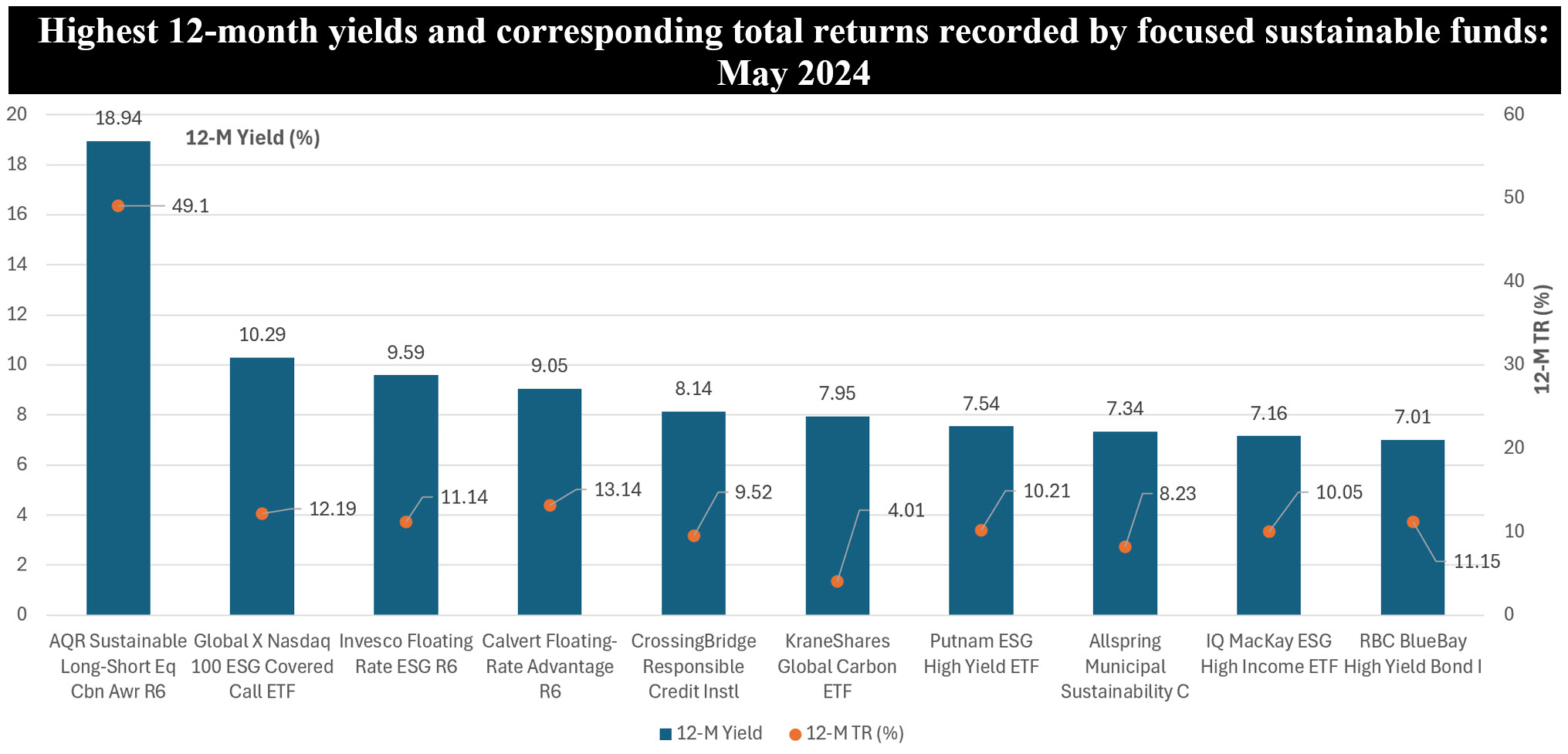

The Bottom Line: The top yielding sustainable investment funds, mutual funds and ETFs, recorded an average 12-month yield of 9.3% at the end of May.

Notes of Explanation:

Notes of explanation: Funds with multiple share classes are only listed once based on the highest yielding share class as of May 31, 2024. Sources: Morningstar Direct; Sustainable Research and Analysis LLC.

Top 10 sustainable investment funds record average 12-month yield of 9.3%

- Focused sustainable investment funds, both mutual funds and ETFs, a total of 1,491 funds, recorded an average yield of 1.95% at the end of May while the median yield stood at 1.46%. Twelve-month yields ranged from a low of 0% to a high of 18.94%. Concurrently, the same universe of funds posted an average total return of 13.9%, ranging from a low of 4.0% to a high of 49.1%.

- The top 10 funds based on the yields generated by the highest yielding share classes, recorded a significantly higher average yield of 9.3% (median yield of 8.0%), ranging from a low of 7.01% to a high of 18.94%. The funds in this segment were dominated by bond funds and in particular, high yield and floating rate funds. Other strategies include long-short equity, a covered calls strategy and investments in futures contracts on emission allowances issued by various “cap and trade” regulatory regimes that seek to reduce greenhouse gas emissions over time.

- All but two of the top 10 funds distribute income monthly. The exceptions involve two funds that distribute income once a year and include the AQR Sustainable Long-Short Equity Carbon Aware Fund and the KraneShares Global Carbon ETF.

- The highest yielding fund is the $35.1 million AQR Sustainable Long-Short Equity Carbon Aware Fund (whose R6, I and N share classes posted yields of 18.94%, 18.88 and 18.76%, respectively). The fund, which was launched in December 2021 with $10 million and hasn’t gained much traction since then, currently seeks to achieve its investment objective by investing in or having exposure to securities of U.S. and foreign issuers through the construction of a long-short investment portfolio that favors attractive companies as determined by AQR Capital Management, LLC., the fund’s advisor using proprietary quantitative investment indicators and certain Environmental, Social and Governance (ESG”) criteria. The fund integrated certain Environmental, Social, and Governance considerations into its security selection and portfolio construction processes and sought to hedge climate risks. It incorporated multiple metrics of climate exposure, such as carbon emissions and fossil fuel reserves, to hedge against climate-related investment risks. That said, effective on or about August 19, 2024, the fund is changing its name to the AQR Trend Total Return Fund, and, in addition to other investment strategy changes, it will no longer employ a sustainable investment approach. This change, along with various other factors, could have an impact on the fund’s future income distributions.

- In addition to a review and thorough consideration of a fund’s fundamentals, including the fund’s investing strategy and approach to sustainable investing, income-oriented investors, and in particular investors who rely on monthly distributions of net investment income, should carefully review a prospective fund’s dividend distribution policy and its capacity to support its income distributions in the future under various scenarios.